Barrett Business Services: Buy BBSI Stock Before Earnings Today

Dilok Klaisataporn/iStock by using Getty Visuals

You will have to forgive me for abandoning my usual format, as modern post will be brief and sweet. Bottom line up entrance: acquire Barrett Enterprise Solutions ahead of earnings are introduced right after the marketplace closes these days. They are 13{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} undervalued even under pessimistic assumptions, and 32{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} off their all-time highs, for no great motive.

BBSI Stock Valuation

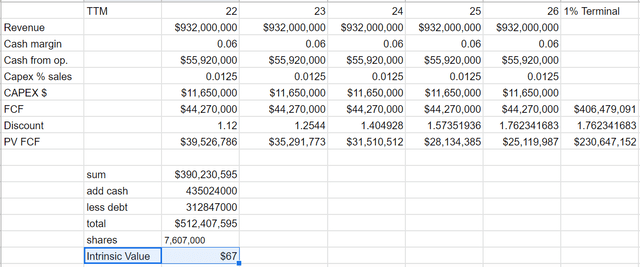

I will start where I ordinarily conclude, and that is with a DCF assessment. Listed here is the spreadsheet, with a discussion following:

Spreadsheet (Compiled by author)

Discover the flat revenue for the following 5 many years, a cash from functions margin of 6{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} that is way below their extended-phrase common (pandemic decades with negative values inclusive) of 8.4{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, CAPEX fees that amount of money to 1.25{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of income in spite of CAPEX historically currently being only .72{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of revenue, a terminal price of only 1{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, and the significant discounted price of 12{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} (my essential charge of return). Even under this gloomy condition, BBSI is nonetheless value $67, nicely over the place they are now investing.

Barrett Organization Services – Quarterly Expectations

Administration sounded extremely optimistic about how they have been established up to finish the year. Q3 revenues have been up 8.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} more than the prior year’s similar quarter, and if the exact same repeats in Q4 they will put up an all-time substantial quarterly profits of $253 million. This would carry their once-a-year earnings to $951 million, also a report.

Specified that their revenue is calculated as a p.c of the wages of the employees of the clientele they aid, and considering that wages and work have the two been sturdy these days, the chance of them accomplishing these history quantities is incredibly superior.

In spite of these strong figures the stock trades at a P/E ratio of just a lot less than 13. I anticipate sizeable various expansion on the again of sturdy outcomes and healthy forecasts.

Also encouraging is the actuality that as of the conclude of Q3 they still experienced $31 million remaining on a share repurchase plan. With the stock acquiring faced these kinds of a extreme descent, hopefully they had been opportunistic about splurging when the price ranges have been small.

Other pertinent developments

BBSI has penned new coverage preparations with Chubb wherever-in they are no extended assuming the possibility of paying promises for masking their clients’ workers payment demands. That chance has been transferred, and all related liabilities from prior many years underwriting will gradually run-off the equilibrium sheet. This significantly de-dangers the organization product.

They have moreover consolidated their department footprint and moved to a much more personnel light company design. This must see price tag savings accrue about time.

Also, BBSI has implemented a new referral program wherever-in they can funnel much more options. From the conference contact:

Very last quarter we reviewed our for a longer time-time period initiatives in which we intend to maximize the best of the funnel by concentrating on guide era by using an omni-channel digital campaign wherever we focus on both consumers and new referral associates in distinct markets. We are only 4 to five months into the various trials, but I am energized about what we are looking at and I would like to offer some studies since the previous earnings connect with.

We have signed up 82 new referral companions and we set up 74 new conferences with interested likely shoppers. We are testing and refining our a variety of profits initiatives by sector, measuring the return on investment and will transport the most effective method to our other markets. We continue to package our new engineering with our nationwide giving, and we proceed to see much larger prospects.

Last but not least, BBSI recently rolled out a new engineering system. It is by way of this automobile that they will be in a position to enhance their benefit proposition by supplying new products and services, and subsequently justify charging a lot more for what they do. From the CEO:

We crafted our portal out with the plan that we personal our technology destiny. So, we have the means to plug in more goods and solutions. Whether or not we make enhancements or boost productiveness in there or we white label things and plug it in. There is a limitless likely for goods and products and services that we can convey in. And we’ve got folks performing on executing to that solution highway map so that we can in the long run have a lot more matters that we can provide to make us both extra beautiful or the business enterprise stickier. But we are not heading to spill the popcorn right up until we do the launch on all those.

Summary

Forgive me for not becoming as thorough and in-depth as typical. But provided that this update is time delicate, I favored concision. Eventually, BBSI is executing at a degree considerably increased than their P/E would point out. If success occur in as healthy as I am anticipating, numerous expansion is likely. Coupled with probably earnings development from larger income and lower expenses, buyers will take pleasure in tremendous value appreciation.