171 Republican lawmakers join effort to stop student loan forgiveness program

A person hundred and 20-8 Property Republicans and just about all Republican senators on Friday submitted amicus briefs with the Supreme Courtroom opposing the Biden administration’s federal student credit card debt cancellation plan, which has been halted as tens of tens of millions of Individuals await the justices’ ruling on its legality.

Although White Household officers have been adamant that the president is inside his authority to wipe out hundreds of billions in government-backed loans to offer “breathing home to tens of tens of millions of performing families,” Republicans difficult it just take the opposite see.

The forgiveness prepare that could ease up to $20,000 for eligible personal loan recipients is an unconstitutional breach of the separation of powers and a violation of the Higher Instruction Relief Possibilities for Pupils Act of 2003 (HEROES Act), according to the House GOP short.

“The Biden administration’s college student mortgage bailout is a political gambit engineered by specific fascination teams abusing the HEROES Act for these kinds of a ploy is shameful,” Home Instruction and the Workforce Committee Chairwoman Virginia Foxx, R-N.C., explained in a statement.

The Property GOP brief integrated 25 members on Foxx’s committee and around 100 other lawmakers. Residence Speaker Kevin McCarthy did not sign it, even though Majority Chief Steve Scalise, Majority Whip Tom Emmer and Residence Judiciary Chairman Jim Jordan did.

Individually, 43 Republican senators signed their possess brief in assistance of the obstacle to the personal loan forgiveness system. Led by Tennessee’s Marsha Blackburn, they also connect with the president’s prepare illegal and assert it exceeds his office.

U.S. Rep. Marsha Blackburn speaks at an event, Jan. 24, 2015 in Des Moines, Iowa.

Scott Olson/Getty Photos, FILE

The White Household has pushed back again.

“Although opponents of our program are siding with exclusive pursuits and seeking every single which way to hold hundreds of thousands of middle course Americans in financial debt, the President and his Administration are combating to lawfully give middle-course family members some breathing place as they get well from the pandemic and put together to resume mortgage payments in January,” spokesman Abdullah Hasan stated in Oct.

However, the Residence Republicans say they imagine Biden is exploiting the language of the HEROES Act, which the administration argues vests the training secretary with expansive authority to alleviate monetary hardship for federal university student financial loan recipients as a end result of the COVID-19 pandemic.

“In fact, the full objective of the HEROES Act is to authorize the Secretary to grant pupil-financial loan-relevant reduction to at-danger debtors due to the fact of a nationwide emergency — exactly what the Secretary did below,” Solicitor General Elizabeth Prelogar wrote in a Supreme Court submitting defending the proposed personal debt cancellation.

Right after lawful challenges final year saw the forgiveness system halted by lessen courts, the Supreme Court announced in December that it will hear oral arguments on the concern at the conclude of February.

A selection on the software is then expected by June.

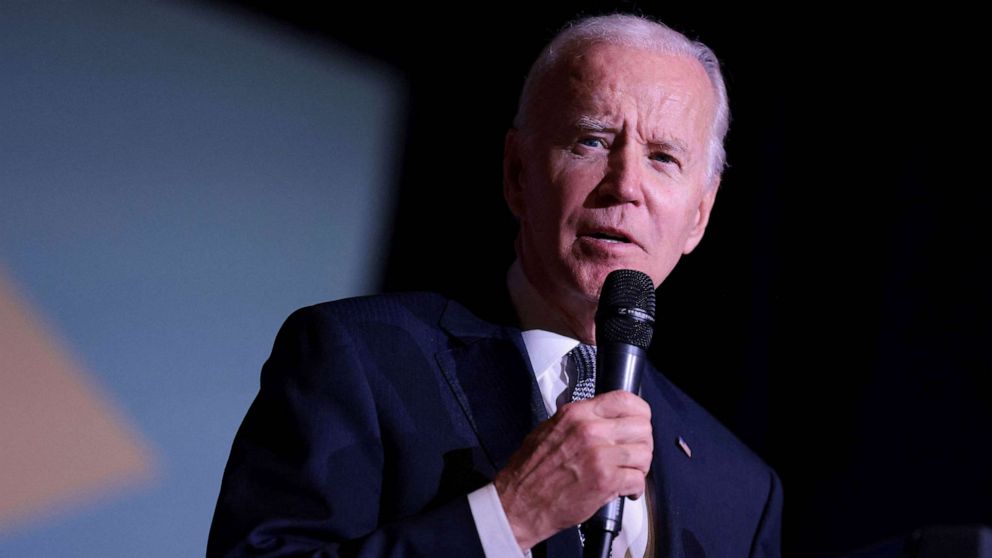

US President Joe Biden speaks about scholar debt aid at Delaware Point out University in Dover, Delaware, Oct. 21, 2022.

Oliver Contreras/AFP by means of Getty Images, FILE

The moratorium on mortgage repayments, which was to start with set in place under President Donald Trump before in the pandemic, is now set to expire 60 times right after the decision or 60 days following June 30 — whichever day will come 1st.

A vocal opponent of Biden’s system, Foxx also accused the administration of “bypassing Congress” to put into practice personal loan forgiveness.

“Congress is the only body with the authority to enact sweeping and basic modifications of this character, and it is ludicrous for President Biden to think he can simply bypass the will of the American folks,” she reported in her assertion.

Rep. Virginia Foxx speaks at a press meeting at the U.S. Capitol, March 09, 2021 in Washington, DC.

Gain Mcnamee/Getty Images, FILE

Foxx advised ABC Information in an job interview last month that she believes it is an “injustice” for taxpayers to fund the administration’s “scheme.” The strategy would price $400 billion, according to an estimate from the nonpartisan Congressional Spending budget Business office, and its approximately half-a-trillion-greenback value tag worries Rep. Jeff Duncan, R-S.C.

Inspite of the White Residence expressing the cancellation would give needed financial relief, Duncan stated it would be sending the U.S. more into a “credit card debt spiral.”

“The Court docket must invalidate the Secretary of Education’s sweeping scholar mortgage forgiveness software due to the fact it trespasses on Congressional authority and violates the separation of powers,” he explained.

The U.S. Training Office has claimed the president’s selection to terminate up to $10,000 for some personal loan recipients — these who made less than $125,000 on their 2020 or 2021 taxes or $250,000 submitting jointly — or $20,000 for minimal-money recipients who acquired Pell grants could effect approximately 43 million People who owe $1.6 trillion in scholar loans.

That was notably vital in light of how COVID-19 upended the economic climate, according to the White Residence.

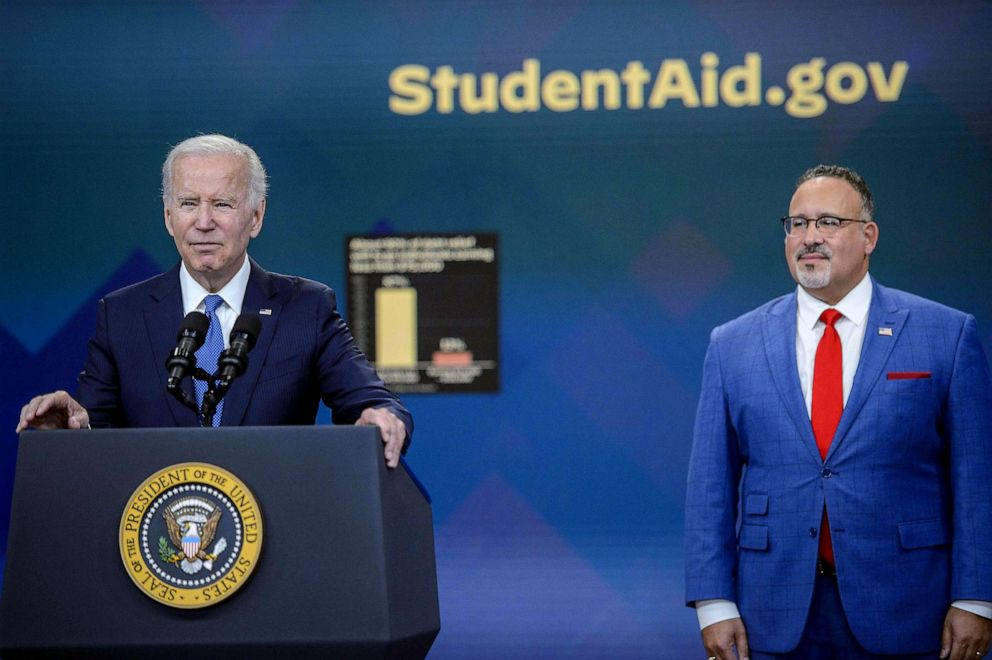

US President Joe Biden speaks as Miguel Cardona, US secretary of instruction, listens in the Eisenhower Govt Office Creating in Washington, D.C., Oct. 17, 2022.

Bloomberg by means of Getty Images, FILE

“This is why we took this action — to make sure that tens of thousands and thousands of People in america are ready to deal with a time that was really hard, in particular in the previous pair of a long time,” White House press secretary Karine Jean-Pierre instructed ABC News’ Karen Travers final week. “That is been the essential priority of the president: to make confident people … who felt the pinch if you will, who felt the hurt the most these past pair of many years due to what COVID did to the overall economy, obtained a small added support.”

Immediately after the cancellation program introduced past year, 26 million persons signed up on the net right before it was halted by the courts.

Of that group, 16 million were approved ahead of the department’s internet site stopped accepting programs to enable the authorized procedure participate in out. Nonetheless, no personal loan forgiveness has been discharged.

Final thirty day period, around a dozen advocacy groups like the NAACP filed briefs in support of the president’s plan.

“Student financial loan debtors from all walks of life experienced profound economical harms throughout the pandemic and their continued recovery and prosperous reimbursement hinges on the Biden Administration’s pupil credit card debt reduction approach,” Education and learning Secretary Miguel Cardona reported in response to the coalition of teams signing up for in help of the strategy. “We will continue on to protect our legal authority to give the personal debt relief working and center-course family members obviously need and have earned.”