93{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of payday loan borrowers regret taking out their loans, survey finds

Payday financial loans can be a debt entice for borrowers who are not able to find the money for to make payments. This is how you can repay your payday mortgage equilibrium prior to it can be sent to credit card debt collectors. (iStock)

Payday loan providers prey on borrowers with lousy credit who desperately have to have cash, trapping them in a cycle of higher-fascination credit card debt that is challenging to repay.

The wide the greater part (93{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}) of debtors regret using out their payday financial loan, in accordance to a new survey from DebtHammer. Just 1{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of respondents explained their monetary situations improved after borrowing a payday bank loan, even though 84{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} claimed they were worse off.

Payday financial loans give individuals an avenue to borrow modest, short-expression dollars financial loans with out a credit score look at. But the common repayment time period is just two months, which potential customers 4 in 5 borrowers to borrow a new payday personal loan to repay their present personal debt, the Shopper Monetary Protection Bureau (CFPB) documented.

It’s attainable to get out of payday bank loan debt without the need of renewing your personal loan and incurring extra expenses. Retain looking at to master how to crack the cycle of payday bank loan borrowing, these types of as consolidating personal debt with a individual loan. You can assess fees on credit card debt consolidation loans for free of charge on Credible with no impacting your credit score score.

Best Quick-Expression Financial loans: Evaluate YOUR Alternatives

3 ways to get out of a payday loan

The average value of a payday personal loan is equivalent to an once-a-year proportion level (APR) of nearly 400{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} — in other text, borrowers who preserve rolling above their payday loans could pay back 4x the amount of money they originally borrowed around the study course of a calendar year.

Payday creditors may well have you think that rolling above your mortgage is the only way to fork out off your personal debt, but that’s not the scenario. Right here are a few choice methods to crack the payday loan cycle:

Read about every reimbursement prepare in the sections beneath.

3 Things YOU Should Hardly ever DO WITH YOUR Unexpected emergency FUND

1. Financial debt consolidation loans

Individual financial loans are lump-sum loans that are usually made use of to consolidate additional substantial-fascination financial debt, such as payday financial loan personal debt. They appear with preset interest charges and compensation terms, which suggests that your every month payments will be the exact same while you repay your debt.

These credit card debt consolidation financial loans are commonly unsecured, which indicates that you you should not have to set up an asset as collateral. Because they are unsecured, lenders ascertain your fascination price and eligibility dependent on your credit score score and personal debt-to-profits ratio.

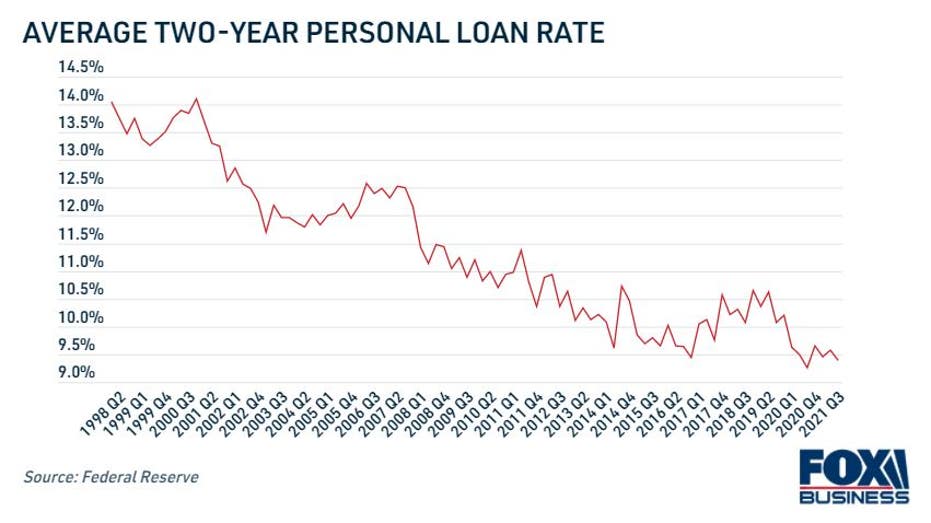

Properly-certified borrowers may well qualify for a minimal rate on a particular personal loan for debt consolidation. Own bank loan premiums are in close proximity to all-time lows, according to the Federal Reserve, averaging 9.39{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in Q3 2021.

Some credit history unions also present smaller payday substitute loans (Buddies), which let users to borrow up to $2,000 with an curiosity fee cap of 28{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. Nonetheless, these loans can be tricky to uncover given that just a tiny part of credit score unions offer you Pals.

You can see if you qualify for a personal debt consolidation financial loan on Credible with a delicate credit score inquiry, which will not affect your credit score. Use a personalized financial loan calculator to estimate your month to month payments to see if this selection can aid you get out of payday mortgage debt.

Credit score CARD Desire Rates SPIKE TO In the vicinity of ALL-TIME Higher, FED Facts Exhibits

2. Extended payment designs

An prolonged payment system (EPP) lets payday financial loan borrowers repay their credit card debt about a for a longer time time than the usual two-7 days repayment expression. Quite a few states need payday creditors to supply EPPs, so you can have to analysis your state legal guidelines to see if you’re eligible.

Some payday lenders may perhaps offer you EPPs irrespective of regardless of whether they are required to do so by regulation. Creditors belonging to the Neighborhood Monetary Providers Affiliation of The usa (CFSA) are essential to present EPPs to borrowers, but other money establishments may not provide this alternative.

HOW Long DO Negative Merchandise Stay ON YOUR Credit history REPORT?

3. Credit score counseling

Nonprofit credit history counseling agencies give free or low-expense expert services for borrowers who are battling to deal with their financial debt. One particular of these expert services features enrolling payday personal loan borrowers in a credit card debt administration system (DMP).

Below a DMP, a credit score counselor will enable you build a finances and debt compensation program. Credit counselors may perhaps be equipped to assistance you negotiate with payday loan companies to lock in a lower fascination price or lower the bank loan amount.

You can see a whole listing of certified nonprofit credit counselors on the Division of Justice web-site. If you however have questions about payday bank loan debt aid, study far more about financial debt consolidation by getting in touch with a knowledgeable financial loan officer on Credible.

Debtors WHO CONSOLIDATE Credit score CARD Personal debt CAN Conserve $2K+ ON Typical, Information Displays

Have a finance-relevant problem, but you should not know who to check with? E mail The Credible Revenue Specialist at [email protected] and your concern could be answered by Credible in our Money Pro column.