The best business and finance tips for creatives : Life Kit : NPR

Not every hobby needs to be a side hustle. But, if you set out to make money off of yours – congratulations, you’re running a business! Now you have to pay attention to finances.

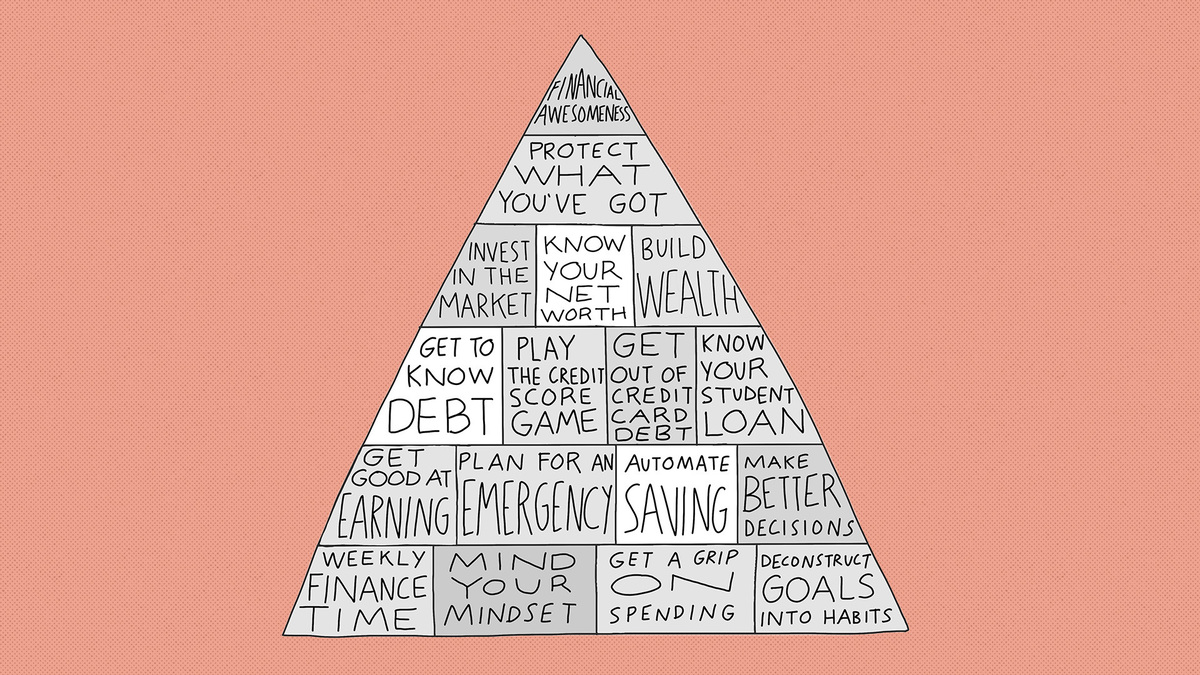

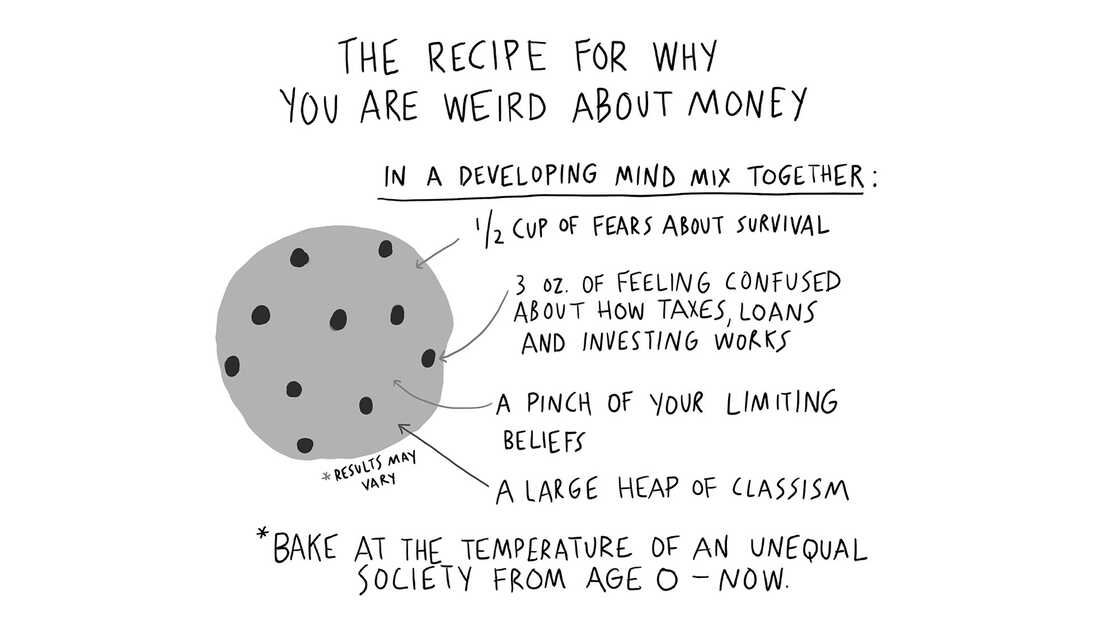

It can be uncomfortable taking something you do for fun and turning it into a product with a dollar value, especially if you’re a creative person. Add on the trope that being financially savvy is antithetical with being a true artist, and it’s no wonder many creatives feel “bad with money.”

But when you ignore your finances, you’re not only missing out on peace of mind, you’re also losing the ability to make sound business decisions that come from a place of clarity rather than an emotional “I’ll take what I can get” energy.

Writer, illustrator and musician Paco de Leon runs a financial education firm and bookkeeping agency. Her book, Finance for the People, is a beginner-friendly guide to navigating your financial life. De Leon joined Life Kit to offer her best money management tips for creatives.

Paco de Leon is a musician, author, illustrator, founder of The Hell Yeah Group and author of Finance for the People.

Left: Penguin Life; Right: Photograph by Jean Pablo

hide caption

toggle caption

Left: Penguin Life; Right: Photograph by Jean Pablo

Set up weekly finance time

Whether you’re following up on invoices, logging expenses, paying bills or researching accountants, many financial chores are forgotten if we don’t take time to prioritize them. To avoid this, set up a weekly finance meeting with yourself and treat it as sacred. Spend anywhere from 20 minutes to an hour to check things off your list, instead of only doing them when you remember.

“Don’t allow people to book meetings or bother you during that time,” says de Leon. “Having that space to focus will allow that part of your life to expand.”

Separate your personal and professional finances

It’s easy to neglect your finances if all your money is kept in the same account and your transactions aren’t marked as personal or professional.

So, bank with your business in mind. Monitor your money and how it’s being used by creating separate checking and savings accounts for your personal and professional finances. Budgeting for your business becomes a lot easier when you have a clear idea of what you’re actually spending and earning.

At first, it might feel a little scary if there’s no money flowing in. But, de Leon says, it can also feel good to look at your stagnant accounts and ask, “How am I going to water this? How is this going to get fed?”

Don’t forget taxes

Another reason for separating your professional and personal finances is it makes it easier for you to report your earnings to the IRS, which you’re required to do, regardless of the amount you make.

And, if you make more than $400 a year, you’ll likely have to pay both income tax and self-employment tax. To prepare for this, de Leon says to save anywhere from 10 to 30 percent of the money you earn and put it in your business savings account to prepare for tax season.

If preparing for taxes is scary or stressful, consider hiring an accountant! The U.S. tax code is thousands of pages long and it changes often. Hiring someone to help you navigate it can provide “a huge return on your investment in terms of how much it costs,” says de Leon.

Know your market

Here’s a hard truth: Just because you enjoy making photographs and your friends like them on Instagram doesn’t mean your next step should be buying a domain name, producing hundreds of prints and setting up an online shop.

To better understand if there’s demand for what you offer, de Leon recommends asking yourself, “Whose problem am I solving?” Who is looking for what I do or make, and why?

From an artistic perspective, it might feel strange to frame your work as a solution to a problem, says de Leon. But if you’ve decided to put your work in a commercial space, that question helps you consider who you are trying to reach, who is willing to buy your work and what they are willing to spend.

To demystify pricing, consider concrete and abstract costs

Pricing your products or setting your rates is like a “cactus bush,” says de Leon. “It’s prickly and hard to navigate.”

Pricing requires you to consider concrete factors, like the cost of your materials and workspace, and abstract ones, like the value of your time, your level of experience, who you want to reach and what you offer that no one else can.

If examining all of that sounds overwhelming, remember that pricing falls within a range. There’s a low and high end for every service and product on the market. Ask your peers or research online to get a sense of what those limits are and afterward, reflect on where you want to be in that range and why.

It can feel simpler for beginners to add up all of the above and decide on an hourly rate. But, depending on what you’re offering and the more experience you gain, setting a price based on overall value – the need you’re filling or solution you’re providing for someone – is ultimately better for creators, says de Leon.

Know when to ask for help or raise your prices

If you are earning revenue from a skill or product, you might be doing a bunch of other things, too: sourcing, marketing, shipping, bookkeeping.

Pay attention to the tasks that feel difficult. What slows you down, burns you out, or takes up time that you’d rather spend doing something else? It may be helpful to outsource this task.

And, if your time becomes more valuable…well, it just might be time to raise your prices and see what happens.

The podcast portion of this story was produced by Sylvie Douglis.

We’d love to hear from you. If you have a good life hack, leave us a voicemail at 202-216-9823 or email us at [email protected]. Your tip could appear in an upcoming episode.

If you love Life Kit and want more, subscribe to our newsletter.