A Florida teacher thought she’d settled her student loan debt 20 years ago. Then she got a bill for $1 million.

For virtually a 10 years, the govt took hundreds of bucks each individual thirty day period out of the paychecks of a Florida female named Michelle to recoup old scholar financial loans that were unpaid and overdue. The process, known as garnishment, is authorized, and the U.S. Section of Training can purchase it for someone’s wages, tax returns and Social Safety to power compensation on defaulted loans.

Michelle’s garnishment commenced in 2008. As a public faculty teacher in Orlando, who questioned to be identified by her initially title only simply because this tale consists of her private funds, she struggled for the following 8 or nine several years to make finishes satisfy even though supporting her two kids.

“I practically lost my home and everything about this for the reason that I just could not find the money for it,” she said. And with approximately $800 for each thirty day period out of the blue absent, Michelle recalled at occasions going through unattainable selections working day to day: “I have received to consider, ‘Do we get this food or do we continue to keep the lights on? Which is additional vital proper now?'”

Just after the garnishment time period ended, Michelle thought that her student debts were being compensated in entire. But, this earlier spring, she started off acquiring notices about a distinct financial loan, which she borrowed via the now-defunct Perkins Personal loan Application even though pursuing an undergraduate degree at the College of Florida.

The program offered reduced-curiosity federal financial loans to undergraduate and graduate college students with “exceptional financial need to have,” according to the Department of Education, and is now becoming phased out given that officially closing in September 2017. Michelle used for bank loan forgiveness through the Perkins plan immediately after graduating from the College of Florida in 1997, and afterwards satisfied the teaching provider necessities to get it.

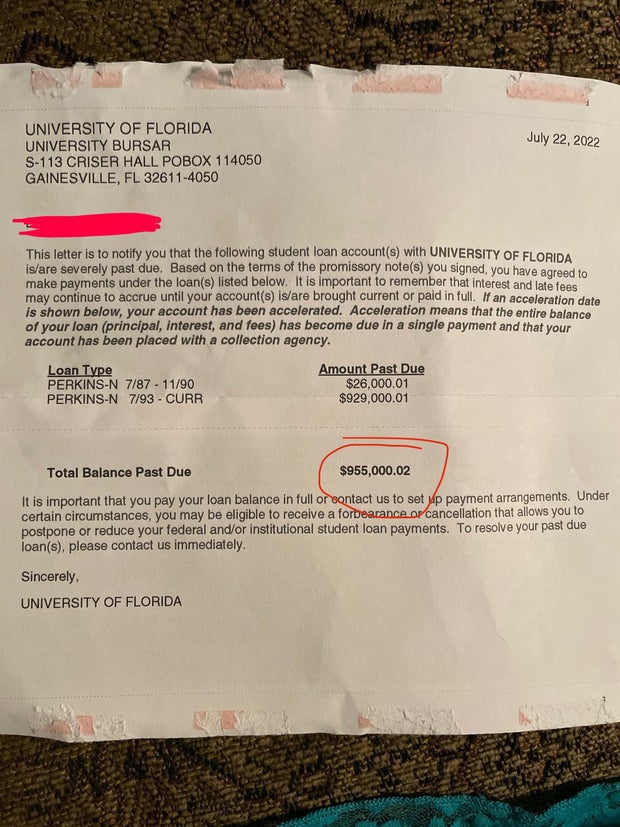

So, when Michelle opened a letter from her alma mater in July suggesting that her Perkins mortgage repayments were “seriously previous due,” she was shocked. Even far more confounding than the invoice by itself was the amount of money it said she nonetheless owed the college: $955,000.02.

“I essentially went into despair. I went into hiding. I did not know how to make perception of it since it was so extended in the past,” mentioned Michelle. “So now, I am like, I’m about to retire and I am about to shed almost everything.”

Michelle turned out to be wrong. Many thanks in huge part to an web stranger with many years of skills who eagerly made available to support kind via the university student personal loan debacle, her predicament altered nearly overnight.

Michelle’s daughter posted the letter to Reddit — a web site that Michelle stated she experienced frequented “possibly two times” in her daily life just before — in a area dedicated to discussions about student loans. The site’s people promptly tagged a person member — Betsy Mayotte, the president and founder of an corporation referred to as The Institute of Student Bank loan Advisors, which provides a selection of totally free providers to borrowers like Michelle.

courtesy Michelle through Reddit

Mayotte is a typical in the site’s r/StudentLoans subreddit, exactly where persons share personal experiences and guidelines as they navigate daunting repayment schedules amid switching personal debt reduction guidelines less than the Biden Administration, and frequently works by using it to link with folks who have to have information about their loans. In a remark on the first article from Michelle’s daughter, another user calls Mayotte the “GOAT,” which stands for best of all time.

Mayotte, possessing labored right before with Perkins personal loan debtors who experienced been blindsided by unanticipated bills, stepped in as a liaison involving Michelle and the University of Florida. The unique quantity was speedily identified to be a miscalculation. A spokesperson at the College of Florida attributed the error to a technological problem at ECSI, a corporation that universities employ the service of to act as a mortgage servicer for former learners repaying balances through the Perkins software.

Although the university mentioned in a statement that it could not remark on Michelle’s circumstance particularly, citing records defense guidelines for pupils, the university pointed out that “no scholar at the University of Florida has at any time owed” virtually $1 million in student financial loans.

“Nonetheless, in July, the College of Florida figured out that the computer system process employed by the organization that handles billing for the university issued statements with erroneous quantities to debtors for several schools, such as UF,” the statement continued. A college spokesperson afterwards explained ECSI prepared to issue new statements “reflecting the appropriate balances” within a week of the mistake coming to gentle.

A spokesperson at ECSI verified the calculation difficulty and acknowledged in a assertion that the organization “despatched letters to a tiny selection of debtors reflecting incorrect amounts owed on their loans” over the summer.

“These letters were instantly corrected and we apologize for any inconvenience this may perhaps have brought on,” the spokesperson explained.

By the finish of August, Michelle experienced gained at least just one of a number of amended statements that would eventually appear by mail from the College of Florida. The new harmony nonetheless ran quite high, about $8,000, and though Michelle mentioned she “felt far better, of program, simply because that was not a million,” she also suspected the revised number, which did not match the harmony reflected in her on the web account, was incorrect.

Just after graduating with her bachelor’s degree, Michelle experienced utilized for mortgage cancellation by way of a training software provided to Perkins bank loan recipients. It promised to terminate a part of the borrower’s mortgage for just about every academic 12 months invested educating in selected educational facilities, or particular matter parts. For illustration, an individual who taught in a university serving students from small-money family members, or taught particular education and learning, math, science or overseas language lessons would be qualified for complete personal loan forgiveness.

Michelle fulfilled the requirements in various training positions held in excess of the study course of five yrs. She submitted the documents required to ensure her eligibility for reduction beneath the Perkins software recommendations, and assumed the personal loan was forgiven. But, when Mayotte once again arrived at out to the university with questions about Michelle’s up-to-date equilibrium, she was instructed that Michelle’s documents in no way arrived.

“They claimed they in no way acquired it,” stated Mayotte. She observed that, in her practical experience, miscommunication is popular involving Perkins mortgage debtors and their loan servicers, inspite of corporation procedures that technically have to have financial loan servicers to send borrowers every month notifications about their expenses, specially when they are earlier because of. Unlike other federal student loans that are managed by distributors or servicers affiliated with the Section of Education and learning, Perkins mortgage servicers have traditionally been the universities on their own, which then outsource bank loan servicing jobs to a 3rd occasion.

“I see all the time, people today that say, ‘I have not experienced a monthly bill for my Perkins mortgage in 10 decades, 20 years,'” stated Mayotte. “It tends to make it definitely difficult for the borrower. You know, a ton of periods it is really a legit monthly bill. But if it is not, what buyer keeps information for 20 years to be ready to force again on that?”

ECSI did not grow to be a bank loan servicer for the College of Florida right until the early 2000s, several years soon after Michelle submitted her forgiveness paperwork to the college, and the business spokesperson stated it “had no involvement” in the report-retaining approach that identified irrespective of whether or not she was granted reduction.

“Nevertheless, we were joyful to support the institution with the problems they had with this borrower and rectify the financial loan forgiveness,” the spokesperson stated.

Michelle, “fortunately,” per Mayotte, was in a position to prove her eligibility for retroactive relief as a result of the Perkins personal loan instructing system. Her last equilibrium: $408, which, she explained, was paid in total as of two weeks ago.

“The only word I experienced was amen when I received that letter,” Michelle said. “I could not approach it entirely. I was just grateful.”

While Michelle’s exorbitant scholar financial loan harmony was a error, Mayotte explained she has labored with a couple of consumers ahead of who truly do owe close to $1 million for revenue borrowed to go to school.

A new report revealed by the Training Knowledge Initiative factors to the ongoing university student credit card debt crisis in the U.S., which has established tricky to solution irrespective of President Biden’s promised personal loan forgiveness plan — now on hold, per court order, and possibly headed to the Supreme Court. Student credit card debt now totals $1.745 trillion nationwide, according to the report, which destinations the common federal financial loan credit card debt balance at just less than $38,000. But, with Biden’s forgiveness approach stalled, the administration not long ago introduced that it is extending the pause on pupil personal debt repayments right until June of up coming calendar year.

“Instruction, when financed by college student loans, does not live up to its mantra as the ‘great equalizer,'” claimed Michelle in an email, adding that debtors, significantly these who go on to get the job done in the general public sector, typically “grow old with the burdens of university student loans and are from time to time in no way, at any time absolutely capable to make future strategies, to enhance lifestyle, to help you save, to commit, or retire on time. The pay out is frequently as well lower — paycheck to paycheck — and the existence cycle of loans very last solely too extensive.”