Barrett Business Services (NASDAQ:BBSI) Has Announced A Dividend Of US$0.30

Barrett Enterprise Companies, Inc. (NASDAQ:BBSI) will spend a dividend of US$.30 on the 3rd of December. The dividend produce will be 1.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} based on this payment which is nevertheless above the market common.

Check out out our most recent analysis for Barrett Enterprise Expert services

Barrett Organization Services’ Dividend Is Perfectly Coated By Earnings

Amazing dividend yields are fantastic, but this does not make a difference a great deal if the payments cannot be sustained. Prior to this announcement, Barrett Business Services’ earnings simply included the dividend, but totally free hard cash flows had been adverse. We consider that dollars flows should really get priority over earnings, so this is certainly a fret for the dividend going forward.

In excess of the following calendar year, EPS is forecast to broaden by 4.6{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. Assuming the dividend continues together latest tendencies, we think the payout ratio could be 26{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} by next year, which is in a pretty sustainable range.

Barrett Organization Services Has A Stable Observe Record

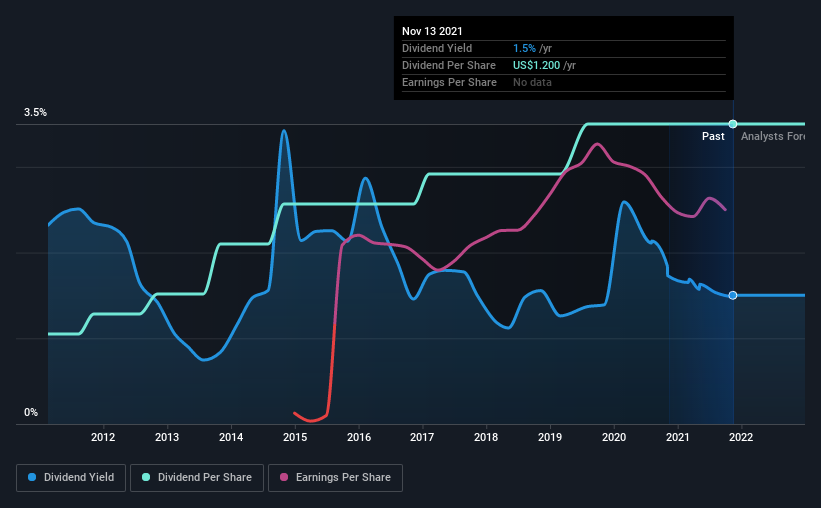

The firm has been paying a dividend for a long time, and it has been pretty steady which gives us confidence in the foreseeable future dividend possible. Since 2011, the dividend has long gone from US$.36 to US$1.20. This will work out to be a compound annual development amount (CAGR) of about 13{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} a 12 months more than that time. We can see that payments have proven some incredibly wonderful upward momentum with no faltering, which offers some reassurance that foreseeable future payments will also be reputable.

The Dividend Has Growth Likely

Investors who have held shares in the organization for the past couple many years will be happy with the dividend cash flow they have received. It is encouraging to see Barrett Company Products and services has been expanding its earnings for every share at 8.4{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} a 12 months over the earlier 5 decades. Expansion in EPS bodes perfectly for the dividend, as does the very low payout ratio that the firm is at this time reporting.

Our Feelings On Barrett Company Services’ Dividend

In summary, while it can be superior to see that the dividend hasn’t been cut, we are a little bit cautious about Barrett Small business Services’ payments, as there could be some issues with sustaining them into the long run. Even though the lower payout ratio is redeeming function, this is offset by the small dollars to go over the payments. We would be a contact careful of relying on this inventory primarily for the dividend cash flow.

It can be significant to note that organizations acquiring a dependable dividend plan will produce larger trader self-assurance than these obtaining an erratic just one. Meanwhile, even with the great importance of dividend payments, they are not the only elements our viewers really should know when evaluating a business. Circumstance in position: We have noticed 2 warning signals for Barrett Company Providers (of which 1 is likely significant!) you ought to know about. If you are a dividend trader, you could possibly also want to seem at our curated record of significant doing dividend inventory.

This report by Merely Wall St is normal in character. We offer commentary dependent on historic information and analyst forecasts only working with an impartial methodology and our posts are not meant to be fiscal tips. It does not represent a recommendation to invest in or market any stock, and does not acquire account of your objectives, or your fiscal problem. We intention to convey you extended-expression targeted investigation pushed by fundamental data. Notice that our assessment might not aspect in the hottest value-delicate firm bulletins or qualitative product. Just Wall St has no situation in any shares mentioned.

Have feed-back on this post? Involved about the content material? Get in touch with us directly. Alternatively, e mail editorial-crew (at) simplywallst.com.