Barrett Business Services: Recent Performance Is Encouraging (NASDAQ:BBSI)

courtneyk

As businesses grow, they experience certain pains that they wouldn’t have experienced if they weren’t growing at all. In the past, many firms would deal with this in-house by developing their own capabilities. But over time, separate businesses began to pop up that specialized in servicing businesses when it came to activities outside of their core competencies. Although this came at a cost, it often proved beneficial for the firms needing the services because it allowed them to focus their capabilities on their core mission. One company that’s dedicated to helping other firms in this capacity is Barrett Business Services (NASDAQ:BBSI). Although the firm was negatively affected by the COVID-19 pandemic, its overall financial track record outside of that has been impressive. Growth continues into the 2022 fiscal year and shows no real signs of stopping. Add on top of this the fact that shares look affordable at this point in time, and I think that it makes for a decent ‘buy’ prospect at this moment.

A business for your business

According to the management team at Barrett Business Services, the company operates as a leading provider of business management solutions for small and mid-sized companies. In this capacity, the company has developed its own management platform that utilizes a knowledge-based approach from the management consulting industry and, when combined with tools from the human resource outsourcing space, benefits its customers by taking on certain tasks so that the customer in question can focus their efforts elsewhere.

Management’s own assertion is that the company works with over 7,600 companies each day, Utilizing a three-tiered progression system. The first tier is referred to as Tactical Alignment and it involves focusing on the mutual setting of expectations with its customers. Through this process, the company begins an assessment and discovery phase where it essentially aligns its customers’ objectives, attitudes, and culture with its own processes, controls, and culture. From there, we move on to the next tier which is known as Dynamic Relationship. In this stage, the company emphasizes organizational development as a means of achieving each client’s business objectives. During this time, the firm focuses on process improvement, developing best practices, implementing supervisor training, and promoting leadership development. And finally, there is the third tier known as Strategic Counsel. This involves advocacy on behalf of the business client, with the goal of cultivating an environment in which all efforts conducted by the firm are directed by the mission and long-term objectives of said client.

If this all sounds too vague, it might be helpful to look at the specific services that the company offers. The first of these is known as PEO (Professional Employer Services). Under this umbrella, the company enters into a client services agreement in order to establish a co-employment relationship with each client company. This involves Barrett Business Services taking on the role of facilitating payroll, payroll taxes, workers’ compensation coverage, and other administrative functions on behalf of its clients. While Barrett Business Services handles these activities, the client in question maintains physical care, custody, and control of the worksite employees that it oversees. The other primary service the company offers is referred to as Staffing and Recruiting. This basically includes on-demand and short-term staffing assignments, contract staffing, direct placement, and long-term or indefinite-term on-site management. In this case, sometimes, the on-site management employees are actually employed by Barrett Business Services itself.

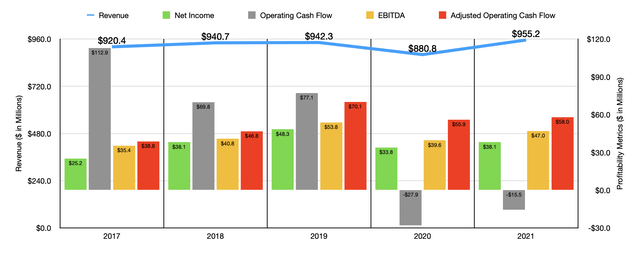

Author – SEC EDGAR Data

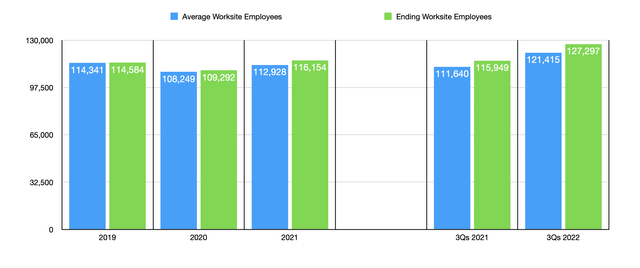

Over the past few years, the management team at Barrett Business Services has done a fairly good job growing the enterprise. Revenue rose from $920.4 million in 2017 to $942.3 million in 2019. The COVID-19 pandemic pushed sales down to $880.8 million in 2020. But this decline was short-lived, with sales shooting up to $955.2 million in 2021. One key determinant of the company’s growth would be the number of worksite employees that it has in its network. In 2019, for instance, the company averaged 114,341 worksite employees. This dropped to 108,249 in 2020 before rebounding some to 112,928 in 2021. As a leading indicator, the company also provides the number of worksite employees that it has as of the end of any given period. Over the three-year window covered, these numbers were 114,584, 109,292, and 116,154, respectively.

Author – SEC EDGAR Data

Profits for the company have been fairly consistent from a growth perspective as well. Net income grew from $25.2 million in 2017 to $48.3 million in 2019. In 2020, profits shrank to $33.8 million before hitting $38.1 million in 2021. Cash flow has been all over the map and, for most of the past five years, has actually declined. But if you adjust for changes in working capital, you would see that it rose between 2017 and 2019, climbing from $38.8 million to $70.1 million. It then plunged to $55.9 million in 2020 before inching higher to $58 million in 2021. A similar trend can be seen with EBITDA, with the metric ultimately hitting $47 million in 2021 compared to the $39.6 million reported for 2020.

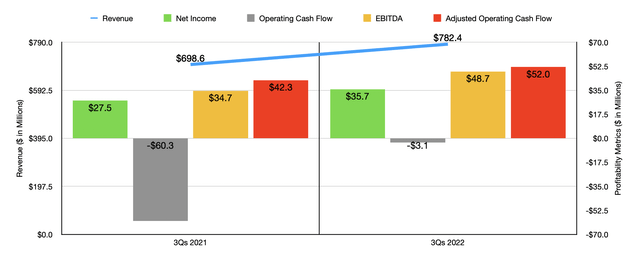

Author – SEC EDGAR Data

Growth for the enterprise has continued into the 2022 fiscal year. For the first nine months of the year, revenue totaled $782.4 million. That’s 12{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} higher than the $698.6 million reported the same time one year earlier. What’s really interesting is that the company saw a surge in the number of worksite employees that it has during this time. The average number in the first nine months of 2022 came out to 121,415. That’s up from the 111,640 seen only one year earlier. As for the ending number, this number jumped from 115,949 to 127,297 over the course of a single year. For 2022 as a whole, the company expects the average number of worksite employees to be between 8{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} and 9{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} higher than they were one year earlier. This should help gross billings to climb by between 12{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} and 13{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} year over year.

Author – SEC EDGAR Data

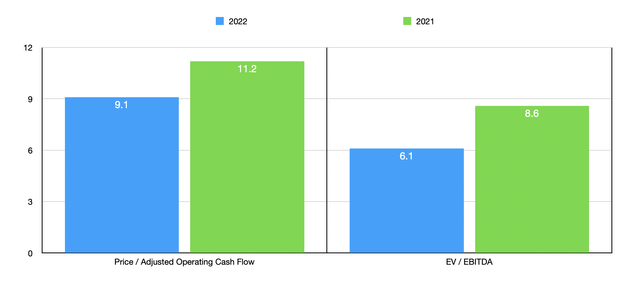

Unfortunately, no guidance was given when it came to profitability metrics. But if we annualize results experienced so far for 2022, we would anticipate adjusted operating cash flow of $71.3 million and EBITDA of $66 million. Based on these figures, the company is trading at a forward price to adjusted operating cash flow multiple of 9.1 and at a forward EV to EBITDA multiple of 6.1. These numbers compare favorably to the 11.2 and 8.6 readings that we get, respectively, using data from the 2021 fiscal year. As part of my analysis, I also compared the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 3.4 to a high of 14.3. And when it comes to the EV to EBITDA approach, the range was from 0.8 to 15.5. In both cases, two of the five companies were cheaper than Barrett Business Services.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Barrett Business Services | 9.1 | 6.1 |

| Kelly Services (KELYA) | 10.2 | 8.2 |

| TrueBlue (TBI) | 6.7 | 5.1 |

| Heidrick & Struggles International (HSII) | 3.4 | 0.8 |

| HireRight Holdings Corp (HRT) | 9.5 | 8.8 |

| HireQuest (HQI) | 14.3 | 15.5 |

Takeaway

Given current economic conditions, I understand why investors would be concerned about a company like Barrett Business Services. It’s not unthinkable that financial performance could weaken in the next few quarters. Having said that, the company fared quite well during the COVID-19 pandemic and any downturn we experience is unlikely to be worse than that. Add on top of this how cheap shares are on an absolute basis and the fact that shares look reasonably priced compared to similar firms, and I would make the case that it represents a decent ‘buy’ prospect at this time.