Barrett Business Services: Value In Stock Repurchase Program (NASDAQ:BBSI)

ansonsaw

Barrett Business Services (NASDAQ:BBSI) counts with expertise accumulated since 1965 and an extensive network of referrals, which will likely help enhance sales growth. Under the most optimistic case scenario that includes M&A operations and geographic expansion, my DCF model resulted in a valuation of $155 per share. In my view, even considering risks from geographic concentration of revenue in California and failure of partner agreements, the current stock price appears too low.

Barrett Business Services: Better Guidance And A Stock Repurchase Program

Barrett Business Services, Inc., offers business management solutions. With a management platform bringing knowledge from the management consulting industry and the human resource outsourcing industry, the company has been successful since 1965.

Investor Presentation

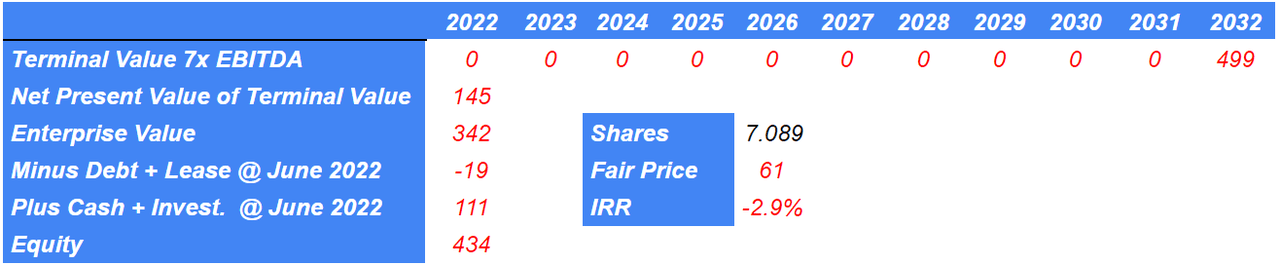

Let us go straight to the point. In my view, there are two main reasons to have a look at Barrett Business now. First, management recently increased its guidance. Second, gross billings are now expected to grow at close to 13{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} y/y. In my view, as soon as traders have a look at the new guidance, the stock price will most likely trend north:

In light of the strong performance in the second quarter, BBSI is increasing its outlook for 2022 and now expects the following: Gross billings growth of 11{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} to 13{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, increased from 10{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} to 12{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in the prior outlook. Source: BBSI Reports Strong Second Quarter 2022 Financial Results

Besides, the company recently reported a new stock repurchase program, which will likely enhance value generation for shareholders in the coming months. We are talking about the acquisition of $75 million of stock over the next two years:

On February 28, 2022, BBSI’s board of directors approved a new stock repurchase program authorizing the Company to purchase up to $75 million of its stock over a two-year period. Source: BBSI Reports Strong Second Quarter 2022 Financial Results

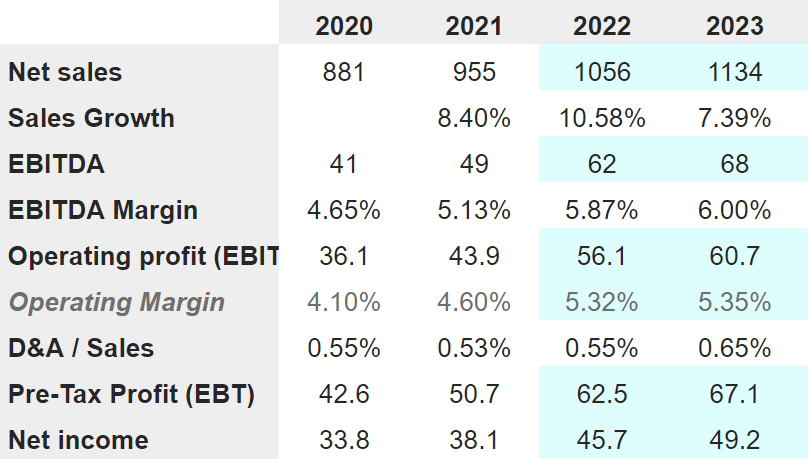

Great Expectations From Other Financial Analysts

Analysts out there are quite optimistic about Barrett Business Services. They believe that net sales growth could stand at 10{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in 2022 and 7.39{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in 2023. In 2022 and 2023, the EBITDA margin is expected to reach 5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} to 6{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, and the net income would grow to $49 million in 2023. These numbers made me interested in the company, and I decided to form my own opinion.

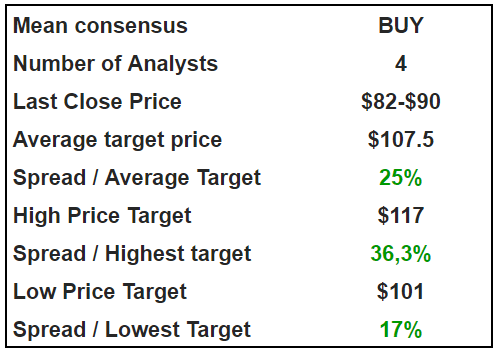

Other Investment Analysts

Let’s finally note that the average target price by the analysts stands at $107 with a high price target of $117 and a low-price target of $101. I obtained much more optimistic results.

Other Investment Analysts

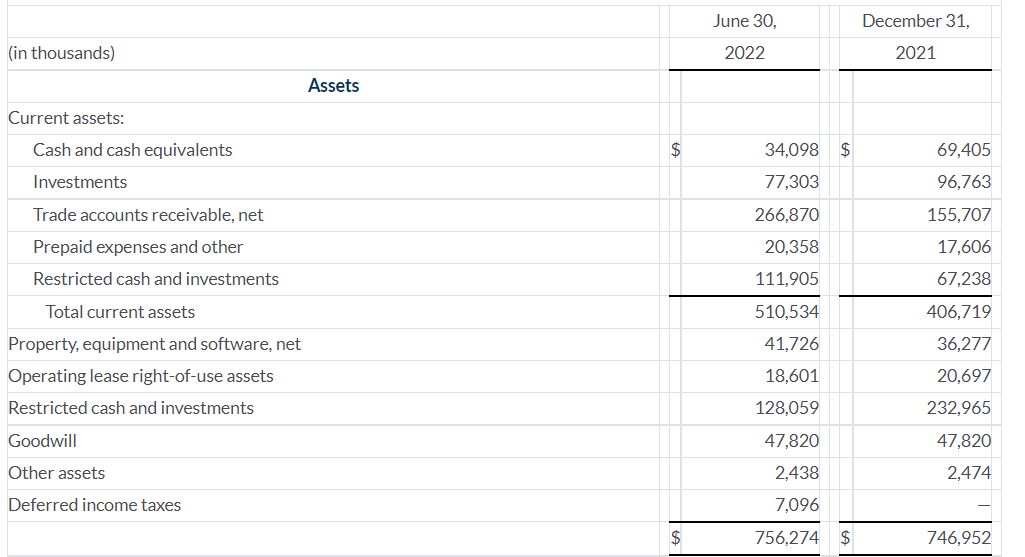

Balance Sheet

As of June 30, 2022, Barrett Business Services reports $34 million in cash, $756 million in total assets, and an asset/liability ratio of 1x-2x. The company’s financial situation appears solid.

Quarterly Report

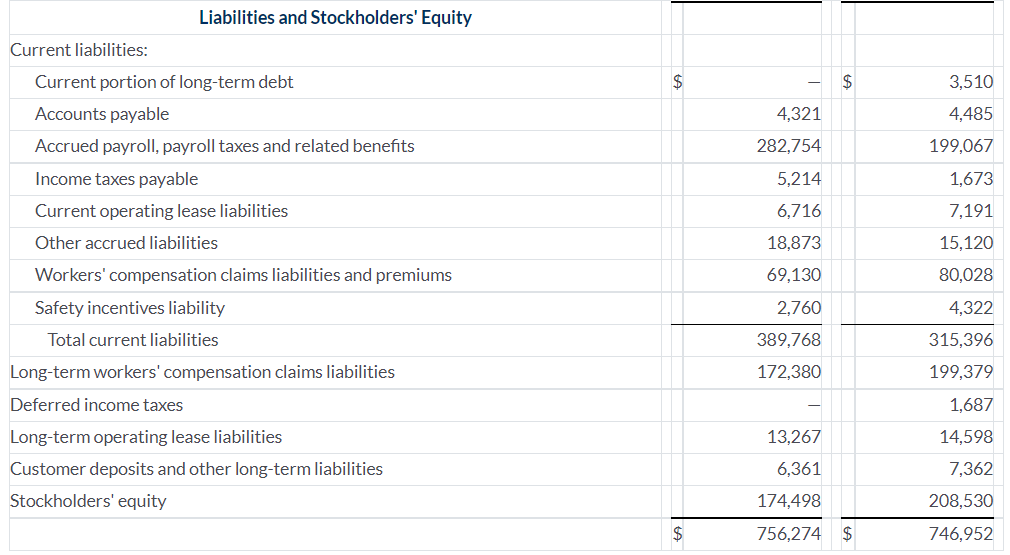

Management does not report debt, which most financial advisors would appreciate. With that, long-term operation lease liabilities stand at $13 million, and accrued payroll, payroll taxes, and related benefits stand at $282 million. Long-term workers compensation claims liabilities are equal to $172 million. Let’s tell it this way, employees and workers seem to be financing part of the company’s operations.

Quarterly Report

The Most Likely Scenario Includes 7.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} Sales Growth And A Fair Price Close To $125

Under normal conditions, I believe that organic growth will continue to play a major role. The company knows well how to add new clients as well as design new products. Keep in mind that management counts with know-how accumulated since 1965. I also believe that in the near future, economies of scale and leverage will help enhance the free cash flow margins. These business catalysts were depicted in a recent presentation to investors.

Investor Presentation

In my opinion, if the management successfully hires new business teams in existing branches, client referrals will most likely help generate revenue growth. More revenue growth will likely help push the company’s valuation up:

We believe our clients are one of our best advocates and powerful drivers of referral-based growth. In each market, operations teams provide expertise, consultation and support to our clients, driving growth and supporting retention. We anticipate that by adding business teams to existing branches, we can achieve incremental growth in those markets, driven by our reputation and by client referrals. In most markets business development efforts are led by area managers and are further supported by business development managers. Source: 10-k

I also believe that the role of partners will likely help Barrett Business find new clients. Let’s point out that the company counts with a network of insurance brokers, financial advisors, attorneys, and CPAs that introduce the software to clients. Under this case scenario, I assumed that the network built for many years will continue to enhance business:

Our business growth has three primary sources: referrals from existing clients, direct business-to-business sales efforts by our area managers and business development managers, and an extensive referral network. Partners in our referral network include insurance brokers, financial advisors, attorneys, CPAs, and other business professionals who can facilitate an introduction to prospective clients. Source: 10-k

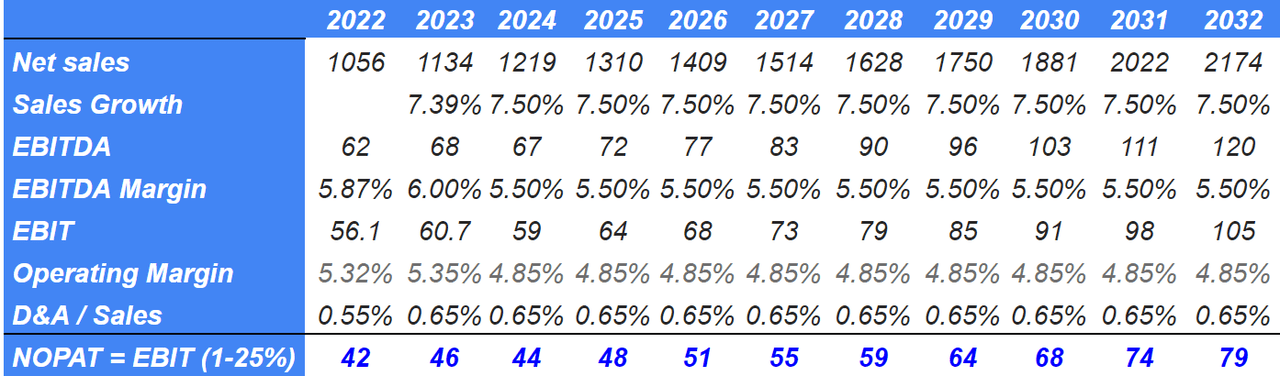

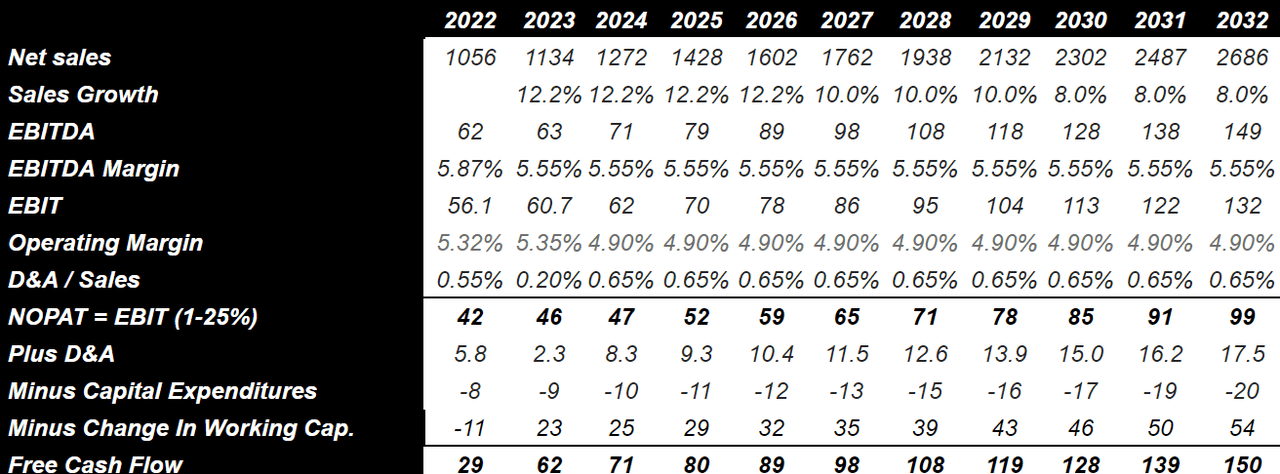

Considering previous sales growth, I believe that sales growth at around 7.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} y/y is likely. It means that the company would deliver close to $2.17 billion in sales in 2032. If we also assume an EBITDA margin around 5.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} and D&A/Sales close to 0.65{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, non-operating profit after tax would stand at almost $80 million by 2032. I believe that my numbers are conservative.

Author’s Work

If we add D&A between $5 million and $15 million, and subtract capex around $7.5 million and $15 million, the free cash flow would stay between $30 million and $120 million. With a discount of 11.855{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, the net present value of future free cash flow would stand at almost $450 million.

Author’s Work

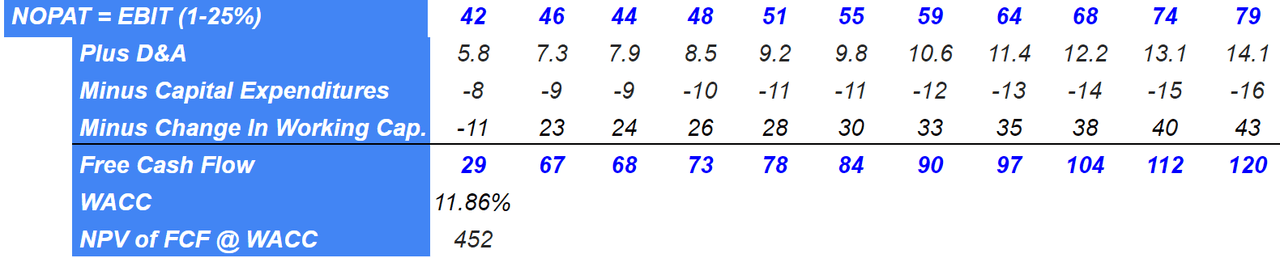

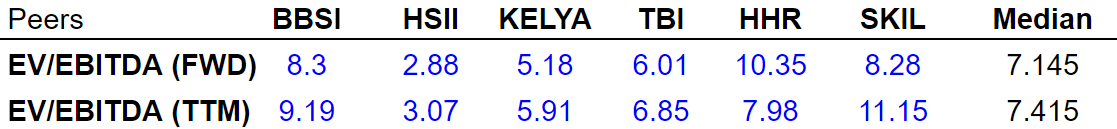

Peers trade at an average of close to 7x EBITDA. However, I believe that Barrett Business could trade at 10x EBITDA considering sales growth close to 7.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} and the previous EBITDA margin assumption.

SA

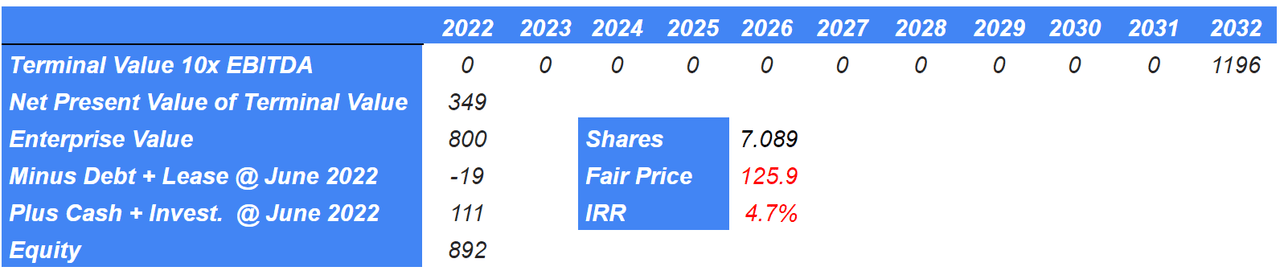

With the previous figures, I obtained an implied enterprise value of $800 million and an equity close to $892.1 million. The fair price would stand at $125 per share, and the IRR could be close to 5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}.

Author’s Work

Risks And My Worst Case Scenario Imply A Valuation Of $61 Per Share

Barrett Business Services uses software from third-party vendors. The price of these productions that the company licenses could increase. As a result, Barrett Business may have to increase their prices, which may lead to lower demand. If Barrett Business decides not to increase their prices, free cash flow could be affected, and the company’s fair valuation would decrease. Management warned about these issues:

Significant portions of our services and operations rely on software that is licensed from third-party vendors. The fees associated with these license agreements could increase in future periods, resulting in increased operating expenses. If there are significant changes to the terms and conditions of our license agreements, or if we are unable to renew these license agreements, we may be required to make changes to our vendors or information technology systems. Source: 10-k

Barrett Business Services reports that close to 73{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of its revenue in 2021 came from California. It is a bit risky. If the economy in California does not perform, or performs less than other regions, shareholders may sell shares of Barrett. As a result, the company’s cost of equity would increase, and the valuation may decline substantially.

Our California operations accounted for approximately 73{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of our total revenues in 2021. As a result of the current importance of our California operations and anticipated continued growth from these operations, our profitability over the next several years is expected to be largely dependent on economic and regulatory conditions in California. Source: 10-k

Under this case scenario, I also assumed that Barrett Business Services would have some issue with certain referral partners. Keep in mind that these partners don’t have exclusive relationships with the company, and could work for and with competitors. If management fails to sign more partner agreements, the revenue line would decline. If management also tries harder to sign more agreements, operational expenses may also increase, which would lower the company’s free cash flow.

We currently maintain a minimal internal professional sales force, instead relying heavily on referral partners to provide referrals to new business. In connection with these arrangements, we pay a fee to referral partners for new clients. These referral firms and individuals do not have an exclusive relationship with us. If we are unable to maintain these relationships or if our referral partners increase their fees or lose confidence in our services, we could face declines in our business and additional costs and uncertainties as we attempt to hire and train an internal sales force. Source: 10-k

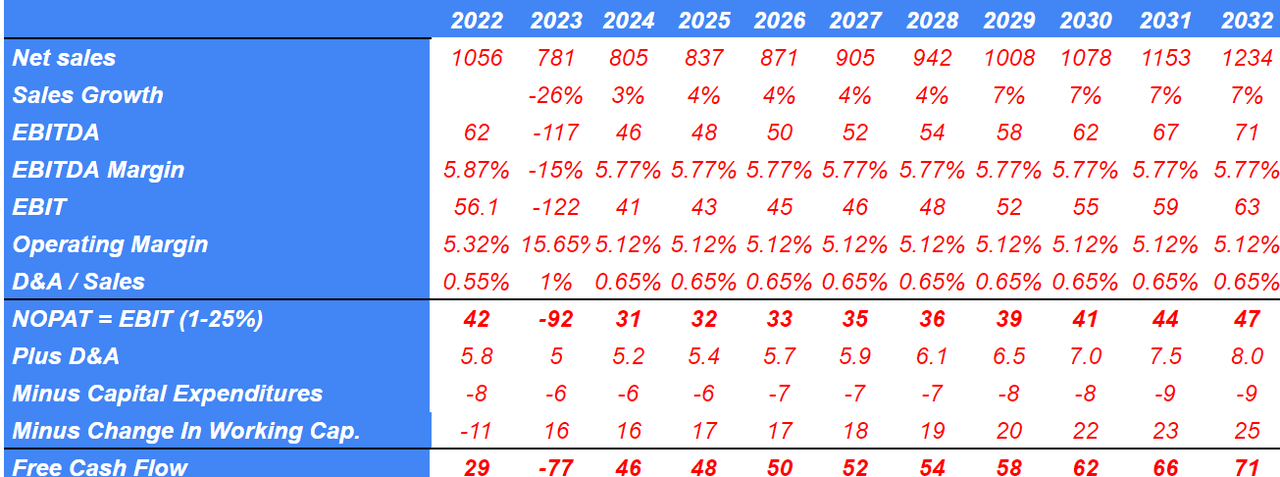

Under an unlikely and detrimental case scenario, I used sales growth of -26{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in 2023 and sales growth between 3{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} and 7{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} from 2024 to 2032. I also assumed an EBITDA margin close to 5.77{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} and an effective tax around 24{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}-26{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. My results include 2032 NOPAT of $47 million.

Author’s Work

With an exit multiple of 7x EBITDA, I obtained an enterprise value of $342 million. If we add cash in hand, and subtract debt of $111 million, the fair price would stand at $61 per share.

Author’s Work

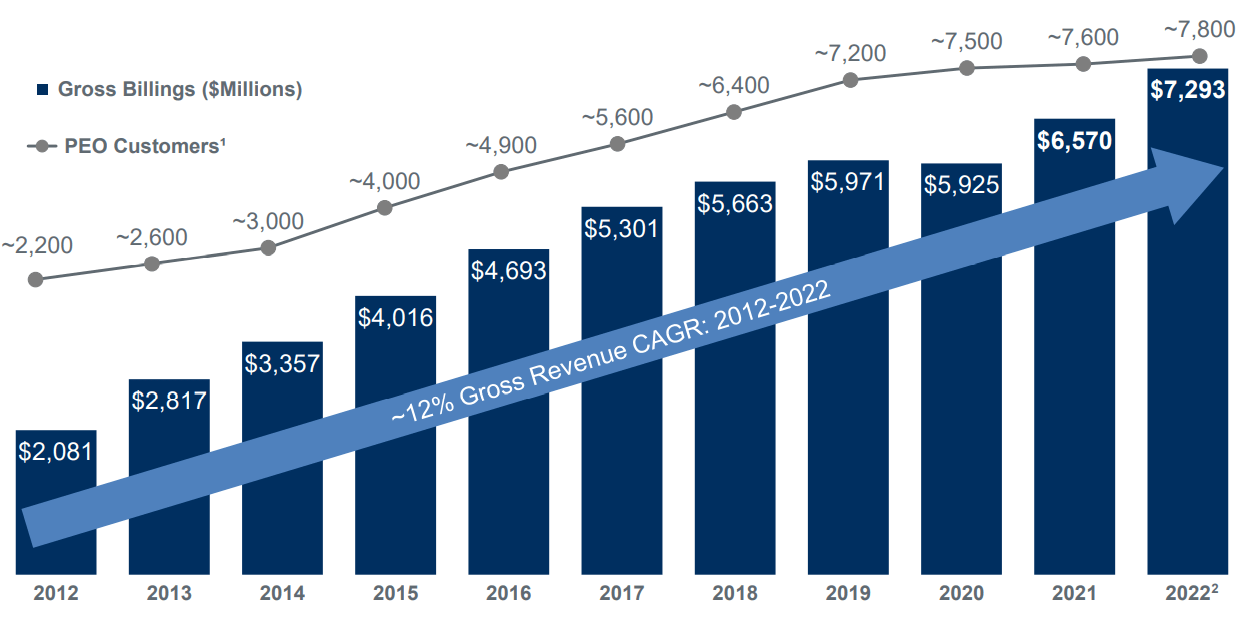

My Best Case Scenario Would Result In A Valuation Of $155 Per Share

From 2012 to 2022, the company reported 12{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} gross revenue growth. Under this scenario, I assumed that future net sales will be close to this figure.

Quarterly Report

I also assumed that geographic expansion and acquisitions will help Barrett Business improve sales growth. Let’s note that management reports a significant amount of goodwill in the balance sheet. It means that the company has expertise in the M&A markets. Directors will know how to run new merger integrations.

Investor Presentation

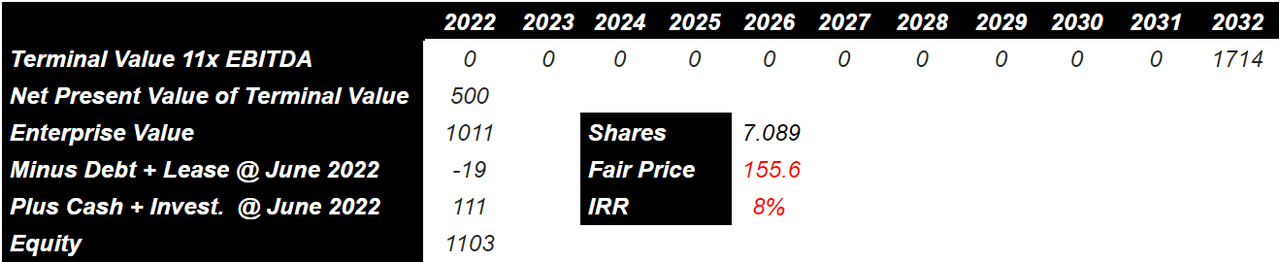

With sales growth close to 12.2{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} and an EBITDA margin of 5.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, 2032 NOPAT would stand at close to $100 million. Now, if we subtract capital expenditures and changes in working capital, and add D&A, 2032 FCF would stand at $150 million.

Author’s Work

With 2032 EBITDA multiple of 11x, I obtained a NPV of the terminal value of $500 million. Finally, the equity value would stand at around $1.103 billion. The fair price would stand at $155 per share, and the IRR would be close to 8{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}.

Author’s Work

My Takeaway

Considering the accumulation of expertise in the industry since 1965 and a large network of partner referrals, Barrett will likely continue to experience sales growth. By assuming further acquisitions and revenue growth around 12.2{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, my DCF model resulted in a valuation of $155 per share. Even taking into account risks from geographic concentration of revenue, licenses from third-party vendors, and failure of partner agreements, the current stock valuation is too low. In the worst-case scenario, I obtained a fair price of $61 per share.