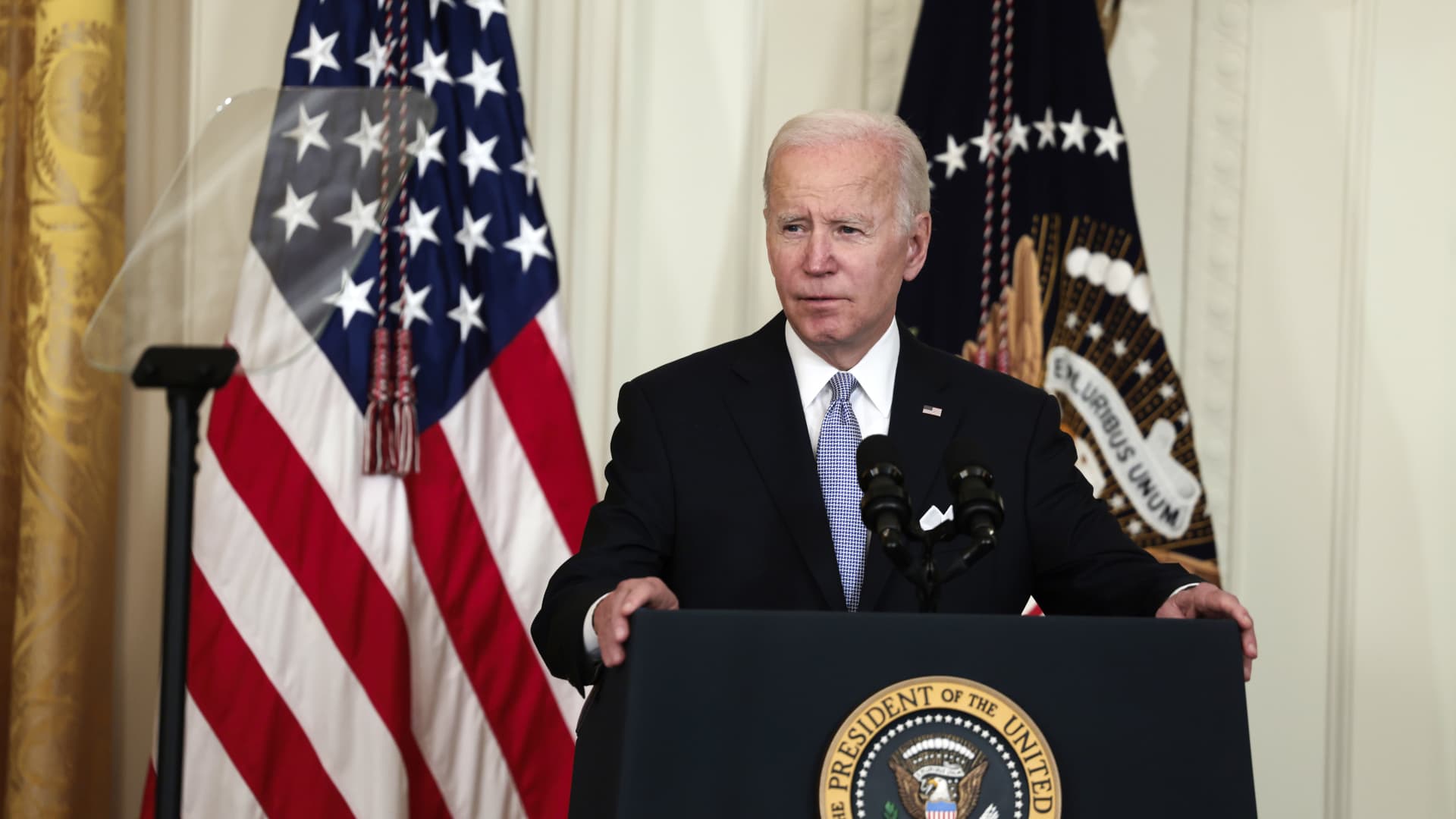

Biden administration cancels $5.8 billion in student loans. More borrowers could see relief soon

The U.S. Department of Schooling canceled about $5.8 billion in excellent scholar financial loans for much more than 560,000 borrowers in the premier one personal loan forgiveness action taken by the governing administration to date, the division introduced Wednesday.

The cancellation applies to all those people who attended colleges operated by the now-defunct Corinthian Schools, one particular of the major for-earnings education and learning businesses that submitted for Chapter 11 bankruptcy in 2015.

Corinthian Colleges has faced quite a few lawsuits because its founding in 1995 — but maybe the most noteworthy is from 2013, when Vice President Kamala Harris sued Corinthian although she was legal professional normal of California for “deceptive and bogus promoting and recruiting” between other allegations, according to the department.

“As of right now, each student deceived, defrauded, and pushed into debt by Corinthian Schools can relaxation assured that the Biden-Harris administration has their back again and will discharge their federal scholar loans,” U.S. Secretary of Education and learning Miguel Cardona explained in a assertion.

Qualifying debtors will not likely need to fill out the application to receive the reduction, either: it will be automated, and they are predicted to be notified in months, the office explained.

Wednesday’s information comes as the Biden administration considers broader scholar financial loan forgiveness for tens of millions of debtors — so much, the administration has permitted $25 billion in bank loan forgiveness for about 1.3 million borrowers.

Although some politicians and economists hailed the shift as a move in the appropriate course towards addressing the $1.7 trillion student debt disaster, hundreds of thousands of debtors have yet to see relief and are thinking when, and if, their financial loans will be forgiven.

This is what to be expecting with pupil personal loan forgiveness in the coming months:

The federal university student financial loan pause will probable be extended as a result of the end of 2022

White Residence officers are zeroing in on canceling $10,000 for all borrowers who gain significantly less than $150,000 for every calendar year, CNBC reports, but the administration has nonetheless to validate this kind of options.

In April, the Department of Instruction extended the pause on university student mortgage repayment, curiosity and collections by way of Aug. 31, 2022, but Michelle Dimino, a senior schooling coverage chief at Third Way, predicts the payment pause will be prolonged still once more by the conclusion of the calendar year, at the very least till right after the midterm elections.

A new poll from Knowledge for Progress and Rise identified that voters may well be considerably less very likely to vote in the midterms if the Biden administration fails to provide adequate relief to borrowers.

Cardona and other best Biden officials have also built it obvious that they are snug extending the pause throughout interviews. “We are going to proceed to monitor it,” Cardona advised Cox Media Group in April. “Appropriate now, we have August 31 and as you have seen in the past, we’ve been comfy moving that day if needed.”

Additional debtors could see reduction faster

In the meantime, however, Dimino expects that far more defrauded borrowers will see their debt canceled or reduced before long, primarily these with pending borrower protection statements or who qualify for a shut faculty bank loan discharge, which signifies your school closed even though you had been enrolled, or you couldn’t comprehensive your system simply because of the closure.

“The a person point we can, and do, hope from this administration at this level is a continued, concerted effort and hard work to help debtors who are struggling the most and provide focused relief,” Dimino adds. “The Department of Education and learning is truly charging forward to get by that backlog of defrauded borrowers and give them the overdue reduction that they are entitled to.”

Verify out:

With scholar mortgage payments frozen right until Might, this is how to use that cash for a economic reset

If you despise budgeting, try the 80/20 rule to conserve funds without the need of monitoring every single one expense

Inspite of substantial-profile team cuts, the task market stays ‘burning hot’ for personnel

Indicator up now: Get smarter about your money and job with our weekly publication