Biden’s student loan forgiveness plan: Breaking down the cost

FOX Business’ Lydia Hu experiences on the newest developments, noting the transfer does not go significantly ample for progressive Democrats who are contacting for a cancellation.

President Biden this week revived the probability of wiping out millions of Americans’ pupil financial loan debt with the stroke of a pen, a coverage that could cost the federal governing administration $321 billion.

Despite the fact that Biden has so considerably canceled just a portion of the personal debt that he promised to erase on the campaign path, the president – who is going through mounting stress from progressives as perfectly as declining approval rankings – floated the probability this 7 days of eliminating $10,000 for every borrower.

“I am contemplating working with some debt reduction,” Biden claimed Thursday in response to a concern at the White Dwelling. “I am not contemplating $50,000 credit card debt reduction. But I am in the course of action of getting a tough search at no matter whether or not there will be added personal debt forgiveness.”

BIDEN CANCELING Student Personal debt WOULD MAKE INFLATION Worse, Professionals Warn

Erasing $10,000 for each borrower would have to have the government to cancel about $321 billion in federally backed financial loans, according to an analysis revealed by the Federal Reserve Financial institution of New York last 7 days. That would reward about 11.8 million debtors, or about 31.1{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, and cancel 30.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of financial loans delinquent or in default prior to pandemic forbearance.

Beneath the policy, the average borrower would receive $8,478 in college student financial loan forgiveness.

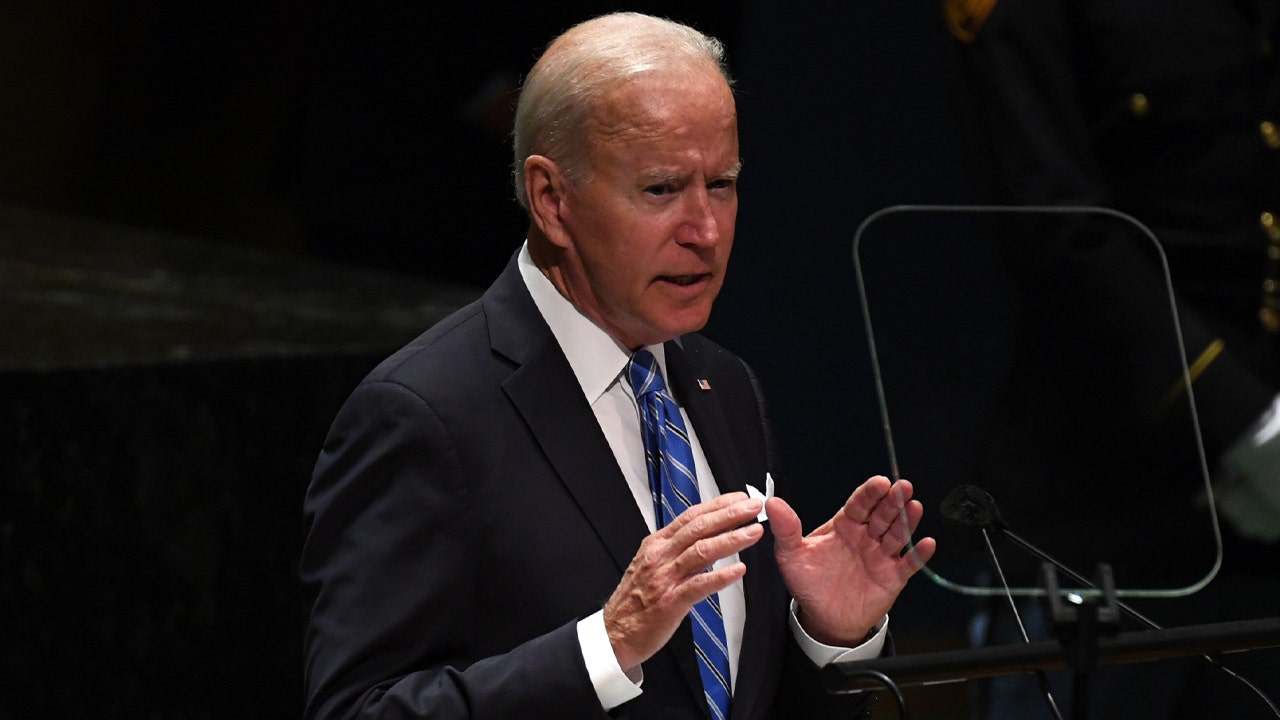

President Biden speaks in the course of an occasion about the Inexpensive Care Act at the White Property on April 5, 2022. (AP Photograph/Carolyn Kaster / AP Newsroom)

Should the Biden administration put in some constraints all around forgiveness, like a domestic profits limit of $75,000, the price tag of the application would tumble from $321 billion to $182 billion, in accordance to the New York Fed. As of December 2021, the whole exceptional harmony for federally owned financial loans was $1.38 trillion.

The nation’s personal debt amount is now at a historic significant of $30 trillion pursuing unparalleled degrees of expending during the COVID-19 pandemic.

Progressives, like Senate Vast majority Leader Chuck Schumer, D-N.Y., have urged Biden to terminate $50,000 in fantastic federal credit card debt for each borrower by means of executive purchase. The Democratic lawmakers have preserved that Biden could use present government authority less than the Increased Training Act to get the Department of Schooling to “modify, compromise, waive or launch” scholar loans.

Biden supported erasing $10,000 in scholar financial debt for most borrowers in the course of his presidential marketing campaign, but has raised concerns about his authorized authority to do so through government order. Previous 12 months, the president asked for a memo from the Training Section to figure out whether he had the electrical power to unilaterally terminate university student loan credit card debt.

These types of sweeping government action would pretty much unquestionably deal with a authorized obstacle, and it truly is unclear no matter whether it could survive. Critics have argued that working with this kind of electric power exceeds the president’s authority granted by Congress. Canceling pupil personal loan personal debt would also add to the nation’s now-ballooning national deficit, which totaled a around-document $2.8 trillion for the 2021 fiscal calendar year.

Senate The greater part Chief Chuck Schumer speaks to reporters at the Capitol on Sept. 28, 2021. (AP Photo/J. Scott Applewhite / AP Newsroom)

The approach may perhaps also disproportionately advantage rich Us citizens, in accordance to an evaluation by the University of Chicago’s Becker Friedman Institute for Economics. The study showed that erasing all scholar personal loan personal debt would distribute $192 billion to the leading 20{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of earners in the U.S., but just $29 billion to the base 20{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of U.S. households.

Underneath a common financial loan forgiveness program, the regular personal among the the prime-earning borrowers would obtain $5,944 in forgiveness, whilst all those with the least expensive incomes would acquire $1,070 in forgiveness, in accordance to the research.

Remarkable university student bank loan financial debt has doubled around the previous ten years, nearing a staggering $1.7 trillion. About one particular in six American older people owes money on federal scholar loan financial debt, which is the most significant quantity of non-house loan financial debt in the U.S. It has been cited as a main hindrance in people’s “financial daily life” by Federal Reserve Chairman Jerome Powell.

Folks relaxation on grass at Brown College in Providence, Rhode Island, on Sept. 25, 2019. (AP Photograph/Steven Senne, File)

The proposal will come as American individuals grapple with the hottest inflation in four a long time, with shopper prices surging 8.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in March from the year-in the past interval. The inflation spike has inflicted monetary agony on millions of U.S. households, specifically very low-earnings people, eroding wage gains and location up a large political obstacle for Biden, who has found his acceptance score sink in conjunction with the rising charges.

GET FOX Company ON THE GO BY CLICKING Below

There is issue amongst some economists that placing extra cash into Americans’ pockets at a time of currently sky-significant inflation could even more exacerbate the issue.

“It is high priced, inflationary, poorly specific, and fails to handle the root challenges in our better instruction funding procedure,” Maya MacGuineas, president of the Committee for a Accountable Federal Price range, mentioned in a assertion Thursday. “Full credit card debt cancellation would be a huge hand-out to abundant medical professionals and attorneys, would worsen our inflation crisis, and would price tag virtually as significantly as the entire 2017 tax cuts.”