Don’t Ignore The Fact That This Insider Just Sold Some Shares In Barrett Business Services, Inc. (NASDAQ:BBSI)

Any one interested in Barrett Organization Products and services, Inc. (NASDAQ:BBSI) must in all probability be aware that the Impartial Director, Jon Justesen, lately divested US$111k truly worth of shares in the corporation, at an typical value of US$76.50 just about every. On the vibrant facet, that sale was only 5.2{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of their holding, so we doubt it really is really significant, on its personal.

Barrett Small business Services Insider Transactions About The Previous Year

In the final twelve months, the most significant single sale by an insider was when the Impartial Chairman of the Board, Anthony Meeker, bought US$152k worthy of of shares at a selling price of US$76.17 for every share. That suggests that an insider was promoting shares at down below the current rate (US$76.27). When an insider sells down below the current rate, it implies that they thought of that reduce price tag to be good. That helps make us wonder what they assume of the (better) current valuation. Although insider providing is not a good indicator, we are unable to be positive if it does indicate insiders assume the shares are completely valued, so it is really only a weak indication. This one sale was just 11{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of Anthony Meeker’s stake.

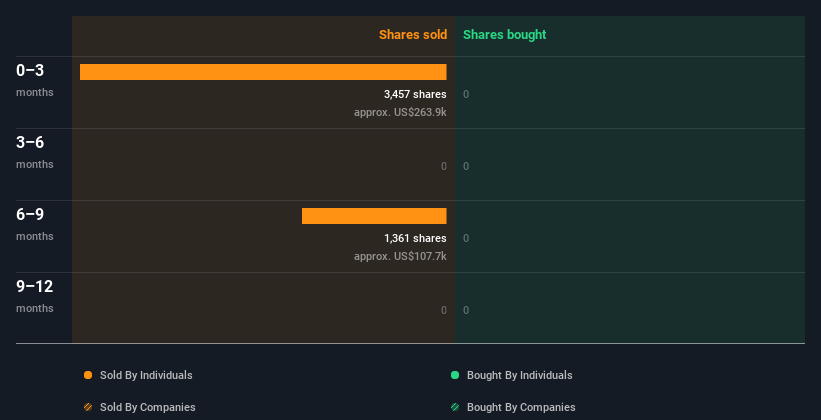

Barrett Business enterprise Expert services insiders didn’t acquire any shares about the final yr. You can see the insider transactions (by corporations and people today) over the previous year depicted in the chart below. By clicking on the graph below, you can see the precise aspects of each individual insider transaction!

I will like Barrett Organization Companies improved if I see some large insider purchases. When we hold out, check out out this free of charge checklist of growing organizations with appreciable, latest, insider shopping for.

Insider Ownership of Barrett Business enterprise Services

I like to glance at how a lot of shares insiders own in a firm, to aid notify my watch of how aligned they are with insiders. We normally like to see reasonably high amounts of insider ownership. It appears that Barrett Enterprise Expert services insiders individual 4.7{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of the enterprise, worth about US$27m. We have unquestionably found larger ranges of insider ownership somewhere else, but these holdings are adequate to propose alignment concerning insiders and the other shareholders.

So What Do The Barrett Business enterprise Solutions Insider Transactions Show?

Insiders haven’t acquired Barrett Business Expert services inventory in the past three months, but there was some marketing. And even if we search at the very last year, we did not see any buys. Insiders individual shares, but we’re nonetheless quite cautious, given the historical past of profits. We would apply some caution before acquiring! Though we like knowing what’s heading on with the insider’s ownership and transactions, we make guaranteed to also think about what risks are experiencing a inventory before creating any financial investment decision. Every company has pitfalls, and we have noticed 2 warning symptoms for Barrett Organization Expert services (of which 1 is a little bit regarding!) you should really know about.

But be aware: Barrett Business enterprise Solutions could not be the finest stock to acquire. So get a peek at this totally free listing of interesting providers with significant ROE and lower financial debt.

For the purposes of this report, insiders are these men and women who report their transactions to the appropriate regulatory human body. We at the moment account for open sector transactions and non-public inclinations, but not derivative transactions.

This posting by Just Wall St is normal in mother nature. We present commentary primarily based on historical knowledge and analyst forecasts only working with an impartial methodology and our posts are not intended to be fiscal guidance. It does not constitute a recommendation to buy or market any stock, and does not take account of your targets, or your economical situation. We intention to bring you lengthy-expression concentrated examination pushed by essential details. Note that our examination could not component in the most current selling price-sensitive organization bulletins or qualitative product. Only Wall St has no situation in any stocks pointed out.

Have responses on this posting? Concerned about the content? Get in contact with us specifically. Alternatively, e mail editorial-group (at) simplywallst.com.

The sights and opinions expressed herein are the sights and thoughts of the writer and do not essentially replicate individuals of Nasdaq, Inc.