Federal court strikes down Biden’s student loan forgiveness program

Washington

CNN

—

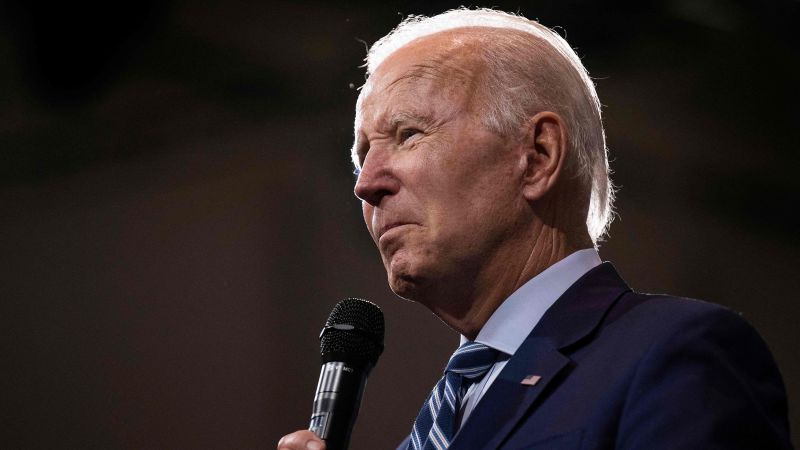

A federal decide in Texas has struck down President Joe Biden’s college student personal loan forgiveness plan, declaring it illegal.

The lawsuit was submitted by a conservative team, the Occupation Creators Community Foundation, in Oct on behalf of two debtors who did not qualify for financial debt aid.

Biden’s method was previously on hold owing a separate authorized problem.

The Biden administration has argued that Congress has offered the secretary of education and learning the electricity to broadly discharge university student mortgage personal debt in a 2003 legislation regarded as the HEROES Act.

But the Texas federal decide discovered that the legislation does not give the executive department crystal clear congressional authorization to make the scholar bank loan forgiveness method.

“The system is as a result an unconstitutional workout of Congress’s legislative energy and have to be vacated,” wrote Choose Mark Pittman, who was nominated by then-President Donald Trump.

“In this place, we are not ruled by an all-powerful govt with a pen and a cell phone,” he ongoing.

The Justice Section stated Thursday that it would attractiveness the determination, and White Household press secretary Karine Jean-Pierre mentioned in a assertion that “we strongly disagree with the District Court’s ruling on our university student credit card debt aid program.”

“For the 26 million borrowers who have currently offered the Section of Schooling the required data to be deemed for personal debt relief – 16 million of whom have already been authorised for relief – the Section will maintain onto their information and facts so it can immediately course of action their reduction when we prevail in court docket,” Jean-Pierre said.

The Biden administration has been banned from canceling any financial debt due to the fact the 8th US Circuit Court docket of Appeals place an administrative maintain on the application on Oct 21.

The appeals court docket has yet to rule on that lawsuit, brought by 6 Republican-led states. A lower courtroom decide dismissed the lawsuit on October 20, ruling that the states did not have the lawful standing to carry the challenge.

The Biden administration is struggling with a number of other lawful worries to the method. Supreme Court Justice Amy Coney Barrett has denied two different requests to challenge the method.

Less than Biden’s application, specific debtors who earned less than $125,000 in both 2020 or 2021 and married couples or heads of homes who created much less than $250,000 each year in all those several years are qualified to have up to $10,000 of their federal college student bank loan financial debt forgiven.

If a qualifying borrower also gained a federal Pell grant whilst enrolled in school, the personal is eligible for up to $20,000 of credit card debt forgiveness.

In the situation dominated on Thursday, one particular plaintiff did not qualify for the college student mortgage forgiveness application due to the fact her loans are not held by the federal federal government and the other plaintiff is only qualified for $10,000 in credit card debt relief simply because he did not get a Pell grant.

They argued that they could not voice their disagreement with the program’s regulations for the reason that the administration did not put it through a official notice-and-remark rule building method less than the Administrative Process Act.

“This ruling safeguards the rule of regulation which necessitates all People to have their voices read by their federal government,” said Elaine Parker, president of Task Creators Community Basis, in a statement Thursday.

The advocacy team was started by Bernie Marcus, a main Trump donor and former House Depot CEO.

Payments on federal scholar financial loans have been paused because March 2020 owing to a pandemic-connected gain. They are set to resume in January.

This tale has been current with supplemental info.