Federal student loan payments restart in 2 months: How borrowers can prepare

Pupil financial loan borrowers will be anticipated to resume payments in May possibly immediately after two a long time of federal forbearance. This is what to know. (iStock)

Federal pupil financial loan payments will resume in Could for the initial time considering the fact that the COVID-19 pandemic commenced in March 2020. This presents borrowers just two months to begin getting ready their funds after two years of federal forbearance.

Democrats have warned President Joe Biden that resuming payments devoid of college student loan cancelation would be “disastrous” in advance of the 2022 midterm elections. And though polling details suggests that most People in america want the scholar personal loan payment pause prolonged through the close of the calendar year, the Biden administration has not announced designs to lengthen forbearance once more.

Keep looking through to discover how to put together for federal college student loan compensation, which includes money-pushed reimbursement, more federal deferment and student loan refinancing. You can look at pupil mortgage refinancing fees on Credible for free of charge with no impacting your credit rating rating.

Pupil Mortgage PAYMENT PAUSE HAS Value THE Government $100B

How to put together for the conclude of pupil bank loan forbearance

Federal borrowers will be expected to resume generating payments on their scholar financial loan financial debt in just two brief months. Missed payments may perhaps be documented to the important credit bureaus, which can ding your credit history rating. Prolonged intervals of delinquency make you ineligible for federal rewards like deferment or forbearance, and could sooner or later final result in wage garnishment.

If you might be not completely ready to resume federal college student mortgage payments, here is how you can get started preparing now:

- Verify your loan compensation phrases. Pay a visit to the Federal College student Support (FSA) web page to see your remaining financial loan stability, regular payment sum and your payment due day.

- Re-enroll in automated payments. Debtors whose pupil credit card debt was transferred to a new loan servicer will require to re-enroll in vehicle-spend to stay clear of missing a payment in May perhaps.

- Established up an revenue-pushed reimbursement program (IDR). Federal university student personal loan debtors may be in a position to restrict their monthly payments to 10-20{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of their disposable cash flow as a result of an IDR approach.

- Implement for further federal deferment. Economic hardship and unemployment deferment give suitable debtors an additional 36 months of federal forbearance, for the duration of which curiosity accrues.

- Refinance your student financial loans at a lower level. Student loan refinancing may possibly aid you lower your month to month payments by a lot more than $250, according to a modern Credible evaluation.

It truly is vital to observe that refinancing your federal pupil credit card debt into a non-public pupil bank loan will make you ineligible for pick protections, these types of as IDR designs, administrative forbearance and federal student mortgage forgiveness applications. You can discover much more about pupil financial loan refinancing on Credible to ascertain if this credit card debt reimbursement method is proper for your economic situation.

POLL: Americans Doubtful THAT PRESIDENT BIDEN WILL Cancel Pupil Loans IN 2022

Non-public loan companies may possibly supply far more aggressive student personal loan rates

Among all current pupil mortgage borrowers, the common interest rate is 5.8{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, according to the Schooling Data Initiative. The interest rate you pay relies upon on the variety of scholar loans you have, this kind of as Immediate Application Financial loans or Mother or father Moreover Financial loans. These are the ordinary federal interest fees by financial loan variety amongst 2006 and 2022, for every Credible facts:

- Undergraduate Immediate Financial loans: 4.60{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}

- Graduate Immediate Loans: 6.16{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}

- Immediate Plus Loans: 7.20{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}

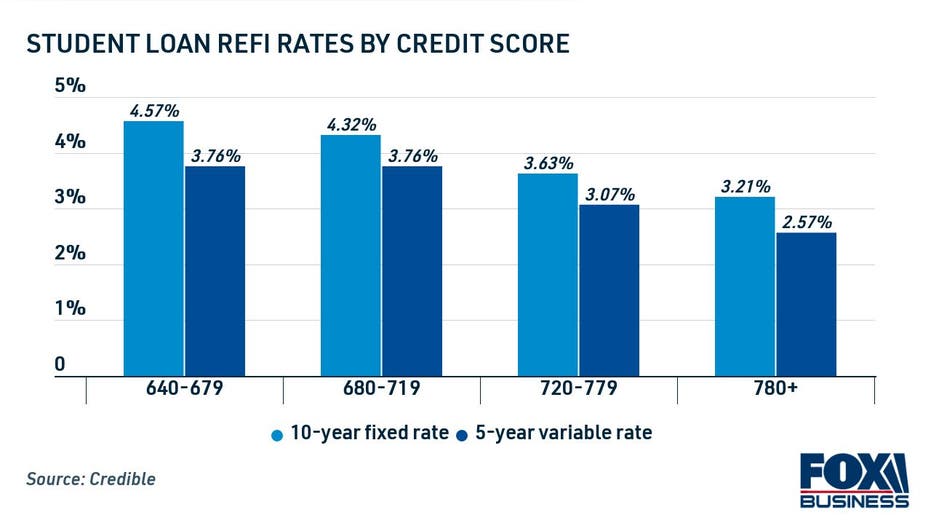

In comparison, properly-competent borrowers who refinanced their scholar financial loans on Credible during the 7 days of Feb. 14 noticed regular prices of 3.75{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} for 10-calendar year fixed-rate financial loans and 3.10{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} for 5-yr variable-level loans.

When federal student personal loan charges are based on when you originated the mortgage, personal college student loan rates are likely to range by credit rating rating and debt-to-money ratio (DTI). Borrowers with truthful or bad credit might take into consideration enlisting the enable of a creditworthy cosigner to increase their prospects of getting a very low level.

Scholar financial loan refinancing has the potential to save debtors countless numbers of dollars over time, but it could not be the ideal shift for absolutely everyone. If you strategy on applying for college student personal loan forgiveness plans like Public Provider Financial loan Forgiveness (PSLF), then refinancing to a private college student loan would make you ineligible.

Debtors who will not system on utilizing federal pupil loan gains may well take into consideration university student personal loan refinancing although rates are minimal. Refinancing your student bank loan debt at a lower curiosity price may support you cut down your month-to-month payments, pay back off credit card debt decades more rapidly and help save revenue more than the everyday living of the loan.

As an extra benefit, non-public student loan creditors are prohibited from charging refinancing service fees. The desire fee you fork out signifies the overall charge of borrowing the bank loan. A college student loan refinance calculator can support you determine if this economical tactic is proper for you.

You can search latest university student personal loan refinancing fees throughout several on line loan companies in the table down below. Then, you can check out Credible to see your approximated rate with a smooth credit score check out, which will never hurt your credit score score.

BIDEN ADMINISTRATION CANCELS One more $415M IN University student Mortgage Financial debt: DO YOU QUALIFY?

Have a finance-similar issue, but you should not know who to inquire? E mail The Credible Dollars Skilled at [email protected] and your problem may well be answered by Credible in our Revenue Specialist column.