Financial education is effective and efficient

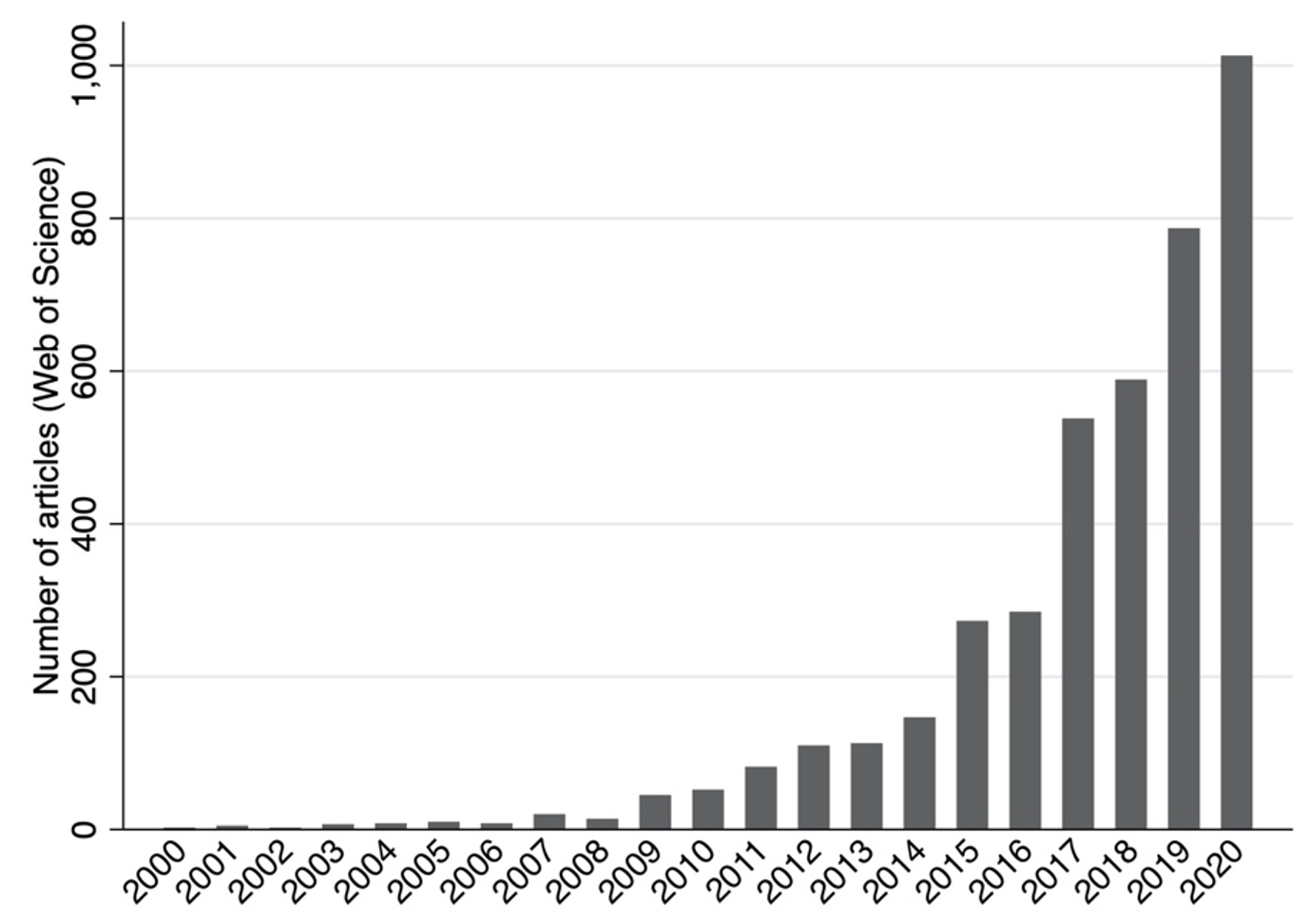

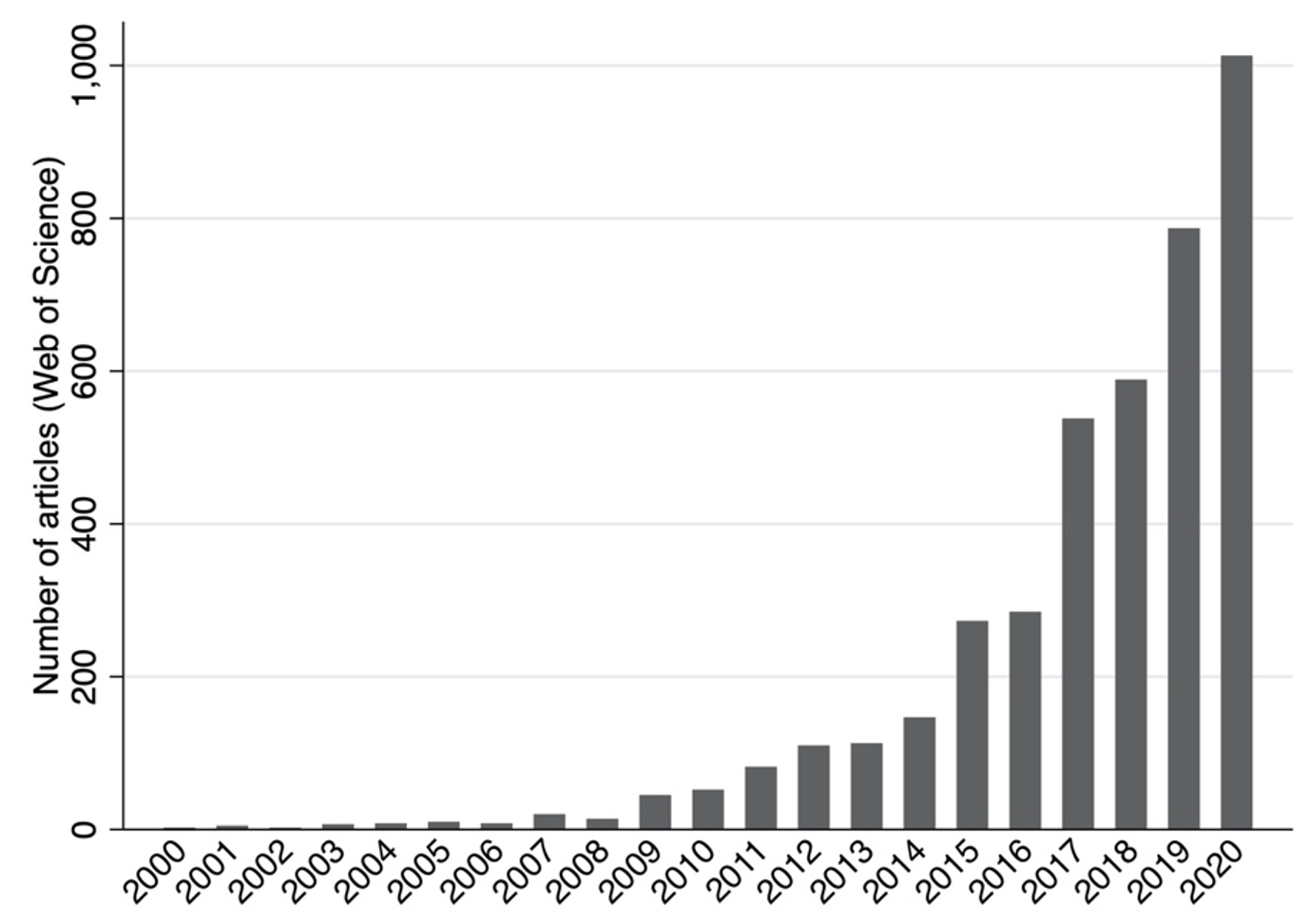

Analysis on economical literacy has been gaining momentum, and the variety of posts that incorporate the time period ‘financial literacy’ in their title or summary has grown swiftly in the past 10 decades (see Figure 1). The recognition of financial literacy is even further apparent in coverage and policymaking: the big greater part of OECD member international locations now have nationwide methods for fiscal training (OECD 2015).

Figure 1 Number of content articles on ‘financial literacy’ for each year in the Internet of Science, January 2022

Continue to, there is resistance to introducing economic schooling in faculties or the office. Two big arguments in opposition to monetary education and learning are that it would be ineffective and inefficient. We investigate the applicable proof and display that these concerns are misguided.

Evidence from randomised managed trials

The proof on money schooling consists of far more than 1,000 released studies. Right here, we concentrate on a somewhat modest established that is regarded as the gold typical of arduous evaluation – randomised managed trials. We retrieved 76 randomised managed trials, masking 33 nations and around 160,000 individuals (Kaiser et al. 2020). The noted interventions ordinarily concentrate on several procedure consequences in just one particular review, building 673 treatment effects in whole: 50 randomised controlled trials report 215 outcomes about financial understanding and 64 report 458 consequences with regards to a variety of domains of financial behaviour.

Meta-analyses with a variety of methods

We use a meta-assessment to ascertain the basic impact of economical instruction, applying the 670 procedure consequences as observations. The treatment method result on every single consequence is calculated in standardised suggest distinctions. These consequences are then aggregated.

There are two main strategies in the literature to evaluate usefulness. Meta-analysis in fields such as drugs usually works by using the prevalent-result tactic, which assumes that there is a widespread real influence and that noticed variations in remedy-influence estimates are due to random sampling mistake.

In money instruction, nonetheless, most meta-analyses rely on the random-outcomes technique, which assumes that the reports beneath consideration are quite heterogeneous, in particular with regards to goal teams, intervention goals, or intensity (e.g. Miller et al. 2015). As a result, the normal outcome is assumed not to be a preset parameter but, somewhat, a distribution of probable accurate effects. We use this latter approach, while we are watchful to exhibit that our findings are not driven by the selection of the estimation technique (Kaiser et al. 2020, Appendix B).

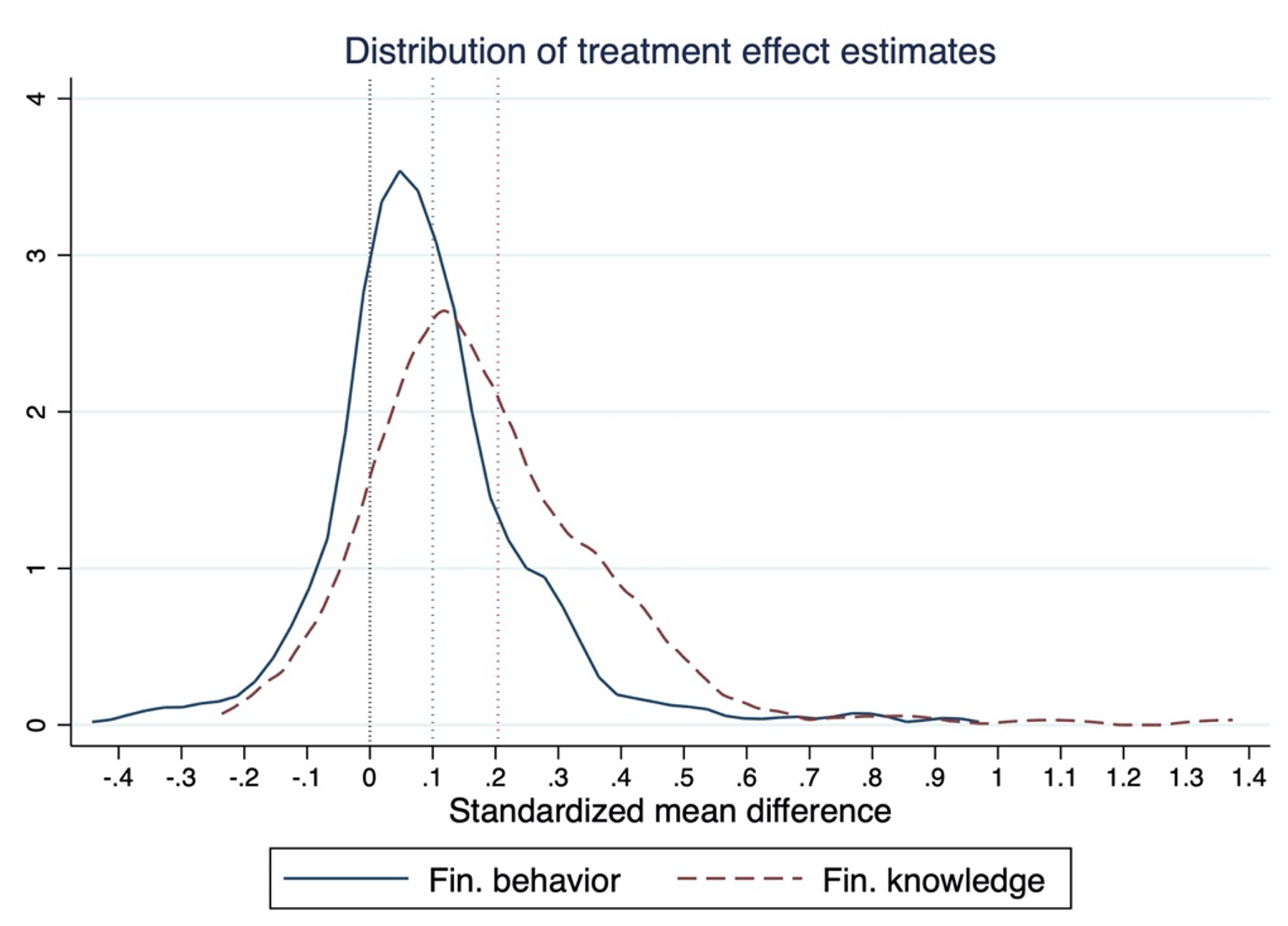

Financial education improves awareness and behaviour

We locate that economical instruction will work and performs effectively. Performance is assessed by two benchmarks: 1st, by contemplating the believed general result and, 2nd, by evaluating the magnitude of cure effects to other fields of education interventions. The mean influence of monetary education and learning on expertise is about .2 standard deviations, and the necessarily mean effect on behaviour is .10 standard deviations. The equipped distribution of these benefits is proven in Figure 2.

Figure 2 Uncooked distribution of cure influence estimates (Kaiser et al. 2020)

Notes: Dotted lines show meta-assessment weighted averages at .1 and .204 regular deviations for the outcomes of money behaviours and financial know-how, respectively.

The self esteem intervals associated with these estimates rule out zero-results of monetary education and learning. Even now, the comprehensive distribution of noticed treatment method-outcome estimates suggests that not all interventions realize success (determinants of accomplishment include, for case in point, teacher excellent or motivating mothers and fathers see Borowiecki 2022, Listing et al. 2021). This fact, nonetheless, does not justify the declare of ‘mixed evidence’ for financial instruction simply because this sort of failures are prevalent and noticed in other fields of schooling too. Moreover, some failures are usually anticipated in fields with very little encounter, and fiscal education is a young industry, as also indicated by the increasing impact dimensions amid more new randomised controlled trials relative to the very first interventions.

Particular finance instruction is as effective as schooling in other domains

We assess the effectiveness of fiscal instruction to other fields to assess what can be anticipated from fiscal schooling. The order of magnitude of .20 conventional deviations (i.e. the typical influence on fiscal understanding) is equivalent to typical outcomes of other instructional interventions. Relying on the classification of Kraft (2019), our final result of .203 can be deemed as a medium to large effect.

With regards to the impression on monetary conduct, conduct may perhaps be a lot more hard to influence than know-how. In this perception, the reasonably lesser measurement of the statistical outcome of financial instruction on conduct helps make sense. An typical influence of .1 normal deviations is comparable to other domains of academic interventions, these kinds of as health or electrical power conservation.

End result is robust to adjusting for publication bias

Even if the estimated success is strong to the estimation strategy, there is issue that posted benefits could possibly be distorted by the selective publication of experiments. Factors for this sort of a publication bias are that lecturers might be far more very likely to publish papers with statistically considerable final results than with null success, and that funding institutions may perhaps desire good results. There is indeed robust evidence for publication bias and selective reporting of success in economics (e.g. Brodeur et al. 2020). Thus, it appears vital to account for potential biases just before earning a judgement on the usefulness of financial schooling.

We apply the technique by Andrews and Kasy (2019) to management for a attainable publication bias. Success clearly show that this bias is current and significant, with conditional publication chances of insignificant benefits staying amongst 25{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} to 40{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} as opposed to success that go tests for regular degrees of statistical importance. Therefore, the described efficiency of financial training might be inflated thanks to publication bias, but the modified result dimensions keep on being sizeable (about .15 regular deviations on information and about .06 regular deviations on behaviour) and the involved self-confidence intervals rule out zero-consequences.

Money schooling is a small-price tag intervention

Whilst economic education programmes are efficient on average, small is known about their costs and price-performance. In our sample of randomised managed trials, 20 papers also report costs.

The mean charge for each outcome and participant is about $60, which is a ‘low cost’ educational intervention in accordance to Kraft (2019). As a result, the medium-sized remedy effects appear to be at small fees, resulting in a usually favourable cost-success ratio.

Summary

The debate about financial education and learning programmes is at times hindered by the argument that the evidence about their effectiveness is ‘mixed’. This stems from concentrating on randomised controlled trials which generally seem to report scaled-down estimates of statistical effect than effects-analysis models with lessen degrees of interior validity (Fernandes et al. 2014, Kaiser and Menkhoff 2017).

Nonetheless, when we analyse not long ago available randomised managed trials that consist of a big range of reports across 33 countries, we come across a sizeable standard impact of fiscal schooling on knowledge and behaviour at a comparatively very low charge. This final result retains true for various empirical designs and changing for publication bias. These success offer a stable foundation to lengthen research into better comprehending which styles of programmes are most impactful, price tag-efficient, and scalable and for whom.

References

Andrews, I, and M Kasy (2019), “Identification of and correction for publication bias”, American Economic Assessment 109(8): 2766–94.

Borowiecki, K J (2022), “How lecturers influence creative imagination: Proof from tunes composition considering the fact that 1450”, VoxEU.org, 29 January.

Brodeur, A, N Prepare dinner and A Heyes (2020), “Methods subject: p-hacking and publication bias in causal examination in economics”, American Economic Evaluation 100(11): 3634–60.

Fernandes, D, J G Lynch Jr and R G Netemeyer (2014), “Financial literacy, money education, and downstream monetary behaviors”, Administration Science 60(8): 1861–83.

Kaiser, T, A Lusardi, L Menkhoff and C City (2020), “Financial training affects fiscal knowledge and downstream behaviors”, CEPR Dialogue Paper 14741 and Journal of Financial Economics, forthcoming.

Kaiser, T, and L Menkhoff (2017), “Does monetary instruction impact monetary habits, and if so, when?”, Planet Bank Economic Critique 31(3): 611–30.

Kraft, M A (2019), “Interpreting result sizes of training interventions”, Academic Researcher, forthcoming.

List, J, J Pernaudet and D Suskind (2021), “Addressing the roots of educational inequities by shifting parental beliefs”, VoxEU.org, 12 December.

Miller, M, J Reichelstein, C Salas and B Zia (2015), “Can you help another person become monetarily able? A meta-evaluation of the literature”, Earth Financial institution Research Observer 30(2): 220–46.

OECD (2015), National procedures for economic instruction, OECD/INFE Coverage Handbook, Paris: OECD.