Financial literacy among students in Philadelphia: It’s time to close the gap

Economical literacy and private finance education should be a major priority

throughout all stages of lifetime, yet a latest survey carried out among the

Philadelphia Metro Place citizens demonstrates that it’s absent from 1 critical

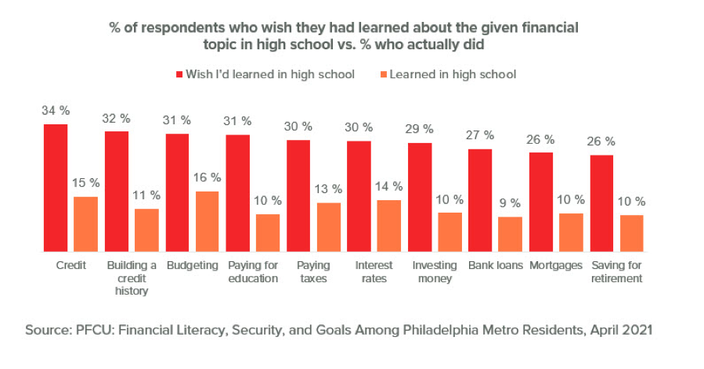

position: universities. The survey uncovered that higher university is the most widespread

location that Philadelphians wish they had uncovered about all aspects of

finance, but in fact, really little money education is occurring in

colleges. This will have to modify in purchase to raise the economical literacy of

Philadelphia all round, guaranteeing that people can not only survive, but

thrive fiscally.

Philadelphians’ verify resilience, irrespective of absent formal monetary schooling

Just before mapping out a strategy to enhance upcoming fiscal literacy initiatives,

it is vital to understand how Philadelphians have realized about many

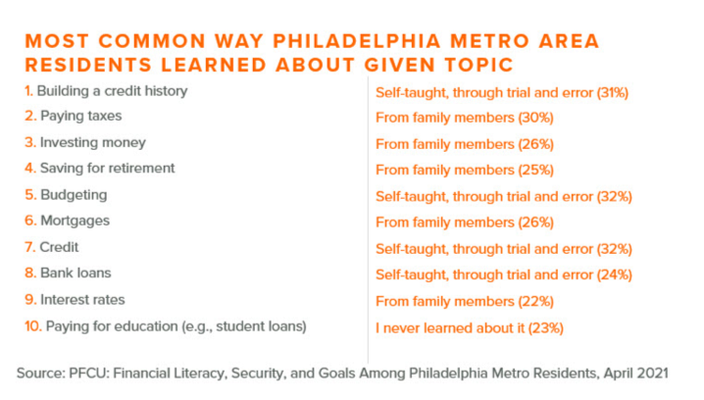

economic topics up right until now. The survey found that it is incredibly scarce for

Philadelphians to discover about taking care of their funds through official

instruction, as the most common approaches inhabitants report discovering about various

facets of controlling their funds are as a result of household or self-teaching.

Whilst getting the trial-and-error solution offers a one of a kind prospect to

study by expertise, and can even instill a sense of satisfaction in just the

unique for instructing on their own or their beloved ones a new talent or

idea, it is inherently problematic, as the learnings could be incorrect

or flawed in some way, hindering the particular person from really grasping the

root notion.

For instance, many more mature generations go down parts of cash guidance that

may have been precise or valuable in the earlier, these as the considered that

revenue is safer beneath your mattress in your have residence than in a credit history union

or bank. However, this is no more time the circumstance, as your income is improved off

in a financial savings account the place it is insured and can mature with fascination. Slight

nuances this kind of as this can make a massive change in the lengthy term, specifically

contemplating how the environment around us is altering regularly.

Probably just one of

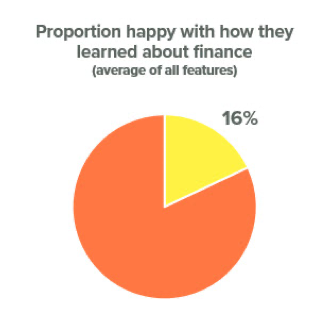

the most illuminating findings from the study is that Philadelphians

documented they have been disappointed with the way they realized about finance, in spite of

expressing feelings of confidence in their present financial problem. In

truth, only 16{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of respondents documented that they are satisfied with how they

figured out about finance, which means that we, as credit rating union leaders, have

operate to do when it will come to giving economic instruction.

Encouraging money security between Philadelphians of all ages

Financial education efforts will have to start as early as probable, even if at a

significant stage. Instructing small children the benefit of conserving their allowance, no

issue the greenback quantity, or the importance of expending responsibly through

their most formative many years can build a solid basis of personal

finance understanding that will have them through their grownup existence. But the

stress of schooling should not drop only on parents in particular in this

digital planet, the options to teach and understand are unlimited.

Philadelphians have expressed that this style of instruction is one thing they

wanted at a young age, however it was not built readily available to them. This is

one thing we hope to see modify over time, and when university districts

mostly dictate what is taught in the classroom, finance leaders can get

artistic in how they supplement common learnings with valuable finance

information. To do this among center university learners in Philadelphia, PFCU

partnered with Spark, a Philadelphia-dependent nonprofit group that

provides middle faculty college students opportunities centered all over occupation

exploration, to host a artistic contest in celebration of Monetary

Literacy Thirty day period.

The

2021 Virtual Financial Literacy Imaginative Contest

provided the young generation an prospect to share, in their personal words and phrases,

what money literacy signifies to them in their present-day phase of life, as

properly as what financial aims they had set for the up coming 5, 10, or 15 decades.

Every pupil was inspired to post a imaginative essay, poem, or piece of

artwork about what monetary security means to them for a prospect to earn the

grand prize ($500), second-place prize ($300), or 3rd-area prize ($200).

The successful submissions from the pupils place the real that means of

“financial security” into perspective, precisely with regards to the winning essay submission.

“Financial safety not only means to me that I am not involved about

whether or not my earnings or income can include my living costs, but it also implies

that I have pretty more than enough money saved for my long term economic plans and

desires,” wrote the grand prize recipient, Samia Hossain, in her essay

submission about financial protection. Samia also incorporated lessons from

her mother and father into her essay, noting that they experienced saved revenue to get a new

dwelling to present extra place for their increasing family—a money intention that

impressed Samia’s stage of watch all around fiscal security. Hearing firsthand

from the younger era that there is an urgent desire to obtain

fiscal stability in the upcoming only even further reinforces that this operate

desires to grow to be a top precedence for finance leaders nationwide.

Regardless of whether by way of an engaging innovative contest, small-sort movies on social media, or

a occupation-based workshop, there are so numerous distinct ways to educate the

upcoming technology on dependable economical habits and behaviors. By generating a

constant concerted effort and hard work to reach pupils at any age working with these

methods of economic education and learning, we hope to see Philadelphians enhance

their have sense of financial literacy and in the long run reach their

economical objectives.

To view the total analysis report, click in this article.