Georgia is now the latest state to mandate personal finance education

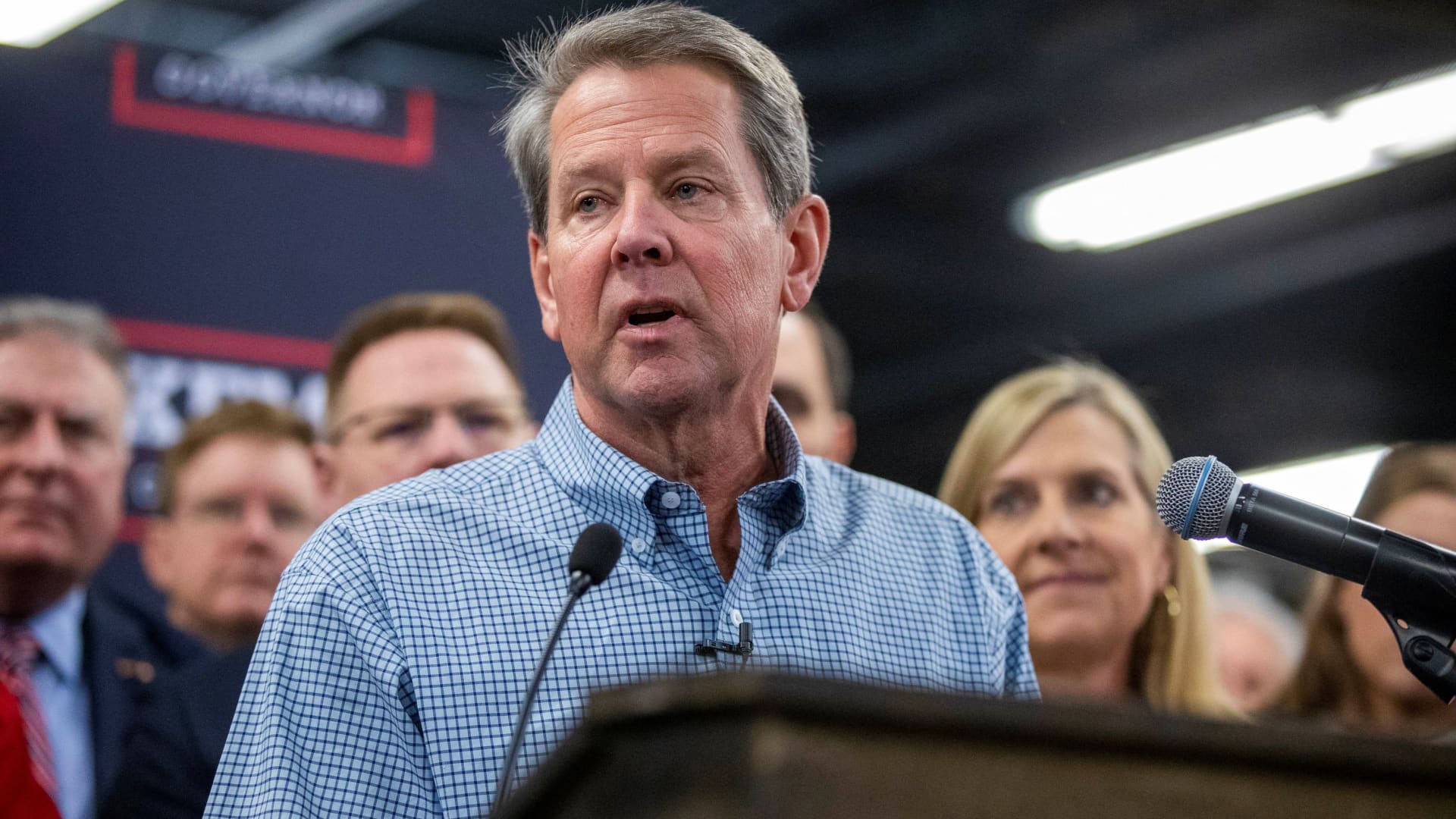

Ga Governor Brian Kemp tends to make remarks in the course of a take a look at to Adventure Outdoors gun store as he pushes for a new state regulation to loosen requirements to have a handgun in general public, in Smyrna, Georgia, January 5, 2022.

Alyssa Pointer | Reuters

Large university pupils in Georgia will quickly have certain accessibility to a personal finance course just before they graduate.

On Thursday, Republican Gov. Brian Kemp signed into legislation SB 220, a bill requiring individual finance classes for large college learners. Starting off in the 2024-2025 school 12 months, all 11th- and 12th-grade learners will need to have to acquire at least a 50 {ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}-credit score study course in economical literacy before graduation.

The measure “will make sure that [students] master monetary literacy in our educational institutions, like the great importance of great credit score and how to price range effectively so that they can be greater well prepared for the globe outside of the classroom,” claimed Kemp throughout the signing occasion.

Far more from Make investments in You:

16 U.S. cities wherever females below 30 receive more than their male peers

Excellent Resignation is spurring businesses to offer fiscal-wellness positive aspects

A 4-working day workweek pilot system is now underway in the U.S. and Canada

A rising trend

Georgia is the 13th point out to mandate personalized finance training for its pupils, in accordance to nonprofit Subsequent Gen Personalized Finance, which tracks these costs.

It is really the newest in a growing trend of states including personal finance schooling. In the final 12 months, Florida, Nebraska, Ohio and Rhode Island have handed related legal guidelines and are in the system of applying them for all college students.

After Georgia’s invoice is executed, it will imply that far more than 35{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of pupils in the U.S. will have entry to a financial literacy course. That’s more than double the share of college students that had accessibility to this kind of coursework in 2018, according to Up coming Gen Personalized Finance.

Having laws necessitating particular finance education are critical to make certain students have equivalent prospects. There are superior educational institutions that supply individual finance programs in states without the need of mandates, but accessibility is not equal, according to a new report from the nonprofit.

Only 10{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of students in states with out assured obtain to private finance can get this kind of a study course. That share drops to 1 in 20 in colleges in which 75{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of learners are nonwhite or receive cost-free and minimized lunch.

What point out could be upcoming

There are however a few states with pending laws that may possibly be handed later in the year.

South Carolina, for example, has a bill at the moment in conference committee. Now that Georgia’s legislation has turn out to be legislation, South Carolina is the only point out in the Southeast that does not have mandated own finance coursework, in accordance to Tim Ranzetta, co-founder of Upcoming Gen Particular Finance.