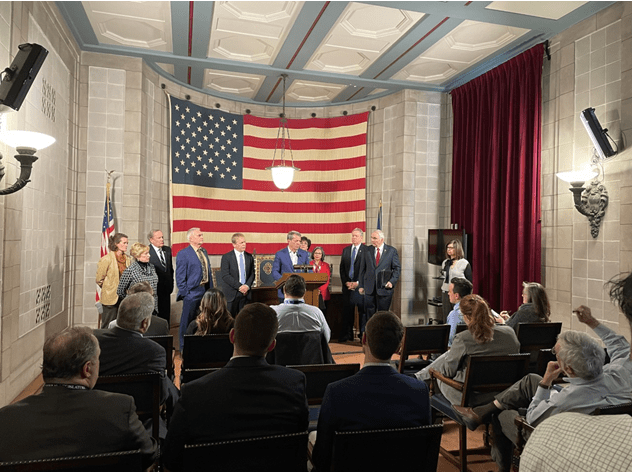

Governor Pillen Announces Education Finance Bills

LINCOLN, NE – Tuesday, January 17, 2023, Governor Jim Pillen, accompanied by a number of point out senators such as members of the Legislature’s Schooling Committee, introduced 3 precedence charges for the Legislative session aimed at growing the state’s financial investment in education and learning and lowering university reliance on property taxes.

“We need to and we will commit in just about every Nebraska kid so that the education they acquire is the greatest good quality, no issue where they live in our condition,” said Governor Pillen. “These charges are the culmination of great teamwork from teams representing stakeholders from throughout Nebraska. By this laws, we will be certain potential generations of learners are on strong footing, make funding much more uniform across all college districts, and present Nebraskans with house tax reduction that is prolonged overdue.”

LB 583, introduced by Senator Rita Sanders, phone calls on the point out to allocate $1,500 each year for each K-12 general public faculty university student by means of the Tax Fairness and Educational Options Support Act (TEEOSA). The boost amounts to practically $113 million in condition assist. In addition, the bill proposes a statutory provision that 80 {ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of exclusive training funding be protected by means of a combination of federal and condition funding. The point out part, virtually $160 million, would be on top rated of the existing $250 million in yearly aid for special education and learning.

Senator Rob Clements proposed laws to create the Education and learning Future Fund, which allocates $1 billion of point out normal resources through the 2023-2024 biennium and $250 million each and every yr afterward for the applications of:

- Providing $1,500 for each scholar every year by way of TEEOSA

- Funding the state’s part of unique education

- Increasing funds to K-12 educational entities, ensuing in dollar-for-greenback assets tax relief

- Allocating grants aimed at retaining licensed instructors within just Nebraska

- Allocating grants aimed at furthering job and technological education opportunities for K-12 quality students

- Allocating grants to raise mentoring alternatives for K-12 quality learners

The ultimate proposal (LB 589), brought on behalf of the Governor by Senator Tom Briese, produces a three percent cap on assets tax earnings that a college district gets. It is a soft cap that can be overridden by 75 {ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of voting university board associates or the acceptance of 60 p.c of the district’s registered voters, need to there be a need.