Governors say financial education should extend beyond school years

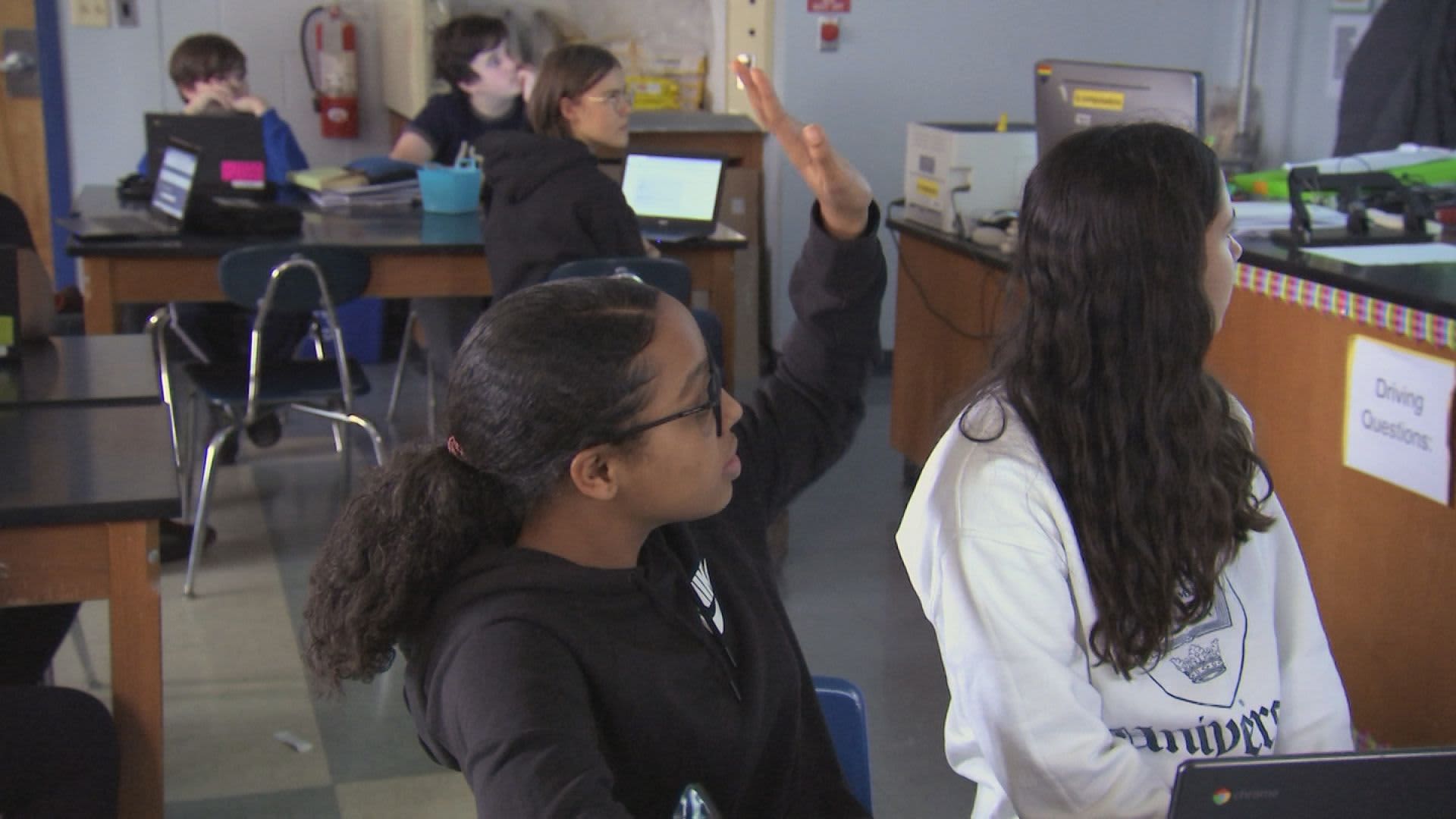

Student Olivia Raymond participates in a individual finance program in her center faculty class in West Orange, New Jersey, in February 2020.

CNBC

Pursuing fiscal literacy is anything that should continue outside of conventional university many years, according to several condition governors.

“We believe it is a lifelong expertise,” New Jersey Gov. Phil Murphy explained to CNBC’s Sharon Epperson in the course of Wednesday’s event, Commit in You: The Governors Approach Session on Fiscal Education and learning.

Gov. Steve Sisolak of Nevada agrees about the value of fiscal literacy.

“It truly is a talent that is needed for your total existence,” he said. “We have to technique it far more prolonged-term in that regard.”

Condition of personalized finance training

There are no federal rules for own finance schooling in faculties, which implies it is really up to individual states to established their own principles. And there are 23 states that mandate a individual finance study course for pupils, in accordance to the 2022 Study of the States from the Council for Financial Instruction.

In New Jersey, personal finance training is taught in center college, and lessons in economical, financial small business and entrepreneurial company literacy are needed to graduate.

“You require to get to people whilst they are youthful, and which is the animating reason guiding acquiring economical literacy education into our middle university curriculum,” explained Murphy, a Democrat.

Far more from Make investments in You:

Want a fun way to educate your kids about income? Attempt these games

Inflation fears drive Americans to rethink economic possibilities

Here is what shoppers system to slash back again on if prices keep on to surge

Nevada learners are taught about personalized finance matters as a element of social reports class, generally setting up in grade 3 and heading by means of substantial school. In Mississippi, beginning this yr, a faculty and profession readiness course that involves particular money education is essential for high college graduation.

“Each state has to make their very own conclusion and their own priorities as to what courses are most suitable for their youthful people today,” stated Mississippi Gov. Tate Reeves, a Republican. “But I am completely confident that a elementary knowledge of finances is unbelievably crucial to one’s skill to be profitable in lifestyle.”

That also means that states can alter their suggestions as they see healthy.

“A required course might be the subsequent phase we go to,” mentioned Sisolak, a Democrat. He included that it really is vital to have these curriculum in faculties since numerous college students are unable to get financial training at property from their mother and father, who could also fall quick on economical literacy.

Past faculty

The state governors concur that one particular of the reasons it is crucial to have particular finance curriculum in colleges is for the reason that lots of students’ mother and father cannot instruct them about economical literacy at property or just usually are not talking about income adequate.

New Jersey is also supplying residents accessibility to far more private monetary schooling exterior of faculty. Murphy announced now, all through the CNBC event, that the point out has introduced NJ FinLit, a economical wellness platform.

“Monetary literacy is very essential for Us residents to safe their individual fiscal footing, to be improved positioned to present for their people and established on their own up for long run achievement,” Murphy stated.

The system was produced by Enrich and is driven by San Diego-dependent economic training firm iGrad. It contains personalized finance courses on numerous topics, such as budgeting, conserving, retirement, student loans and has authentic-time price range tools, as well. It is cost-free for all adult New Jersey people.

States have also manufactured absolutely sure that educators have assets for expert progress to keep up with the ever-switching monetary environment and field inquiries about factors these types of as meme stocks and cryptocurrencies.

Mississippi presents a learn teacher in individual finance program and coaching.

“The finest way for a kid to get a top quality schooling is to have a good quality instructor,” Reeves claimed. “You have to consistently have continuing training for individual finance lecturers just like you do for English, math or any other subjects.”

What’s subsequent

Of system, every single condition has places in which its could improve their particular finance training choices for pupils, teaching for instructors and means for adult constituents. And each individual point out will very likely occur up with unique answers and offerings for their citizens heading forward.

Many states are shifting ahead with legislation mandating personalized finance schooling for their pupils. There are presently 54 private finance instruction payments pending in 26 states, in accordance to Following Gen Individual Finance’s invoice tracker.