Graduates can save more money than ever as fixed student loan refinance rates set record low

Preset college student financial loan refinance rates established a new document minimal in the course of the 7 days of Dec. 13, which means that debtors have the prospect to cut down their every month payments, pay off their loans more rapidly and save additional cash on their school credit card debt. (iStock)

Preset pupil financial loan refinance premiums have fallen to a new report reduced, offering borrowers the prospect to help save extra dollars on their student personal debt than ever prior to.

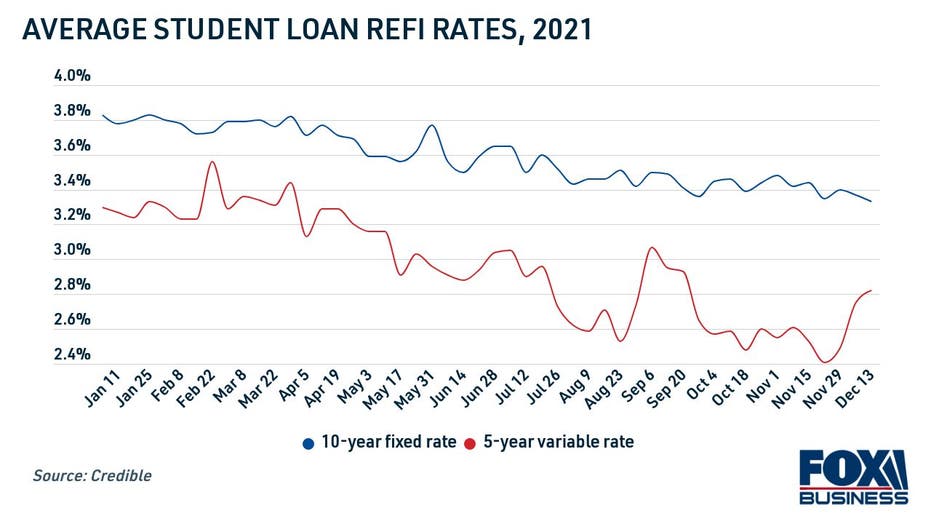

Desire rates on 10-yr mounted-price refinance financial loans averaged 3.33{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} for the 7 days of Dec. 13, according to Credible. This is the lowest preset university student financial loan premiums have been since Credible begun amassing this facts in June 2020.

Student Personal loan DEFERMENT EXTENSION: WHAT Debtors Must KNOW

Variable desire charges for the 5-year refinancing time period rose considerably during the identical week, to 2.82{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. Even now, the variable price is much reduced than it was in the course of the exact time very last year, when they were 3.20{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} on ordinary.

With college student mortgage refinance premiums at historic lows, university student bank loan borrowers have the option to lessen their every month payments, fork out off their personal debt more quickly and help you save funds on total borrowing charges over the lifestyle of the loan.

Continue to keep studying to understand extra about refinancing to a private student loan. Look through university student bank loan refinance costs from personal loan companies in the desk beneath, and visit Credible to see refinancing provides tailored to you without the need of impacting your credit score score.

WHAT IS A Very good Once-a-year Proportion Price (APR) ON A Own Bank loan?

How to qualify for pupil mortgage refinancing

Scholar loan refinancing is when you choose out a new financial loan to repay your recent university student debt with far better terms, this sort of as a lower curiosity price. There are numerous non-public student loan loan providers that offer refinancing, and the method can be finished wholly on line.

When you refinance your pupil personal loan financial debt, your mortgage sum will stay the similar, but your other conditions will very likely alter. It could also be possible to transfer all of your financial loans into just one month to month payment with pupil personal loan consolidation. You can select a shorter personal loan time period to fork out off your pupil debt more quickly, or you can decide for a for a longer time-phrase loan to reduced your every month payments.

Private student personal loan loan companies establish your interest level dependent on a number of eligibility requirements, together with:

- Responsible monetary background. Borrowers with a fantastic credit rating rating and lower debt-to-profits ratio will have the most effective prospect at qualifying for student bank loan refinancing at a low fascination charge. Borrowers with negative credit could take into account enlisting the help of a creditworthy cosigner to qualify for university student bank loan refinancing.

- Loan repayment phrases. Larger sized loans might occur with greater desire charges — furthermore, you can be spending much more in interest around time due to the fact it truly is assessed on a more substantial total. Shorter loans will usually offer you decrease fascination charges, even though lengthier mortgage phrases will value a lot more to borrow in excess of time.

- Style of fascination fee. Mounted-amount loans tend to come with better rates, given that debtors can lock in their rate for the entirety of the personal loan phrase. Variable-price financial loans tend to supply lower premiums, which may possibly rise or drop about the everyday living of the loan relying on market place circumstances.

You can compare university student financial loan rates on Credible for free with a tender credit score pull, then use a pupil mortgage calculator to figure out how substantially you can preserve by refinancing.

HOW TO Check YOUR Entire Credit rating REPORT Without A Tricky Credit PULL

Really should you refinance federal student loans?

Refinancing may possibly help some debtors lock in a decrease fee on their school personal debt, but there are a few things federal university student bank loan borrowers really should know just before switching to a private personal loan.

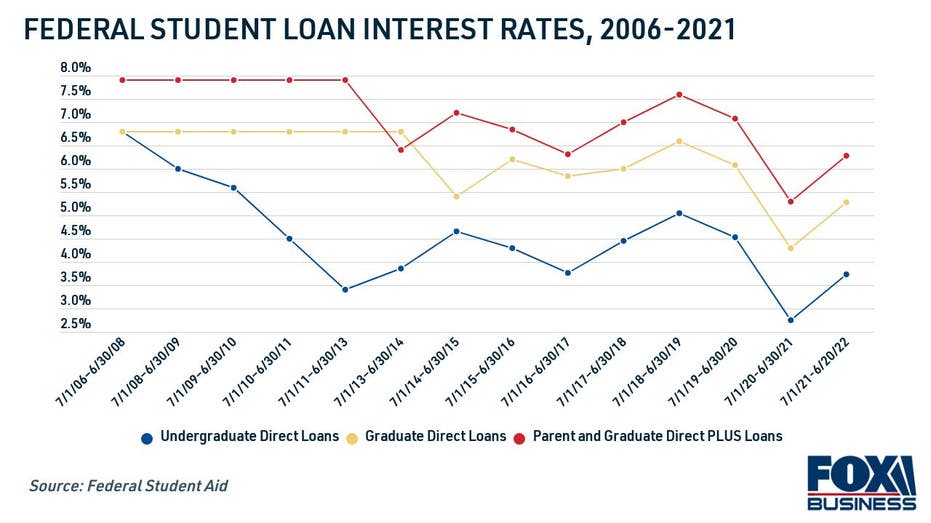

Desire fees are set in another way. Federal student personal loan charges are preset across all debtors dependent on when the loan was originated, whereas private university student loan desire prices change by lender depending on a borrower’s creditworthiness. As well as, private loan providers are likely to give level savings, this sort of as an interest charge reduction for setting up computerized payments (often identified as an Autopay low cost).

Debtors with a large credit history rating and a lower personal debt-to-profits ratio may well qualify for a lessen interest rate by means of a non-public loan provider, but it relies upon on the fixed federal pupil loan level when the loan was disbursed. Here are the present federal student financial loan fascination premiums for financial loans disbursed concerning July 1, 2021, and June 30, 2022:

- Undergraduate Immediate Loans: 3.73{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}

- Graduate Direct Loans: 5.28{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}

- Mother or father and Graduate Immediate As well as Financial loans: 6.28{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}

WHAT IS THE Minimal Credit history Rating Desired TO GET A College student Personal loan?

Non-public university student bank loan lenders do not cost refinancing service fees. When you borrowed your federal personal loan, you probable experienced to fork out a 1-time mortgage price that was a part of the full mortgage total. Federal Immediate Financial loans disbursed on or immediately after Oct. 1, 2020 have been assessed a mortgage fee of 1.057{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. Immediate Moreover loans disbursed throughout the same time interval have a loan price of 4.228{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}

Private university student loans are not qualified for federal added benefits. By refinancing to a non-public scholar mortgage, federal scholar mortgage borrowers are waiving several federal personal loan protections like revenue-pushed compensation ideas, administrative forbearance and pick pupil loan forgiveness programs. Federal student personal loan payments are at this time paused via May well 1, 2022, which usually means that refinancing your federal financial loans into a non-public financial loan now would signify you have to resume month-to-month payments upon acceptance.

However, it might be sensible to lock in a non-public university student mortgage refinance rate when prices are at record lows. Take a look at Credible to see your pupil loan refinancing provides, so you can establish if it’s well worth it to refinance your federal scholar bank loan personal debt.

Private Personal loan ORIGINATION Fees: ARE THEY Worth THE Cost?

Have a finance-connected problem, but really don’t know who to question? E mail The Credible Income Qualified at [email protected] and your dilemma may be answered by Credible in our Cash Specialist column.