Here’s What’s Concerning About Barrett Business Services’ (NASDAQ:BBSI) Returns On Capital

If we want to find a stock that could multiply more than the very long term, what are the underlying traits we need to search for? Ideally, a business will exhibit two tendencies first of all a rising return on money utilized (ROCE) and next, an increasing quantity of capital used. Finally, this demonstrates that it really is a small business that is reinvesting earnings at escalating fees of return. In gentle of that, when we appeared at Barrett Business enterprise Providers (NASDAQ:BBSI) and its ROCE pattern, we weren’t exactly thrilled.

What is Return On Capital Used (ROCE)?

If you have not labored with ROCE ahead of, it steps the ‘return’ (pre-tax financial gain) a business generates from cash employed in its enterprise. Analysts use this formulation to compute it for Barrett Company Products and services:

Return on Capital Utilized = Earnings Before Curiosity and Tax (EBIT) ÷ (Overall Assets – Present-day Liabilities)

.087 = US$39m ÷ (US$809m – US$357m) (Dependent on the trailing twelve months to September 2021).

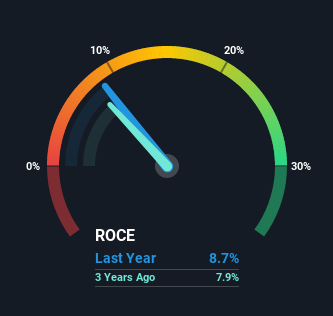

As a result, Barrett Business Services has an ROCE of 8.7{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. On its possess, which is a reduced figure but it is really close to the 11{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} typical generated by the Skilled Providers industry.

Previously mentioned you can see how the existing ROCE for Barrett Enterprise Companies compares to its prior returns on capital, but you will find only so considerably you can convey to from the previous. If you’d like to see what analysts are forecasting likely ahead, you should check out out our free of charge report for Barrett Business enterprise Products and services.

What Does the ROCE Trend For Barrett Organization Services Tell Us?

In conditions of Barrett Organization Services’ historical ROCE movements, the craze isn’t wonderful. To be far more certain, ROCE has fallen from 11{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} more than the very last 5 years. Nonetheless it seems like Barrett Organization Products and services could be reinvesting for lengthy time period progress simply because while capital employed has enhanced, the firm’s sales haven’t modified substantially in the last 12 months. It really is value trying to keep an eye on the firm’s earnings from listed here on to see if these investments do finish up contributing to the bottom line.

On a aspect be aware, Barrett Business enterprise Services’ present-day liabilities are still fairly superior at 44{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of full property. This can provide about some hazards because the firm is essentially operating with a rather significant reliance on its suppliers or other sorts of quick-term creditors. Ideally we might like to see this decrease as that would mean much less obligations bearing challenges.

In Conclusion…

Bringing it all with each other, even though we’re fairly encouraged by Barrett Organization Services’ reinvestment in its individual business enterprise, we’re informed that returns are shrinking. Unsurprisingly, the stock has only gained 39{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in excess of the past five a long time, which probably implies that investors are accounting for this heading forward. As a end result, if you might be hunting for a multi-bagger, we believe you’d have far more luck in other places.

1 closing take note, you really should study about the 2 warning signals we’ve spotted with Barrett Business enterprise Companies (including 1 which is about) .

Whilst Barrett Small business Products and services could not at this time earn the highest returns, we have compiled a list of organizations that at the moment make much more than 25{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} return on fairness. Check out this free of charge list in this article.

This write-up by Only Wall St is common in nature. We offer commentary dependent on historical facts and analyst forecasts only working with an unbiased methodology and our content articles are not intended to be economical information. It does not constitute a suggestion to obtain or promote any inventory, and does not get account of your goals, or your economic problem. We intention to deliver you extended-phrase focused examination pushed by fundamental knowledge. Note that our examination may possibly not variable in the most current price tag-delicate corporation announcements or qualitative product. Only Wall St has no place in any stocks outlined.

Have feed-back on this posting? Concerned about the content material? Get in contact with us specifically. Alternatively, e mail editorial-staff (at) simplywallst.com.

The views and views expressed herein are the sights and opinions of the writer and do not essentially replicate individuals of Nasdaq, Inc.