How more FFEL borrowers may qualify for student loan forgiveness

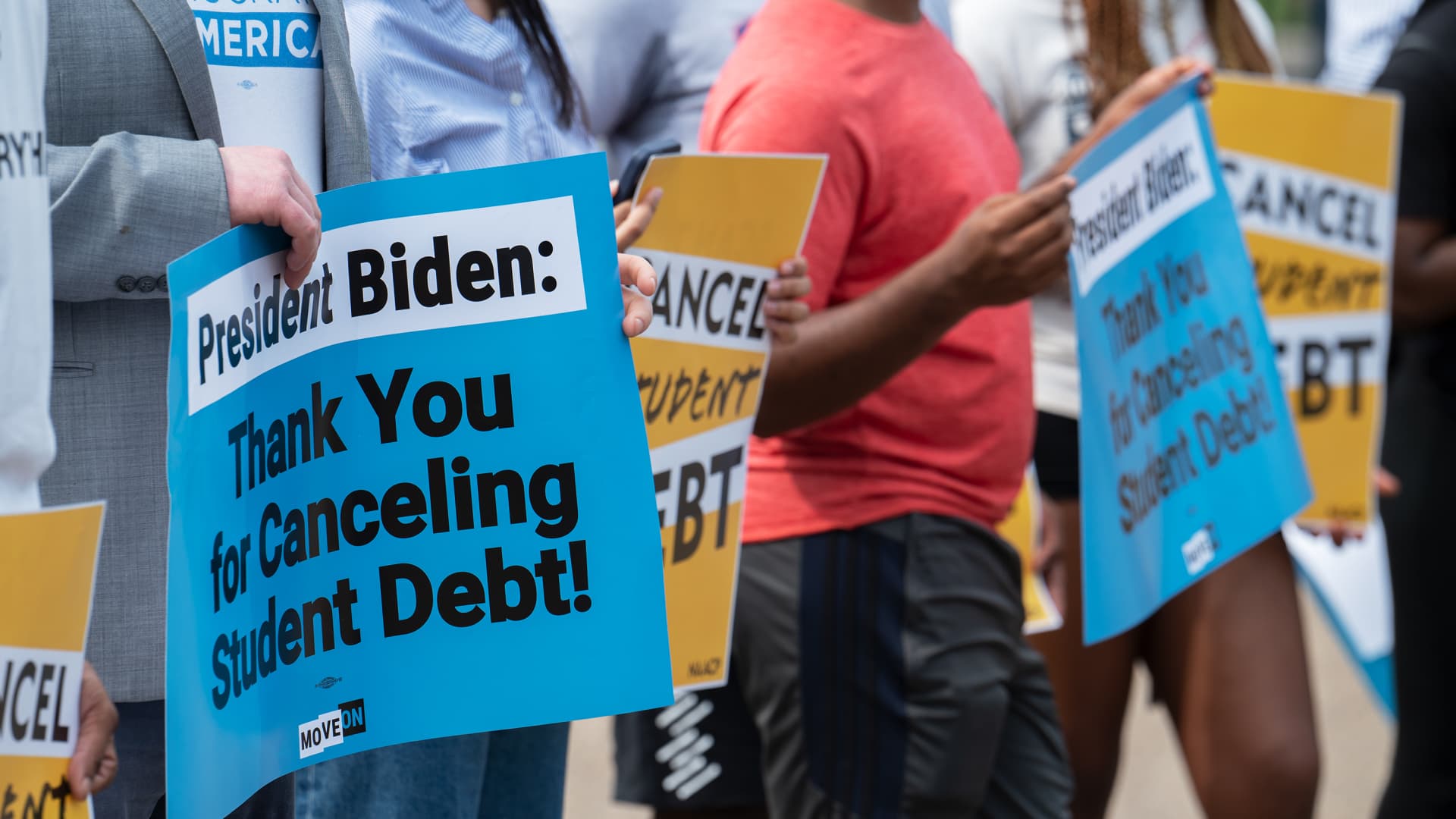

Scholar-mortgage financial debt activists rally outside the house the White Property a working day right after President Biden introduced a prepare that would terminate $10,000 in college student personal loan financial debt for these building less than $125,000 a 12 months in Washington, D.C., on Aug. 25, 2022.

The Washington Put up | The Washington Write-up | Getty Visuals

When the U.S. Section of Instruction announced at the commencing of the pandemic that federal scholar financial loan borrowers could set their payments on pause, thousands and thousands of folks ended up soon unpleasantly shocked to learn they didn’t qualify for the aid.

They ended up excluded because they owned a subset of federal student loans manufactured ahead of 2010, beneath what is actually identified as the Federal Spouse and children Instruction Loans (FFEL) plan. These financial loans have been guaranteed by the governing administration but owned by private companies — and because the Education Section did not have the credit card debt, its payment pause plan failed to apply to it.

Just after President Joe Biden declared previous 7 days that he’d be forgiving up to $10,000 for federal scholar mortgage borrowers who failed to get a Pell Grant, which is a variety of help obtainable to lower-money undergraduate college students, and up to $20,000 for people who did, there was issue that debtors with commercially held FFEL financial loans would be still left out but yet again. (Debtors who generate more than $125,000 for every 12 months, or married couples or heads of homes earning about $250,000, are also slice out.)

Additional from Particular Finance:

Are your university student loans qualified for federal forgiveness? What we know

What President Biden’s college student personal loan forgiveness implies for your taxes

‘It’s a activity changer.’ Pell Grant recipients react to student financial loan forgiveness

Fortunately, the Instruction Section seems to be seeking to uncover means to steer clear of that consequence for the believed 5 million debtors who have a commercially held FFEL loan.

“The Biden administration is reducing via red tape and asserting that tens of millions of formerly neglected debtors will be incorporated in its bold college student credit card debt aid approach,” reported Ben Kaufman, director of analysis and investigations at the Pupil Borrower Security Centre.

Here’s what borrowers require to know.

‘About half’ of FFEL loans are commercially held

The federal federal government commenced lending to learners on a big scale in the 1960s. Back then, however, it failed to instantly give out college student financial loans. Alternatively, it confirmed the personal debt provided by financial institutions and nonprofit creditors underneath the FFEL plan.

That system was eliminated in 2010 following lawmakers built the circumstance that it would be much less expensive and simpler to directly lend to learners. Nearly 10 million people nonetheless maintain FFEL financial loans, in accordance to better schooling expert Mark Kantrowitz.

Currently, Kantrowitz said, “about half are held by the U.S. Division of Instruction and about 50 {ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} by commercial loan providers.”

There are two factors the govt might now hold FFEL loans. When these financial loans go into default, the personal corporations that formerly owned them transfer them above to a promise agency that companies the personal debt on behalf of the federal government, Kantrowitz claimed. The other motive is that the authorities bought again some of the loans all through the 2008 credit rating disaster.

Borrowers eager to know in which their FFEL financial loans are held can go to Studentaid.gov and indicator in with their FSA ID. Then, go to the “My Help” tab, and lookup for your personal loan aspects.

Consolidating may perhaps help you qualify for forgiveness

If you’re a person of the approximately 5 million debtors with a commercially held FFEL financial loan, the Schooling Division tells CNBC that you can simply call your servicer and consolidate into the Immediate Personal loan Application to advantage from cancellation.

There is certainly now no deadline by which debtors want to do this, a section spokesperson explained, but presumably there will be a single.

Since all of these developments are so new, your college student mortgage servicer may not nonetheless know about this solution, Kantrowitz mentioned.

If you might be operating into a wall, it may well be improved to do the consolidation immediately on the StudentAid.gov web page, he reported. You can want to fill out the “federal direct consolidation personal loan software.”

Consolidation can just take a month or far more

Frequently, it normally takes amongst 30 and 45 times for a consolidation software to be processed, Kantrowitz explained.

And be absolutely sure to test on the status of your application if you haven’t listened to back inside of that time frame.

Other forgiveness workarounds might be forthcoming

The Schooling Section will function in the coming months with personal loan providers to make confident commercially held federal university student mortgage debtors can also advantage from forgiveness, according to a spokesperson.

These borrowers will have much more than a year to utilize for the reduction once the government’s pupil mortgage forgiveness application is available, and they will not require to choose any motion now, the spokesperson mentioned.

Payment pause still excludes some FFEL debtors

Together with Biden’s pupil bank loan forgiveness announcement, the president also claimed he’d prolong the payment pause on federal university student financial loans till the end of December.

Sad to say, borrowers with commercially held FFELs are however remaining out of this relief, Kaufman mentioned.