Investing in Barrett Business Services (NASDAQ:BBSI) three years ago would have delivered you a 20{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} gain

Barrett Business Providers, Inc. (NASDAQ:BBSI) shareholders could possibly be concerned soon after observing the share price drop 16{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in the very last quarter. In contrast the inventory is up above the final three many years. Nevertheless, it is not likely a lot of shareholders are elated with the share cost attain of 14{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} more than that time, specified the increasing market.

With that in thoughts, it is really worth viewing if the company’s underlying fundamentals have been the driver of extensive expression performance, or if there are some discrepancies.

See our most up-to-date assessment for Barrett Business Solutions

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share costs do not often rationally reflect the value of a small business. One imperfect but very simple way to consider how the industry perception of a company has shifted is to assess the transform in the earnings for each share (EPS) with the share price tag motion.

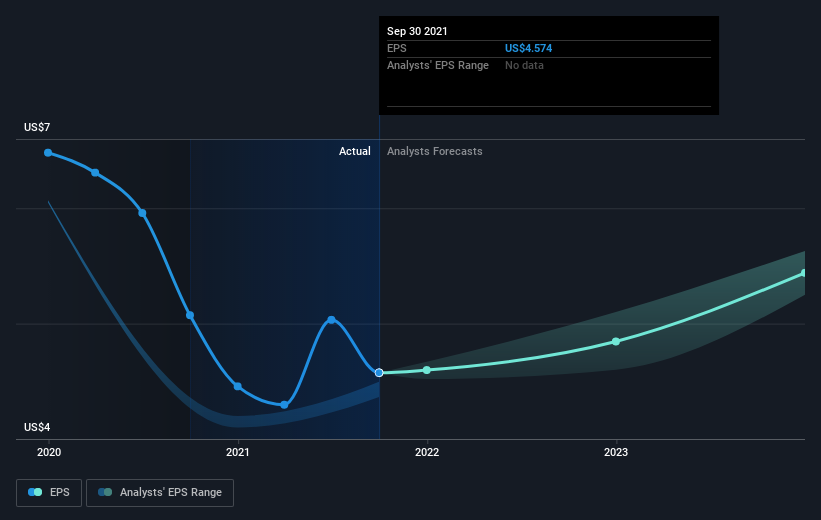

Barrett Company Solutions was ready to mature its EPS at 2.1{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} per yr about three years, sending the share price tag increased. This EPS expansion is decreased than the 5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} normal yearly maximize in the share value. This implies that, as the organization progressed about the past handful of decades, it received the confidence of market contributors. It is pretty common to see traders become enamoured with a business, following a few decades of good development.

You can see down below how EPS has improved above time (uncover the actual values by clicking on the impression).

This no cost interactive report on Barrett Business enterprise Services’ earnings, earnings and cash circulation is a fantastic place to start, if you want to examine the inventory even further.

What About Dividends?

When on the lookout at expenditure returns, it is important to take into consideration the change between full shareholder return (TSR) and share selling price return. The TSR incorporates the benefit of any spin-offs or discounted capital raisings, along with any dividends, based mostly on the assumption that the dividends are reinvested. So for businesses that pay back a generous dividend, the TSR is generally a whole lot bigger than the share selling price return. We notice that for Barrett Organization Solutions the TSR above the last 3 years was 20{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, which is much better than the share rate return described above. The dividends paid by the firm have thusly boosted the whole shareholder return.

A Different Standpoint

Barrett Company Providers shareholders are down 2.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} for the calendar year (even including dividends), but the current market itself is up 16{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. Even the share charges of fantastic stocks drop in some cases, but we want to see enhancements in the basic metrics of a business enterprise, ahead of receiving much too fascinated. On the brilliant aspect, long expression shareholders have designed income, with a gain of 3{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} for every yr more than 50 percent a decade. It could be that the the latest offer-off is an chance, so it may perhaps be worthy of checking the fundamental knowledge for symptoms of a extended expression advancement development. I obtain it incredibly intriguing to appear at share rate in excess of the very long phrase as a proxy for company effectiveness. But to actually get insight, we want to take into account other details, too. Like risks, for occasion. Each individual firm has them, and we’ve spotted 2 warning indications for Barrett Company Companies (of which 1 can make us a bit not comfortable!) you should really know about.

But take note: Barrett Small business Services may perhaps not be the ideal inventory to invest in. So consider a peek at this absolutely free record of appealing corporations with earlier earnings growth (and even further expansion forecast).

Please be aware, the market returns quoted in this write-up mirror the industry weighted ordinary returns of stocks that at this time trade on US exchanges.

Have opinions on this posting? Concerned about the information? Get in contact with us immediately. Alternatively, e mail editorial-group (at) simplywallst.com.

This article by Basically Wall St is basic in mother nature. We supply commentary primarily based on historical facts and analyst forecasts only employing an unbiased methodology and our posts are not intended to be economical assistance. It does not constitute a advice to get or provide any inventory, and does not consider account of your goals, or your financial condition. We intention to provide you prolonged-expression focused analysis driven by elementary details. Be aware that our examination could not component in the newest price tag-sensitive enterprise bulletins or qualitative product. Simply just Wall St has no placement in any stocks pointed out.