Newtek Business Services: You Can Take This BDC To The Bank (NASDAQ:NEWT)

MarsBars/E+ via Getty Images

This article was co-produced with Williams Equity Research (WER)

To keep this article on the manageable side, we suggest reviewing our August 29 writeup on Newtek (NEWT).

That piece describes the company’s longer-term history – including how it converted to a business development company (BDC) in 2014 – and its more recent plans to convert again, this time to a bank. It’s conclusion was:

“The stock isn’t terribly inexpensive, but the recent selloff was a blessing for those looking to initiate a position in the stock. Investors expecting the company to remain a BDC are best suited to look for an entry point closer to $25.”

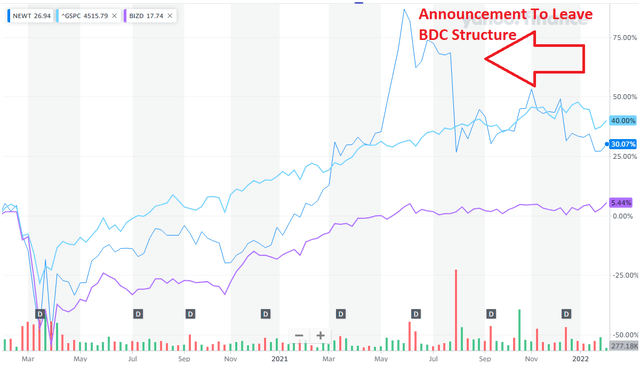

As you can see below, the actual company’s news from that summer day hasn’t been well-received.

Yahoo Finance

Yet, over the last two years, NEWT is up 10{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} over the S&P 500 index. And it’s up nearly 35{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} against benchmarks like the VanEck BDC Income ETF (BIZD).

Not including dividends.

So let’s factor in Newtek’s $2.60 dividend and 9.7{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} current yield for the past two years. When we do, we find this small-cap BDC has actually beaten the S&P 500 by well over 25{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}.

That’s including the drop from about $35 per share to current levels around $27.

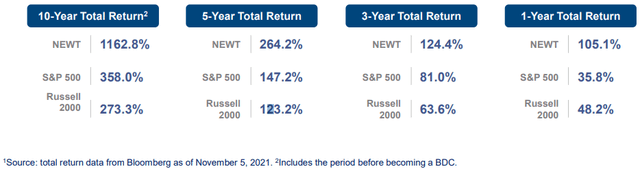

NEWT Q3-21 Earnings Presentation

So…

NEWT has recovered from its unarguably steep fall after announcing it was switching from a BDC to a bank. Yet it’s also outperformed the broader equity markets significantly… and BDC benchmarks by an even greater degree.

As it stands now, we have an opportunity to once again take advantage of confusion and uncertainty. Let’s explore how and why…

Newtek Business Service’s Cash Flow and Dividend

Right now, Newtek is priced as a growth company. So let’s ensure that story makes sense.

The company is scheduled to release its Q4 earnings on February 24. Since we’re not there yet, we need to use data from the rest of 2021 – that and anticipations about future quarters – to base our valuation on.

We also have to acknowledge that it spent Q3 refocusing on SBA loans and away from the temporary – albeit profitable – PPP loans. The same was likely true in Q4 as well.

Plus, we know NEWT’s core business is loaning money to small businesses via Small Business Administration (SBA) program loans. So let’s start there.

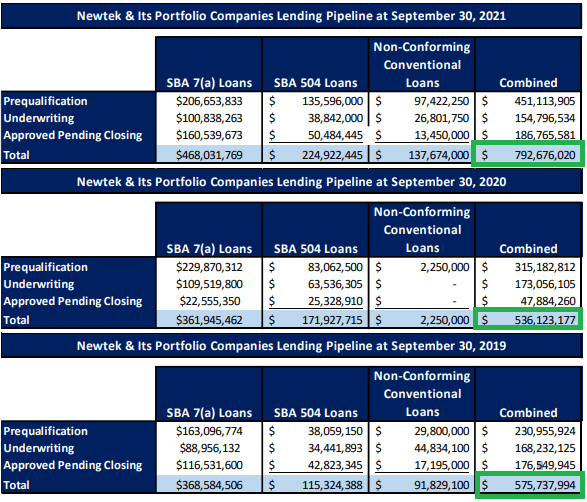

The for-now BDC funded $163.9 million in SBA 7(A) loans in Q3. This represents extraordinary 1,160.8{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} growth year-over-year and 43.4{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} over Q3-19’s $114.3 million.

Of course, we want to eliminate the chance of cherry-picking, so let’s consider longer timeframes as well.

NEWT funded $326.6 million in SBA 7(A) loans in the first three quarters of 2021 – a 336.3{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} increase over the same period in 2020. It’s also an 8.3{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} jump from the same period in 2019.

Obviously, those numbers aren’t quite as dramatic. But they still paint a similarly positive picture. Which means NEWT is generating near double-digit growth compared to any previous period.

Next up, let’s consider expectations for what the fourth quarter produced.

As of October 2021, NEWT’s division responsible for these lending activities – Newtek Small Business Finance, LLC (NSBF) – had $102 million in SBA 7(A) loans approved pending closing.

That’s a record for a single month. If it maintained that pace through December, it would fund as many loans in Q4 as the rest of 2021 combined.

Admittedly, that’s a little beyond our expectations. But October’s number does provide strong support for the growth story nonetheless.

So does the company’s own Q3 earnings release. That’s where we learned it increased its full-year loan funding forecast to between $560 million and $600 million.

Cash Flow and Dividend Continued…

Now that we have a foundation to work from, let’s see the combined numbers:

NEWT Q3-1 Investor Presentation

As we highlighted above in green, 2020 was unsurprisingly mixed versus 2019. But 2021 demonstrated very strong growth in all three loan types.

As equity analysts, it can be far too easy to lose sight of how companies work on a day-to-day basis. In NEWT’s case, many of its loans are driven by simple referrals.

The firm keeps track of this data, which is worth paying attention to. In Q3-21, for example, NEWT received 72,747 loan referrals compared to 12,883 in the same quarter of pre-pandemic 2019.

Again, this begs the question of whether Q3 2021 was an anomaly. Yet we know it wasn’t because NEWT received 367,502 loan referrals for the first three quarters of 2021 compared to 42,609 in the same period of 2019.

Better yet, this should continue with the right management considering the larger industry’s trend. The SBA funded $44.8 billion in loans in fiscal-year 2021 – in addition to the $1 trillion in Covid-related programs.

2021 was far and away a record year for the SBA.

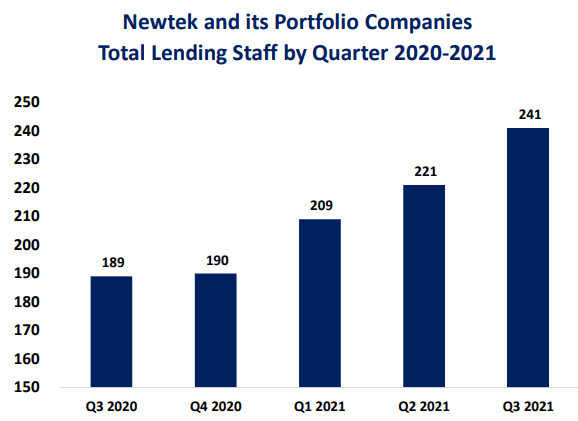

NEWT Q3 Earnings Presentation

It’s a trend that NEWT has embraced by rapidly expanding its lending staff in recent quarters. Which seems to be working for it.

Now, NEWT did generate $12.4 million in Q3-21, which was a 16.7{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} year-over-year decrease. But adjusted net investment income (ANII) – an imperfect metric but still the best to measure NEWT’s dividend-paying capacity in our view – was $0.56 per share.

That’s a 1,300{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} jump over Q3-20.

Since that’s another huge number, let’s look at a few other quarters of comparable data. Like how Q2 ANII was $27 million, or $1.20 per share.

Significant though that quarter’s cash flow generation was, it was down by 12.4{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} compared to Q2-20’s $1.37.

One of the most common mistakes WER sees in general – and particularly with NEWT – is that investors focus on a single quarter’s financials without proper context. That’s why we want to recognize how volatile quarterly data can be.

That and stress the importance of focusing on underlying business drivers over the longer term.

Moving on to Newtek’s Balance Sheet and Risk

NEWT’s leverage at the end of Q2 was 1.16x, or 1.24x before accounting for certain transactions. Compare that to Q3-21’s 1.24x pro forma… while also recognizing its 11.7{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} year-over-year portfolio expansion to $712.5 million.

NEWT’s net asset value (‘NAV’) per share has not been overly volatile. It finished Q3 at $16.23 compared to $15.45 as of the end of 2020. Given how it’s historically traded at about a 2x multiple, that kind of 5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} growth typically translates into 10{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} gains in the stock price.

BDCs in general handled 2020’s challenges well. And the higher-quality firms – which includes NEWT – handled them exceptionally well.

That was in part because the whole industry entered 2020 with extremely favorable diversifications and low leverage. Those are factors we’ve discussed many times in our BDC articles on iREIT on Alpha.

NEWT in particular was increasing dividends throughout the pandemic. The same goes for the current uncertainty surrounding its business model.

For the record, that uncertainty is warranted. But it should be evaluated in the context of a management team that’s been growing the business while managing risk for nearly 20 years.

NEWT was in position to – and in fact did – benefit from one of the toughest economic climates for small businesses in U.S. history. That doesn’t guarantee anything about the future, of course, but it is worth keeping in mind.

Then again, speaking of the future, investors should probably expect continued share price volatility until its bank conversion later this year.

The Question of Newtek’s Valuation

ANII grew 74.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} to $2.81 per share in the first three quarters of 2021 compared to the same period in 2020. Looking back to the first three quarters of 2019, that figure was $31.5 million, or $1.65 per share.

So, no matter how you slice it, NEWT has been growing its portfolio, cash flow, and dividends by double-digit rates for multiple years.

Based on the latest information – much of which is derived from an excellent interview Brad himself conducted with NEWT’s CEO, Barry Sloane – NEWT’s desired conversion to a bank holding company is likely to land at the far end of its initial 6-12 month projected timeline.

That means we should expect at least another two quarters of NEWT functioning as a BDC, including with its distribution policy. Q1’s anticipated distribution is $0.65 and $2.60 for the year.

Confusion in the marketplace has, in our opinion, caused NEWT to trade unfairly down.

Many banks that could be potential peers to its upcoming bank version trade at 3x-6x book value. SoFi (SOFI) and Lending Club (LC), for example, aren’t identical but could still pass for competitors. They trade at the lower end of that despite paying no dividends and generating far less consistent earnings.

If we apply that range to NEWT, it should be trading at $48.12 per share. And the higher end equates to $96.24.

Or we could compare it to other high-quality internally managed BDC peers. If we assume $2.60 per share in annual dividends, NEWT trades with a sky-high 9.9{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} yield at today’s stock price around $26.15.

Main Street Capital, meanwhile, has a base dividend yield of 5.9{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. (MAIN often pays special dividends that close some of the gap to NEWT.) And Capital Southwest Corporation (CSWC), another internally managed BDC, trades with a 7.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} yield today.

But NEWT is clearly the standout value in this category.

In Conclusion…

What about premium or discount to the net portfolio value?

MAIN’s estimated end-of-2021 book value per share of $22.37 means it currently trades at a 92.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} premium. And Capital Southwest’s current metric is 59.3{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}.

NEWT’s premium, for its part, is roughly the same at 62{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. But it generates considerably more cash flow on one dollar of assets compared to Capital Southwest.

That’s demonstrated by how NEWT’s dividend with similar coverage ratios is over 30{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} higher than Capital Southwest’s despite it trading at a slightly lower premium.

In our view, NEWT easily earns its 60{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} premium. We believe 75{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}-85{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} is more appropriate based on its fundamentals – if classified as a BDC. That equates to a BDC share price of $28.20 to $29.70 using today’s financials… and closer to $29-$30.50 based on where NEWT’s book value is anticipated to land in the first half of this year.

Those are the minimum share values that make sense to us.

As we did in mid-2021,we’d start to trim around $35 per share using BDC fundamentals. Unless NEWT delivers better-than-expected results in the interim, that is.

Once NEWT converts to a bank, however, its shares’ marketability changes dramatically.

It’s safe to assume some high-yield income retail investors have already abandoned ship. But it’s equally reasonable to expect a wide swath of institutional investors previously uninterested in NEWT to consider making an investment.

It’s hard to tell at this point. But there isn’t a situation we can come up with where the company trades at a lower premium to book value than it does today.

Even banks with no cash earnings and total dependence on share issuance trade at far greater multiples right now.

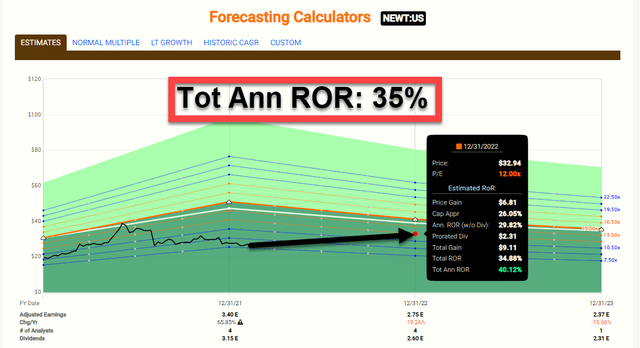

FAST Graphs

In short, NEWT’s near double-digit yield and at least reasonable valuation bring us to the conclusion that shares are currently attractively priced….

My oh My, yet another Strong Buy!

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.