Pearson wins over investors with its digital education vision

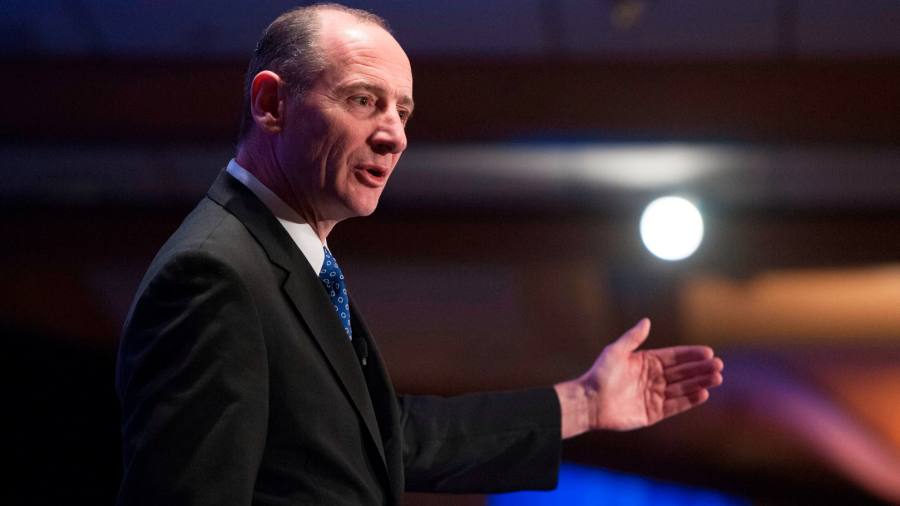

Two many years into the leadership of chief govt Andy Chook, a promise to change a organization finest acknowledged for college training course components into a digital-initial discovering enterprise is below way.

“We no longer invest in CDs, we hear to Spotify. We no longer purchase DVDs, we enjoy Netflix,” the previous Disney govt claimed 6 months into his tenure in an update to buyers. “How we master is also altering, driven by technology and new customer behaviors.”

Soon after a muddled approach before his arrival and 7 earnings warnings in as quite a few yrs, numerous investors consider the organization has achieved a turning issue. Underlying revenue had been up 6 per cent to £1.8bn in the to start with 50 percent of the calendar year and Pearson is the best-carrying out stock on the FTSE 100: up 59 for each cent.

Their optimism stems from Bird’s attempts to repurpose an founded schooling business into a significant-advancement, high-margin disrupter in the digital arena, giving learning from school to college to the workplace.

“What we’re making an attempt to do at the instant is just spot the unique constructing blocks,” Chook claimed in a new interview with the Economical Situations. “It’s pretty substantially the beginning of our journey . . . of what could be explosive advancement.”

So considerably buyers are on board — though with considerably less breathless enthusiasm than the chief govt. Cevian, the activist shareholder with a 10 for every cent stake, pointed to Pearson’s “high-excellent assets” these as its textbook business and its huge shopper get to, and welcomed programs to slice prices by £100mn in 2023. Companion Martin Oliw claimed the corporation experienced a “compelling vision” and a powerful basis for worthwhile advancement.

One particular 1st stage toward this growth is a membership company, Pearson Plus. Launched by Chook past calendar year, it provides customers on the web access to all Pearson’s textbooks for $14.99 a thirty day period — an provide the company says will posture it as a Spotify or Netflix, but for instruction.

Roger Wilkinson, head of fairness investigation at Columbia Threadneedle, a major-10 Pearson shareholder, welcomed the shift. He claimed Chicken was “addressing the future”, greedy “the way men and women take up understanding and teaching has changed”.

At very last rely, the product had 4.5mn people, of which 329,000 have been new having to pay subscribers and the relaxation existing Pearson people who had been instantly signed up.

The comparatively compact variety of new indication-ups does not appear to be to fear investors. Ian Lance, fund manager at prime-10 Pearson investor Redwheel, likened it to Microsoft’s transfer from 1-off purchases to a recurring revenue product. “It turns into a considerably extra responsible, consistent stream of earnings,” he explained.

Margins on those people earnings can also rocket due to the fact — contrary to Spotify or Netflix, which have to retain shopping for or developing new music or enjoyment — training textbooks change very little calendar year on calendar year, cutting down the need to get new written content.

“It’s just the students coming as a result of the conveyor belt who study the very same things just about every yr,” Wilkinson explained. “Pearson previously owns this written content they’re just generally growing the viewers.”

The rebranding arrives on the again of a tumultuous few decades. Pearson began lifetime as a construction organization in the late 1800s and subsequently developed a stake in media with the acquire of publishing, broadcast and information organisations. It was not right up until 2015, following the acquisition of discovering companies these as Edexcel, Harcourt and Connections, that it mostly shifted its focus to training.

For the past ten years, Pearson’s core larger education division has been haemorrhaging revenue to the second-hand sector. Slipping enrolment in US greater training place a dampener on expansion. Plagued by financial gain warnings, Pearson’s sprawling jigsaw of education corporations seemed cumbersome and stuck in the previous.

Nevertheless Fowl insists the corporations he inherited will established the organization apart. “I seemed under the bonnet and I stated, wow, there are some definitely attention-grabbing property in this firm,” he mentioned. “We have at that time 90 for each cent of the parts of the jigsaw, we just want to make a new photo.”

These assets consist of the material of textbooks, that can be repurposed in a lot more profitable formats these as on the net discovering. Vocational BTec qualifications, VUE evaluation centres for sitting down professional qualifications and English language understanding goods are also developing.

Pearson has acquired Faethm, a tech enterprise that assesses firms’ expertise wants, and Credly, a system for accrediting workplace instruction.

Bird’s hopes to consolidate these into a coherent present for companies to retrain their workforce. In the meantime the Pearson In addition membership foundation can funnel consumers to qualifications, teaching and accreditation through their life.

“We go from diagnosis to learning to assessment then to certifying you . . . we’re the only organization that does that,” Bird reported.

Sector sentiment backs up Bird’s swagger. “It’s about enabling corporations to see them as a a person-prevent shop,” said Susannah Streeter, of Hargreaves Lansdown. “And it keeps beating anticipations.”

With the share value now appreciably surpassing its 870p bid, Pearson seems to be justified in rejecting a £7bn takeover endeavor from private fairness group Apollo in March.

Redwheel’s Lance calculated that if the business reaches its 5-12 months targets, its share selling price could strike £12. “This has obtained the possible to be a definitely good business enterprise,” he reported.

Soon after a tough 10 decades, even so, some investors are additional cautious.

Better instruction accounts for at minimum a person fifth of product sales, but demand from customers in the sector is shrinking as a consequence of slipping beginning rates and shifts absent from universities. When the tempo slowed this calendar year, college or university enrolment declined 4.2 for each cent considering the fact that 2020, restricting Pearson’s industry.

And though Bird’s target on place of work schooling is developed to shield versus these headwinds, some are sceptical that its offer matches the rhetoric.

Berenberg reported the group’s “skew toward college” would sluggish down advancement, and described the workforce capabilities device as “subscale” and requiring important acquisitions to compete with other businesses in a crowded place.

Just one of people opponents is Cengage, which has also pursued an all-you-can-take in subscription for higher education students and moved into workplace teaching, such as specific acquisitions.

Traders do not need to have reminding that it is still early times. “It now has to make this vision extra tangible, and demonstrate progress on execution,” explained Cevian ‘s Oliw.

Even so, right after yrs of wandering, Pearson might at last be getting its way.