Schumer escalates pressure on Biden to cancel student loans in 2022

The Senate bulk leader has called on the Biden administration to terminate scholar financial loans in a collection of Twitter posts in excess of the earlier many months. Although some borrowers have certified for a financial loan discharge by the PSLF program, most debtors haven’ (iStock)

To kick off the new yr, Senate Greater part Leader Chuck Schumer explained he thinks it is “a great working day” for the Biden administration to cancel university student personal debt — one thing he also stated about 20 periods on Twitter in December by yourself.

This is WHO HAS Competent FOR Student Bank loan FORGIVENESS Beneath BIDEN

For the earlier numerous months, Schumer has been ramping up strain on President Joe Biden to forgive up to $50,000 worthy of of federal university student mortgage financial debt making use of govt action. Although Biden advocated for broad student financial debt cancellation as a presidential applicant, he has not delivered on his campaign assure because taking business.

Though Schumer and a number of other outspoken progressives have been advocating for Biden to lean on his govt authority to forgive student loans, the White Residence lately stated that the president is waiting around on Congress to produce on college student forgiveness laws.

Keep reading through to find out a lot more about the likelihood of widespread pupil financial loan forgiveness, as effectively as your alternate loan compensation choices like refinancing. You can see your estimated student loan refi prices on Credible for free of charge with no impacting your credit rating rating.

Community Assistance Personal loan FORGIVENESS System JUST Got Less difficult FOR 550,000 Borrowers

Can Biden forgive scholar loans with an govt purchase?

In accordance to the Higher Training Act of 1965, the Secretary of Training has the legal authority to “implement, pay out, compromise, waive, or release any right” to accumulate on federal financial loans, but it truly is unclear no matter if that includes common personal debt forgiveness.

While Schumer and other popular lawmakers like Rep. Alexandria Ocasio-Cortez and Sen. Elizabeth Warren have urged Biden to terminate student bank loan personal debt, not all Democrats are in settlement that the president can do so.

Biden himself has solid doubt on his electric power to terminate university student loans — White Dwelling push secretary Jen Psaki not long ago instructed reporters that the president was waiting around on a monthly bill from Congress. She also added that Biden’s presidential authority to terminate college student financial loans was “beneath review.” Residence Speaker Nancy Pelosi has also beforehand claimed that the president does not have the authority to forgive university student loans, incorporating that it “has to be an act of Congress.”

Passing college student mortgage forgiveness legislation via a divided Congress would be a tough task. Democrats maintain a narrow 50-50 vast majority in the Senate, which suggests they would want the support of moderates like Sens. Joe Manchin and Kyrsten Sinema in order to cancel pupil personal debt.

Plus, federal college student personal loan forgiveness wouldn’t apply to private university student financial loans, which make up 8.4{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of all scholar financial loan personal debt, according to the Training Details Initiative. Personal college student loan debtors could alternatively take into consideration refinancing on Credible even though prices are at file lows.

SCHUMER Phone calls ON BIDEN TO Extend University student Personal loan PAYMENT PAUSE AMID OMICRON VARIANT

3 approaches to deal with your student bank loan personal debt

About 43.2 million People in america have scholar bank loan personal debt, with an average harmony of $39,351, in accordance to the Education Data Initiative. If you are battling to control your scholar loans, contemplate the pursuing alternate financial debt repayment choices:

- Profits-driven compensation ideas. Enrolling in earnings-driven compensation (IDR) will restrict your federal university student financial loan payments to 10-20{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of your discretionary revenue, relying on the sort of financial loans you have. You can get started off on the Federal Pupil Aid (FSA) web-site.

- Further federal forbearance. Federal pupil loans are at present in administrative forbearance till May 2022, but debtors could be eligible for up to 36 extra months of college student loan reduction via economic hardship or unemployment deferment.

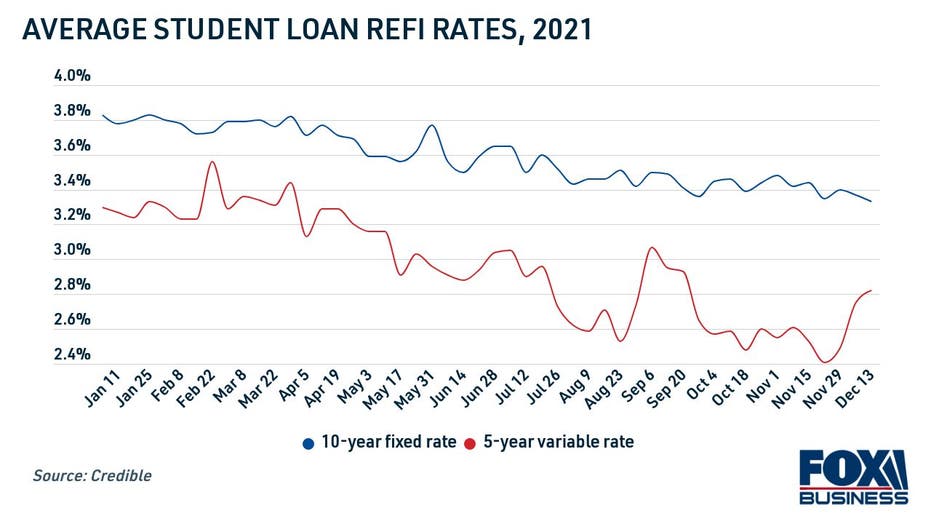

- Student loan refinancing. It may well be possible to reduce your month-to-month pupil personal loan payments by refinancing to a decreased charge as a result of a private financial institution. Set college student bank loan refinance prices are now at document lows, producing it a superior time to lock in far better conditions.

BIDEN’S Training Section HAS CANCELED $1.5B IN Scholar Loans By means of BORROWER Defense

Be informed that refinancing federal scholar financial loans into a personal bank loan will make you ineligible for govt rewards, including the present-day federal pupil loan payment pause, IDR ideas and pick out college student financial loan forgiveness plans.

If you you should not prepare on having benefit of these federal advantages — or if you happen to be a person of the millions of debtors with non-public pupil personal loan personal debt — then scholar mortgage refinancing may possibly enable you pay back off debt speedier, reduced your month-to-month payments and help save money on fascination about time. Look through present-day pupil bank loan charges in the table underneath, and visit Credible to see delivers customized to you.

47K VETERANS AND Lively-Responsibility Assistance Customers Mechanically Get College student Personal loan Reduction

Have a finance-similar concern, but don’t know who to request? Electronic mail The Credible Dollars Qualified at [email protected] and your dilemma may well be answered by Credible in our Revenue Skilled column.