Student loan forgiveness approval letters are going out. Here’s what that means.

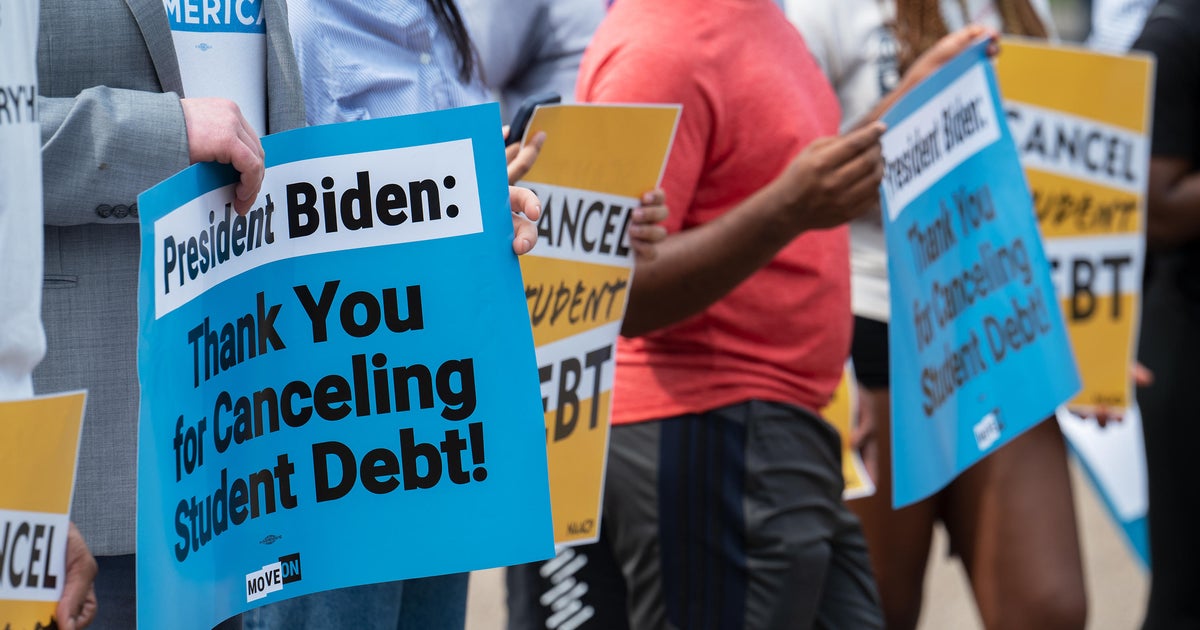

About 16 million borrowers who experienced utilized for the Biden administration’s college student loan forgiveness plan received letters over the weekend letting them know that they have been authorized for personal debt relief.

However, the letter states that a amount of lawsuits “have blocked our capacity to discharge your debt at existing.” The approvals come following two courts blocked the plan, placing legal boundaries right before a federal method that had promised to forgive up to $20,000 in college student credit card debt for about 40 million eligible Individuals.

“Your software is finish and permitted, and we will discharge your authorized personal debt if and when we prevail in court,” Secretary of Instruction Miguel Cardona reported in the letter.

About 26 million people experienced used for the financial loan relief work prior to the court rulings, which have proficiently stopped the Biden administration’s capacity to acknowledge new programs. The Biden administration is desirable individuals decisions, but it really is unclear regardless of whether the situations will be made the decision ahead of 12 months-close, when a pause on scholar personal debt repayment ends.

Financial loan payments resume in January

The letters are aiding “individuals recognize a little bit greater why they haven’t experienced their debts forgiven however,” noted Mike Pierce, government director of the advocacy group Scholar Borrower Security Heart. “That doesn’t wholly do absent with the really authentic financial nervousness that folks with pupil loans really feel at this instant.”

He additional, “As of these days, they will nevertheless get university student mortgage charges in January.”

The irony of acquiring approval for personal loan forgiveness though also currently being explained to that the prepare might not shift forward owing to lawful challenges was not dropped on recipients, who took to social media to remark on the mixed messages.

“Getting the college student mortgage forgiveness approval letter, but saying we really won’t be able to forgive your financial loans at this time is peak 2022,” 1 man or woman wrote on Twitter.

What is getting approved for relief?

The Department of Training sent the letter to 16 million folks who used to have up to $20,000 in university student credit card debt forgiven, telling them they acquired a environmentally friendly light-weight — at minimum from the Biden administration. The letters you should not tell the debtors how much of their loans experienced been erased, having said that.

But since of the court rulings, credit card debt forgiveness are unable to move ahead unless of course the Biden administration is victorious with its lawful issues. The Education and learning Section will “rapidly course of action their reduction the moment we prevail in court,” White Household Push Secretary Karine Jean-Pierre has said.

I used for forgiveness but have not gotten a letter. Why?

The Biden administration had accredited 16 million applications prior to the court rulings, and individuals folks are getting alerts about that now. Some of people applicants might not have gained the e-mail in the first warn, but could acquire an warn in their inbox soon, in accordance to a November 19 tweet from Cardona.

“Starting right now, applicants and other individuals trying to get aid by the Biden-Harris Administration’s College student Debt Relief Prepare will get started receiving updates. You should not be concerned if you you should not get an e-mail currently — far more are coming,” Cardona stated in a tweet.

But the other 10 million people today who utilized but hadn’t been authorised prior to the court rulings may well be in for a longer wait around. “The Biden administration is in a tough spot appropriate now — they aren’t allowed to approve applications until finally a little something modifications in the courtroom,” Pierce famous.

And the approximately 14 million suitable borrowers who have but to utilize are no lengthier ready to do so by way of the Instruction Department’s online software, which has been shut down in response to the court rulings.

Will I see credit card debt reduction in advance of year’s stop?

It is really unclear since that relies upon on the timing of the Biden administration’s appeals, Pierce mentioned. That is significant mainly because payments are established to resume, alongside with the accrual of desire, in January.

The Biden administration could lengthen the pause on repayments further than December, offering borrowers a lot more breathing room as the court procedure performs out, Pierce stated. On Monday, his team and a lot more than 200 other organizations questioned the Biden administration to extend the payment pause.

“People must be viewing for updates,” Pierce observed. “Presented how really hard the president is flighting for financial debt relief, I assume the administration will lengthen it.”

However, as of nowadays, the personal debt reimbursement pause is even now slated to finish on December 31.