Teaching teens about money gets new push

Lender of The usa preferred banking president Aron Levine weighs in on Gen-Z and millennial investment traits.

Youthful persons are at chance of remaining despatched out into the world with out the important expertise to make sound financial choices that will established them up for foreseeable future success.

The vast greater part of U.S. states do not have to have significant university pupils to acquire even one particular fiscal literacy training course in purchase to graduate, leaving mom and dad with the responsibility of educating teens on particular finance and investing.

But which is not going on. Scientific tests show most teenagers are not getting taught money management at residence.

Teenagers are not staying taught income administration techniques in school or at property according to experiments. (Photo by: Jeffrey Greenberg/UCG/Common Photographs Team by using Getty Pictures / Getty Photos)

A recent review by Fidelity Investments identified that when 7 out of 10 teens aged 13 to 17 said they search to spouse and children users as financial part models, only 34{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} described frequently talking about the subject with their mothers and fathers.

Stocks in this Write-up

“The important issue is for parents to start out speaking about cash with their teenagers early and normally,” says Fidelity’s VP of Youth Investing, John Boroff. “Our information reveals teens who communicate about funds with their moms and dads are additional assured on money topics.”

The trouble is that a lot of parents are not self-assured chatting about funds, them selves, in accordance to a single expert.

Dale Alexander has invested the earlier 34 years as an worker positive aspects broker to the schooling market. But the Ga native has ramped up the use of his certified money planner designation in modern years, getting a new contacting teaching young grown ups about dollars immediately after his individual young ones asked him to converse to their friends about the matter.

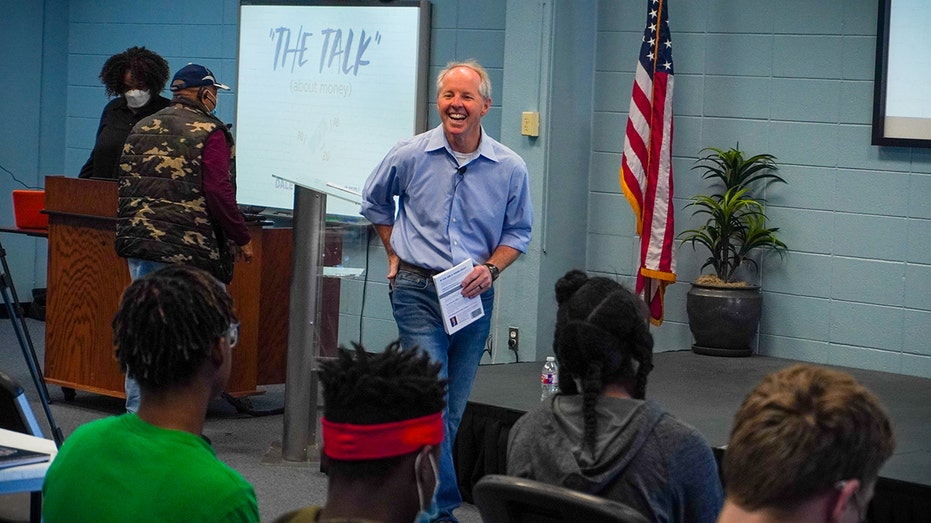

Dale Alexander, writer of “‘The Talk’ (about money)”

In late 2019, Alexander held a session on dollars administration in his convention place for a team of his kids’ mates through Xmas crack, which was recorded on Facebook are living and went “variety of viral,” he instructed FOX Organization.

Since then, he has spoken at dozens of substantial educational institutions and schools in various states, and wrote a book titled “’The Talk’ (about revenue), A Younger Adult’s Tutorial to the One Determination That Variations Everything.”

Alexander claims that children often tactic him after talks and tell him, “My mother and father never ever talked to us about dollars.”

Dale Alexander supplying “‘The Talk’ (about funds)” to a group of learners.

“Section of that motive is probably the mothers and fathers did not have achievement financially, or ended up perplexed about cash, and were just scared to convey it up to their little ones,” he says. “They’re going to talk to their young ones about numerous other critical parts of the kid’s life — it’s possible intercourse or what career job factors like that — but dollars is very rarely talked about in family members.”

Alexander details his learners to Fidelity’s Youth Account, and endorses in the course of his talks that just about every of them down load the application to their phones by the finish of the working day.

“We know teenagers find out finest by doing, which encouraged us to generate the Fidelity Youth Account,” says Fidelity’s Boroff, who notes the corporation with 40 million consumers features educational articles on its web page as properly as films on TikTok, Q&As on Reddit, and quizzes and infographics on the Fidelity application.

A different cost-free investing app established precisely for teenagers is known as Bloom, which has shot to the top rated of the charts in acceptance just after only launching a handful of months in the past.

Bloom co-founders (L-R) Allan Maman, Sam Yang, and Sonny Mo.

Bloom’s a few co-founders, Sonny Mo, Allan Maman, and Sam Yang wished to create one thing person-welcoming and youth-targeted after Mo attempted to help his brother set up a traditional investment account and was struck by how complicated and overcomplicated it was for teen people.

The Bloom crew also appreciates a little one thing about maintaining younger people engaged on a subject: Maman is credited with producing fidget spinners go viral in higher faculty.

Extended Remote Understanding Joined TO A NATIONWIDE Lower IN University student ENROLLMENT

“There is a major problem with fiscal literacy exactly where all these young ones both usually are not acquiring the proper training, or they’re not talking about it at home just due to the fact money in standard is kind of like a taboo subject matter about a ton all around a lot of homes,” Maman explained to FOX Organization.

We empower teenagers to basically started investing with as minimal as $1, but additional importantly, we have a ton of instruction modules to make mastering fun.

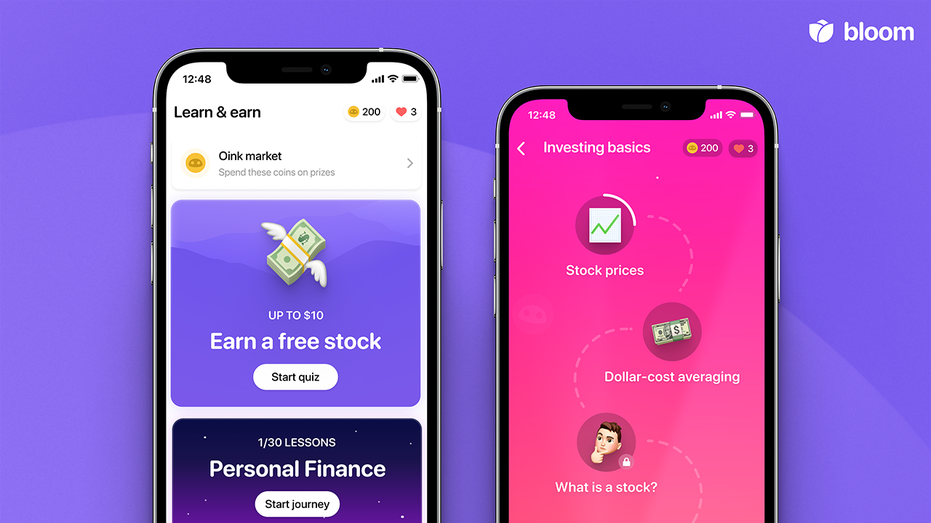

Teen investment decision app Bloom features finding out modules, parental controls, and participation incentives.

Maman claims a lot of regular money literacy classes can be drawn-out and monotonous, so Bloom has produced dozens of simple-to-fully grasp, “bite-sized” classes built for younger newbies.

“So, we empower teenagers to really started investing with as very little as $1, but additional importantly, we have a ton of instruction modules to make finding out pleasurable,” he suggests.

As an extra bonus, Bloom has parental controls offered to lessen pitfalls. Some moms and dads, for instance, favor to restrict their kids’ investments to exchange-traded money (ETFs), rather than unique stocks, Maman discussed.

GET FOX Small business ON THE GO BY CLICKING Listed here

The app has also partnered with on the net studying support Juni, which provides classes on investing, private finance, entrepreneurship and an array of other “true entire world” subject areas that are typically not available to kids in classic university settings.

The typical age assortment of Juni students is 8- to 18-many years-old, and the corporation has witnessed a surge in signal-ups for its lessons because the start out of the coronavirus pandemic.