WCC Leads Way With Financial Education Program for Students

By Em Stangarone

As Americans face document-breaking inflation, widespread credit card debt and the effects of earnings inequality, economical literacy and administration develop into critical to an individual’s means to survive and thrive. To assistance learners come to feel extra at relieve with their funds, Westchester Neighborhood School (WCC) has received a $450,000 grant to keep on its Money Smart Discussion board (MSF) economical coaching application for 3 far more years.

The grant is element of a $2.5 million investment by JPMorgan Chase and managed by the Nationwide Council for Workforce Education and learning to create and carry out money coaching courses at 7 added neighborhood schools based mostly on WCC’s effective design.

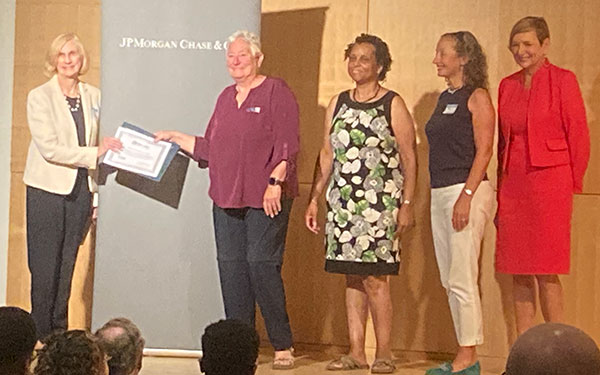

Very last Thursday afternoon, WCC held a kickoff function to rejoice the program’s success and announce the upcoming three faculties chosen for grants: Mott Community College in Flint, Mich., SUNY Fulton-Montgomery Community Faculty in Johnstown, N.Y. and SUNY Rockland Community Higher education in Suffern.

Staff from the 3 schools will start their teaching this month to study how to start their very own money coaching plans. 4 further faculties will be chosen for grants in 2023.

Through last week’s event, WCC President Belinda Miles spoke of how obtain to financial literacy and coaching has been a boon to lots of pupils. She cited studies revealing that 4 in 7 Americans are financially illiterate.

“It’s a person issue to have the information, it’s one more factor to get in there and do it,” Miles mentioned. “Those lessons stay with you, and if you go on that behavior, it can genuinely bear fruit later on on.”

The Dollars Clever Discussion board money coaching program at WCC begun in 2014 and has due to the fact assisted much more than 1,000 learners. Interested pupils indication up, and if recognized to the plan, have just one-on-just one 30-moment conferences each and every other 7 days with an assigned fiscal coach to generate and obtain plans that deal with their person fiscal needs. The system, which is in addition to a student’s typical program of courses, also features workshops on numerous monetary wellness subjects two times a thirty day period.

Learners who go as a result of the software learn how to preserve, finances, construct credit, deal with credit card debt and approach for their potential. By means of coaching and education and learning, the system has helped boost scholar tutorial overall performance and profession readiness, raise graduation charges and promote lifelong fiscal well being.

There are continue to numerous obstacles to monetary literacy, such as a nationwide absence of personalized economical education and learning in educational institutions, said Suzanne Matthews, schooling director at WCC’s Middle for Fiscal and Financial Education. Quite a few learners really don’t know how to save, open a lender account or control a spending plan. Monetary literacy skills can enable them deal with their dollars improved now and put together them for unanticipated fees that might crop up in the foreseeable future, Matthews reported.

Many speakers at the function also observed how absence of economical understanding disproportionately has an effect on women, to start with-era People in america, the economically disadvantaged, and racial minorities. Equipping students with financial know-how can help with economic mobility and closes the racial wealth hole.

“One of the biggest modifications is that learners truly feel empowered to take care of their dollars,” Matthews explained of the program’s participants.

A person such college student is Sarah Kadish, who shared her story at Thursday’s function. Kadish reported she still left a 30-year occupation in clerical operate to return to university and pursue a diploma in internet marketing to support her understand her aspiration of opening her very own greeting card business.

Right before taking part in the Dollars Intelligent Discussion board method, Kadish stated she “lived in fear of funds,” juggling also quite a few credit playing cards even though getting by on a fixed revenue. Now, following doing the job with her money coach, Marisa DiBenigno, she has taken management above her finances, lifted her credit score by 30 details and is searching ahead to conserving and investing income in her business.

“The most vital matter I discovered from MSF was that I have selections about what I do with my revenue, and that has completely liberated me,” Kadish reported. “I am so energized, because of to this system and Marisa’s diligent coaching, to say that I genuinely think I can obtain my aspiration, and incredibly creatively so.”

Examiner Media – Trying to keep you informed with professionally-described area information, capabilities, and sports protection.