Wharton partnership offers college credits to underserved high school students

In fall of 2021, the Wharton College, in collaboration with the National Education and learning Equity Lab began presenting the system Necessities of Particular Finance, which was built to instruct personal finance concepts and money choice-creating to disadvantaged higher faculty college students. Throughout 10 weeks, college students acquired every little thing from defining and calculating uncomplicated and compound interest, to how the U.S. tax program functions, to discovering strategies to fund higher schooling and negotiate the greatest obtainable fiscal support deals.

This pilot plan marked the beginning of a broader energy to entail additional significant university learners and educators with the Wharton World wide Youth Program, which produces and implements Wharton-produced applications and programs for pre-college or university learners to master about company and finance. In January 2021, Wharton Worldwide Youth introduced the Wharton Pre-Baccalaureate Application, the school’s 1st twin-enrollment prospect presenting college or university credits to superior faculty college students. The new Essentials of Individual Finance class leverages the Education Fairness Lab partnership to prolong the achieve of Pre-Baccalaureate to underserved communities in the U.S.

“It is an interesting chance to link the earth-class research and educating of Wharton’s school and students right to the substantial school classroom,” states Wharton World-wide Youth Government Director Eli Lesser. “Our collaboration with the Training Fairness Lab has been unbelievably highly effective as we consider to inspire additional pupils and educators to uncover business enterprise and finance instruction and acquire techniques that will previous a life time.”

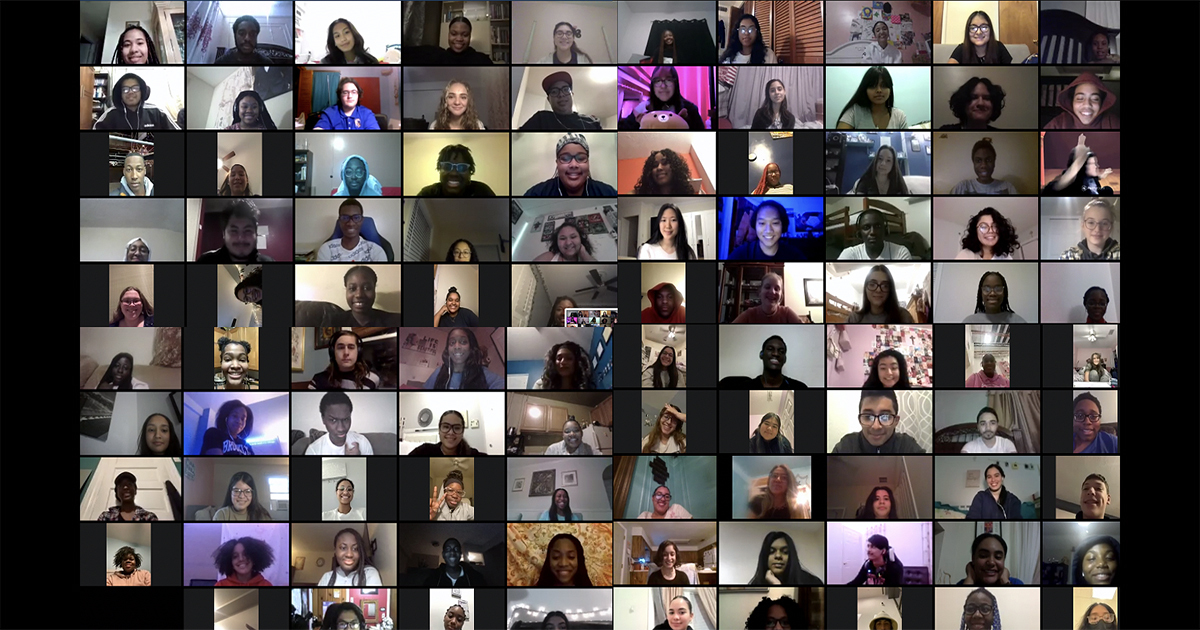

A community of students, educators, and training assistants had been essential to the good results of the Necessities of Individual Finance training course. Wharton provided asynchronous resources that the students accessed in their superior faculty school rooms with the enable of selected large college co-teachers. As soon as a week, every course also synchronously and remotely satisfied with a Wharton MBA training assistant assigned to their class. The training assistants created lesson programs, taught classroom concepts, and monitored student progress.

David Musto, the Ronald O. Perelman Professor in Finance at Wharton, labored carefully with the various stakeholders and MBA pupils to develop and execute the system. Musto, also college director of Wharton’s Stevens Center for Innovation in Finance, suggests he specially recognized the price of educating substantial-school pupils own finance concepts these types of as the compounding of fascination, and addressing their important life conclusions, this kind of as the funding of higher education.

“Financial literacy is this kind of an critical ability that is not taught enough,” Musto claims. “I was proud of the impression that the study course experienced on gifted pupils from fiscally pressured communities about the country. They understood what they had been able of obtaining when they mastered the aspects of a Wharton program in substantial university.”

Wharton Dean Erika James sent keynote remarks at the opening ceremony in September 2021 for students and their family members, spotlighting why Wharton was committed to aid lead this effort and hard work.

“I am so utterly encouraged,” she claimed. “At the Wharton University, we have a great accountability to influence the pipeline of long term organization leaders so that it additional properly reflects the planet all over us. Our partnership with the Nationwide Schooling Fairness Lab mobilizes the in depth alternatives of the Wharton tutorial local community to teach and inspire pupils in traditionally underserved communities.”

Wharton alumnus and trustee Michael Klein, the founder and running husband or wife of M. Klein and Organization who sits on Wharton’s Board of Advisors, resolved associates of the Wharton community, substantial university learners, and Countrywide Education and learning Fairness Lab partners at the program’s closing ceremonies in December 2021.

“What you have accomplished with this very first class will be the beginning of what I imagine will be an incredible partnership with National Education and learning Fairness Lab,” he mentioned at the time. “A good deal of universities speak about inclusion, equity, and accessibility. But quite couple of universities act on it the way Dean James has. I am massively proud of the group from Wharton, from Dean James to the teaching fellows.”

Sebastian Dibenedetto, a sophomore from Engineering & Science College Magnet Higher College in New Haven, Connecticut, claims that the study course “heavily impacted” his life.

“I am very pleased to say that I am heading to be the initially in my family to go to college, and it is opportunities like this that established me on the proper route and gave me the self confidence that I will need,” he suggests. “No make a difference what job you go into, we will all use the lessons taught in Professor Musto’s class.”

Camren Daley, a senior from Manchester Substantial Faculty in Manchester, Connecticut, expressed his appreciation and shared the profound impact this prospect has experienced on him.

“I’m really grateful to the Wharton Faculty and the National Instruction Equity Lab mainly because this program has improved all of our lives,” he says. “This will dwell with us for generations. Honestly, who would believe that young ones like me could occur to the Wharton Faculty and certainly realize success?”

Marissa Sawicki, a Wharton MBA educating assistant, recalls touring by practice to New Haven to surprise her college students for an in-person past class—complete with pizza.

“Participating in Wharton’s partnership with the Countrywide Ed Equity Lab has been a spotlight of my time at Penn so considerably,” Sawicki notes. “Witnessing the enthusiasm, intelligence, and talent of the large college college students, particularly as they discovered a matter as complicated as collegiate finance, still left me feeling inspired and hopeful. I just cannot wait around to cheer on my college students in their coursework in higher education and over and above.”

At the conclude of this course, learners make transferable university credits from Wharton at no price tag to them or their households.

Vivian Gonda Zelter, a 1985 alumna of the College or university of Arts & Sciences who is the director of strategic partnerships at Countrywide Education Fairness Lab, also served as the class supervisor.

“I am motivated to have participated firsthand in this remarkable partnership with Wharton,” she states. “Underserved superior college learners are eager to understand about finance, regardless of whether it’s cryptocurrency or university student loans, and Wharton is unquestionably satisfying this will need throughout the region.”

The Instruction Fairness Lab supports minority college students and faculties in which at the very least 40{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of college students are from low-money households. The objective is to deal with below-matching, a phrase in college or university admissions to explain effectively-certified disadvantaged pupils who select much less-tough institutions or decide not to go to college or university at all.

“Everyone included in this partnership has shown the power of Wharton’s participation in this class,” says Leslie Cornfeld, CEO and founder of the Countrywide Schooling Fairness Lab. “Wharton is assisting to stage the playing subject for large-attaining pupils from low-income backgrounds by empowering them to advance and display higher education readiness, to admissions offices and themselves.”

The 10-week training course is built to help students comprehend crucial personalized finance concepts and find out how to make smart economic selections.