When Should You Buy Barrett Business Services, Inc. (NASDAQ:BBSI)?

When Barrett Organization Expert services, Inc. (NASDAQ:BBSI) could not be the most widely regarded inventory at the moment, it observed significant share value motion in the course of the latest months on the NASDAQGS, growing to highs of US$82.32 and slipping to the lows of US$60.58. Some share cost actions can give traders a much better possibility to enter into the stock, and potentially purchase at a decreased value. A question to response is regardless of whether Barrett Business enterprise Services’ latest investing price of US$60.58 reflective of the actual value of the compact-cap? Or is it currently undervalued, offering us with the chance to obtain? Let’s just take a glimpse at Barrett Business enterprise Services’s outlook and worth based on the most latest money details to see if there are any catalysts for a selling price improve.

What is Barrett Business Services truly worth?

Good news, buyers! Barrett Small business Services is still a discount proper now according to my value several design, which compares the firm’s price tag-to-earnings ratio to the market regular. In this instance, I have made use of the selling price-to-earnings (PE) ratio given that there is not more than enough information to reliably forecast the stock’s funds flows. I obtain that Barrett Business enterprise Services’s ratio of 13.13x is underneath its peer normal of 22.88x, which signifies the inventory is buying and selling at a decrease price tag as opposed to the Professional Services market. Even so, provided that Barrett Company Services’s share is pretty risky (i.e. its price tag actions are magnified relative to the rest of the sector) this could signify the rate can sink decreased, giving us one more probability to purchase in the potential. This is dependent on its superior beta, which is a fantastic indicator for share price tag volatility.

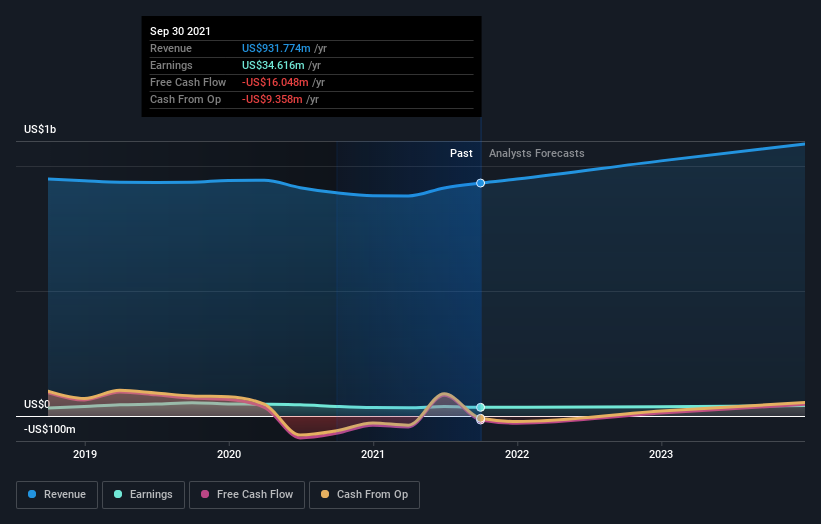

What form of expansion will Barrett Business Providers create?

Foreseeable future outlook is an important part when you’re hunting at buying a stock, in particular if you are an investor wanting for progress in your portfolio. Obtaining a fantastic firm with a robust outlook at a inexpensive price tag is generally a superior expenditure, so let’s also just take a glance at the company’s potential anticipations. With gain predicted to grow by a double-digit 17{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} more than the following couple of several years, the outlook is beneficial for Barrett Small business Products and services. It seems to be like greater income move is on the cards for the stock, which should feed into a higher share valuation.

What this indicates for you:

Are you a shareholder? Considering that BBSI is at present trading beneath the marketplace PE ratio, it may be a terrific time to enhance your holdings in the inventory. With an optimistic financial gain outlook on the horizon, it looks like this development has not yet been entirely factored into the share cost. Nevertheless, there are also other elements such as economic wellbeing to look at, which could explain the present-day cost various.

Are you a potential trader? If you’ve been maintaining an eye on BBSI for a although, now may possibly be the time to make a leap. Its prosperous long term gain outlook is not completely mirrored in the present share price tag but, which suggests it’s not also late to acquire BBSI. But before you make any investment decision decisions, think about other variables such as the keep track of record of its management team, in order to make a nicely-knowledgeable investment conclusion.

Continue to keep in brain, when it comes to analysing a stock it really is value noting the hazards concerned. To help with this, we’ve found 2 warning indications (1 shouldn’t be disregarded!) that you ought to be aware of right before getting any shares in Barrett Business Services.

If you are no longer interested in Barrett Organization Providers, you can use our free of charge system to see our record of around 50 other shares with a substantial growth probable.

Have opinions on this post? Involved about the information? Get in contact with us right. Alternatively, electronic mail editorial-workforce (at) simplywallst.com.

This report by Basically Wall St is standard in mother nature. We provide commentary based on historical details and analyst forecasts only applying an impartial methodology and our posts are not meant to be economical assistance. It does not represent a recommendation to buy or market any inventory, and does not get account of your goals, or your money situation. We intention to convey you very long-time period focused investigation driven by fundamental info. Observe that our assessment might not factor in the hottest price tag-sensitive company bulletins or qualitative material. Merely Wall St has no situation in any shares mentioned.

The views and thoughts expressed herein are the sights and opinions of the creator and do not automatically reflect people of Nasdaq, Inc.