Year-end Tips for Small Business Owners

12 months-finish Recommendations for Smaller Enterprise Proprietors

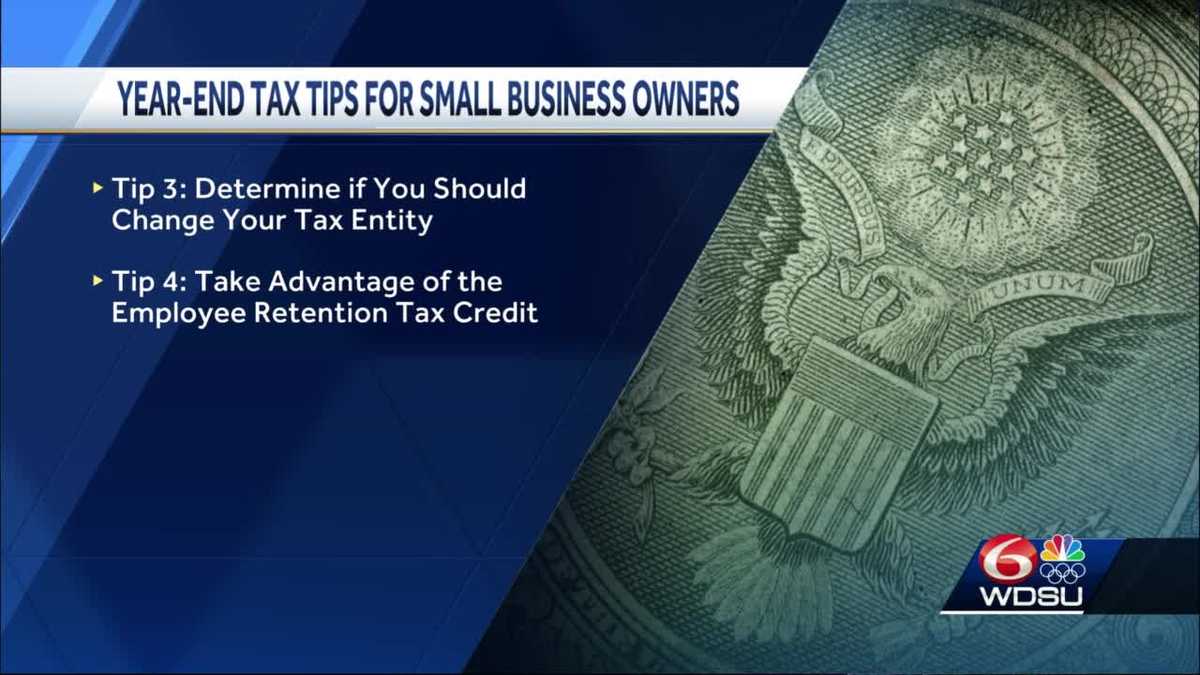

>> NOW IS THE TIME TO Consider NEW Money MOVES TO MAKE A Distinction WITH YOUR TAXES. KEMBERLEY WASHINGTON IS Dwell IN STUDIO. No matter if Another person IS A NEW Chicken DRIVER OR A FREELAERNC OR THEY Have A Smaller Company, GIVE US THE Stage Another person CAN Take Appropriate NOW TO MAKE Those people Alterations Right before THE NEW YR?EA >> Proper, THERE ARE Quite a few MOVES YOU CAN MAKE Ideal NOW, THAT WOULD MAKE A Large Variation WITH YOUR TAXES. THE Initial Detail YOU Could WANT TO Take into consideration AT THIS TIME IS GET Organized Set Apart 30 MINUTES OR SO, TO Simply Acquire TE IM GTOET A Cope with ON YOUR TAX AND Fiscal PAPERWORK. YOU CAN USE THIS TIMTOE Have an understanding of HOW A great deal Money YOU Attained THIS Year Evaluation YOUR EXPEESNS FILE OR SCAN Vital Monetary AND TAX Paperwork OR Timetable A Year-Conclusion Assembly WITH YOUR CPA TO Examine YROU Business Finances AND MOVES YOU CAN MAKE Before THE End OF THE 12 months. Look at CONTRIBUTING YOUR RETIREMENT ACCOUNTS THIS IS A Fantastic TIME TO Establish IF YOU Need to have TO FUND YOUR RETIREMENT ACCOUNTS. Preserve IN Brain, IF YOU HAVE AN IRA, YOU In fact HAVE UNT 4/15 TO Put Cash INTO THE ACCOUNT. However, THIS IS A Very good TIMEO T Decide HOW Much YOU Prepare TO Contribute TO YOUR RETIREMENT TO GET THE MOST TAX Advantage. YOU Should ALSO Think about Speaking WHIT YOUR Money Experienced ABOUT OTHER Options This kind of AS A SEP IRA, WHICH May perhaps Permit YOU TO Add ME.OR 3. Ascertain IF YOU Must Modify YOUR TAX ENTITY THIS CAN MAKE A Substantial DIFFEREENC AND Conserve YOU Hundreds.Many Small Enterprise Homeowners Start THEIR Organizations AS A SOLE PROPRIETOR AND FILE A Program C. Having said that, THIS Could NOT BE THE Best TAX Scenario FOR YOU AT THIS TIME. SOLE PROPRIETORS ARE Issue TO Equally Standard AND SELF-Utilized TAXES OF 15..3{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} YOU Need to Satisfy WITH YOUR CPA TO Identify IF YOU Really should Take into consideration OTHER ENTITIES, This kind of AS AN S-Company, PARTNERSHIP OR Corporation TO Identify IF YOU ARE Equipped TO Save ON TAXES. 4. Consider Gain OF THE Staff RETENTION TAX Credit score IF YOU HAVE Staff members, YOU WANT TO Listen UP. THE Employee RETENTION TAX Credit IS Readily available TO Smaller Enterprise Owners WHO Compensated Workforce AND WHO Saw A Decline IN Profits PRIOR TO THE COVID-19 PANDEM.IC FOR 2020, YOU May QUALIFY FOR UP TO $10,000 For each Personnel AND FOR 2021, YOU May well QUALIFY FOR UP TO $21,000 Per Staff. SO THIS IS These A Massive Offer, UYO DEF WANT TO Speak WITH YOUR CPA OR TAX Experienced TO Attain THE Credit. AND And lastly, IT IS A Superior Thought, Whether or not YOU ARE A Tiny Company Owner OR NOT, Contemplate Producing AN On the internet ACCOUNT WITH THE IRS All through THIS TIME. Location US THIS ACCOUNT CAN Enable YOU Save TIME, Because YOU ARE Able TO RETRIEVE ALL OF YOUR TAX Files, TAX RETURNS Submitted IN One Position. I JUST TWEETED THE Url AT KEMCENTS TO Help YOUET G Started. >> THANK YOU. YOU Often KNOW WHO TO Drop THE GEMS Right ON TIME.

Yr-conclude Tips for Modest Enterprise Homeowners

As we method the close of the 12 months, this is now a fantastic time to consider a number of income moves that will make a variance in your taxes. This is specially the circumstance if you are a compact organization proprietor. Regardless of whether you are an Uber driver, freelancer, or function a little enterprise, C.P.A. Kemberley Washington shares few moves you can make ahead of the clock strikes 12 on Dec. 31.

As we method the finish of the 12 months, this is now a fantastic time to think about a few money moves that will make a change in your taxes. This is in particular the circumstance if you are a smaller business proprietor. No matter whether you are an Uber driver, freelancer, or work a compact business, C.P.A. Kemberley Washington shares few moves you can make right before the clock strikes 12 on Dec. 31.