3 Business Services Stocks With Solid Dividend Payouts

The Business Services sector, despite the coronavirus-induced market uncertainty, has been steadily gathering steam on the back of gradual resumption of business activities, increased adoption and success of the work-from-home model, rise in demand for risk mitigation and consulting services, and expertise in improving operational efficiency and reducing costs. Providers of essential and non-deferrable services, such as waste removal and building maintenance, remained resilient to the pandemic-induced disruptions.

– Zacks

Owing to its widely-diversified nature, the sector seeks to benefit from the growth of the overall economy, which is expected to strengthen further on the success of the ongoing mass vaccination program, continued government response in the form of pandemic-relief packages, expanded unemployment benefits and relaxation of restrictions.

In view of the aforementioned favorable trends, several business services firms such as Charles River Associates CRAI, Automatic Data Processing, Inc. ADP andWaste Connections, Inc. WCN have chosen to reward their shareholders with dividend hikes. We believe consistency in rewarding shareholders through dividend payments or share repurchases not only boost investor confidence but also positively impact a company’s earnings per share.

3 Companies That Rewarded Shareholders

Charles River Associates: This Zacks Rank #2 (Buy) Massachusetts-based consulting company has increased its quarterly dividend rate by 19.2{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, from 26 cents per share to 31 cents per share. The increased dividend will be paid out on Dec 10, 2021 to shareholders of record at the close of business on Nov 30. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Despite coronavirus-induced adversities, Charles River Associates’ top line has been doing well on the back of strength across services, geographies and improved utilization and headcount increase. Charles River Associates recorded double-digit revenue growth in Financial Economics, Forensic Services, Antitrust & Competition Economics, Labor & Employment, Marakon, and Risk, Investigations & Analytics practices. Geographically, growth was witnessed across North American and international operations.

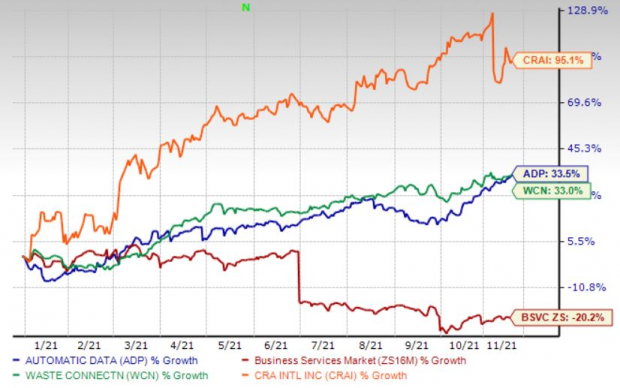

The Zacks Consensus Estimate for Charles River Associates’ 2021 EPS has moved up 7.6{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in the past 90 days. The company’s expected earnings growth rate for the year is 61.2{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. Additionally, it has a long-term (three to five years) expected earnings growth rate of 15.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. The company has a trailing four-quarter earnings surprise of 50.9{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, on average. The stock has rallied 95.1{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} so far this year.

Automatic Data Processing: This Zacks Rank #3 (Hold) New Jersey-based company recently announced a dividend hike of 11.8{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, thereby raising its quarterly cash dividend from 91 cents per share to $1.04. This reflects Automatic Data Processing’s 47th consecutive year of increased cash dividend. The raised dividend will be paid out on Jan 1, 2022 to shareholders of record on Dec 10, 2021.

Automatic Data Processing continues to enjoy a dominant position in the human capital management market through strategic buyouts like Celergo, WorkMarket, Global Cash Card and The Marcus Buckingham Company. It has a strong business model, high recurring revenues, good margins, robust client retention and low capital expenditure. The company has a lower risk of insolvency. Further, Automatic Data Processing continues to innovate, improve operations and invest in its ongoing transformation efforts. Effective cost containment measures have helped the company improve its margin performance. Automatic Data Processing is also witnessing new business bookings and client retention in these challenging times.

The Zacks Consensus Estimate for ADP’s 2022 EPS has moved up 2.4{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in the past 90 days. The company’s expected earnings growth rate for the year is 12.3{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. Additionally, Automatic Data Processing has a long-term (three to five years) expected earnings growth rate of 12{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. The company has a trailing four-quarter earnings surprise of 9.7{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, on average. The stock has rallied 33.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} so far this year.

Waste Connections: This Zacks Rank #3 Canada-based waste removal services company has hiked its quarterly dividend by 12.2{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, from 20.5 cents per share to 23 cents per share. This reflects Waste Connections’ 11th consecutive double-digit percentage increase since the initiation of dividend payment in 2010. The increased dividend will be paid out on Nov 23, 2021 to shareholders of record at the close of business on Nov 9.

A sequential improvement in solid waste volumes and increased recovered commodity values have been aiding Waste Connections’ top line. The company’s focus on secondary and rural markets to garner a higher local market share is appreciable. The company has optimal asset positioning to generate higher profitability. Acquisitions have been helping Waste Connections in expanding its global presence and strengthen its product portfolio.

The Zacks Consensus Estimate for WCN’s 2021 EPS has moved up 2.2{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in the past 90 days. The company’s expected earnings growth rate for the year is 21.9{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. Additionally, it has a long-term (three to five years) expected earnings growth rate of 13.6{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. Waste Connections has a trailing four-quarter earnings surprise of 6{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}, on average. The stock has rallied 33{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} so far this year.

The chart below shows the price performance of the aforementioned stocks compared with the broader Zacks Business Services sector so far this year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP): Free Stock Analysis Report

Charles River Associates (CRAI): Free Stock Analysis Report

Waste Connections, Inc. (WCN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research