5 Business Services Stocks to Buy on Solid Job Data for May

U.S. stock markets are suffering from extreme volatility in 2022 with no sign of effective recovery in the near future. However, several economic data for May and April indicated that the fundamentals of the economy remain strong. The latest is the nonfarm payroll data for May. Interestingly, market participants are concerned that a rock solid U.S. economy will enable the Fed to become more aggressive in hiking interest rate and reducing liquidity from the system.

Strong fundamentals of the U.S. economy, especially, the job market, are likely to drive stock prices of business services stocks. We have selected five such stocks with a favorable Zacks Rank. These are — Kforce Inc. KFRC, Tyler Technologies Inc. TYL, IBEX Ltd. IBEX, Cross Country Healthcare Inc. CCRN and RCM Technologies Inc. RCMT.

Strong Job Data for May

Businesses expanded their operations and hired more manpower despite facing prolonged supply-chain disruptions and a shortage of skilled labor. The U.S. economy added 390,000 jobs in May, surpassing the consensus estimate of 329,000. The unemployment rate stayed at 3.6{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. Job additions were broad-based led by the leisure and hospitality sector.

Labor force participation increased marginally to 62.3{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. However, the data was 1.1{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} below February 2020. The average hourly wage rate grew 0.3{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} compared with the consensus estimate of 0.4{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}. Year over year, hourly wage rate increased 5.2{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}.

Business Services Sector to Gain

The staffing industry comprises companies that provide a wide range of services related to human resources, and workforce solutions and services. Of late, the industry has been witnessing growth in revenues and income. It stands to benefit from the gradual resumption of business activities, which were postponed or restricted by the coronavirus-triggered strict lockdowns worldwide. This led to additional hiring and wage increase.

The steadily improving U.S. economy, backed by an uptick in manufacturing and service activities, led to additional hiring and wage increase. Both manufacturing Index and services Index, measured by the Institute for Supply Management, have stayed above the 50{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} mark for the past two years, indicating continued expansion.

Amid the pandemic, the key focus within the consulting industry is currently on channelizing money and efforts toward more effective operational components, such as technology, digital transformation and data-driven decision-making.

Growth in technology services industry has accelerated on an increasing number of remote workers in the wake of the pandemic. In this era of digital transformation, enterprises are actively seeking a common ground between on-premise and cloud infrastructure that will enable them to provide flexible and easily adoptable hybrid solutions.

The business software industry is benefiting from robust demand for multi cloud-enabled software solutions, given the ongoing transition from legacy platforms to modern cloud-based infrastructure.

The industry players are incorporating artificial intelligence and tools like machine learning in their applications to make the same more dynamic and result-oriented. Elevated demand for enterprise software, which is ramping up productivity and improving the decision-making process, is a key catalyst.

Our Top Picks

We have narrowed our search to five business services stocks that have solid potential for the rest of 2022. These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

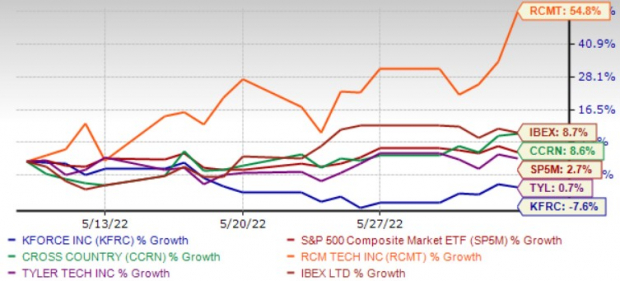

The chart below shows the price performance of our five picks in the past month.

Image Source: Zacks Investment Research

Cross Country Healthcare is a leading provider of innovative healthcare workforce solutions and staffing services in the United Sates. CCRN’s diverse client base includes both clinical and nonclinical settings, servicing acute care hospitals, physician practice groups, outpatient and ambulatory-care centers, nursing facilities, both public schools and charter schools, rehabilitation and sports medicine clinics, government facilities, and homecare.

Cross Country Healthcare sports a Zacks Rank #1 and has an expected earnings growth rate of 54.3{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} for the current year. The Zacks Consensus Estimate for current-year earnings has improved 42.2{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} over the last 30 days.

Kforce is a full-service, web-based specialty staffing firm providing flexible and permanent staffing solutions in the United States. KFRC operates through the Technology and Finance and Accounting segments. kforce.com offers web-based services, including online resumes and job postings, interactive interviews and job placements and career management strategies.

Kforce carries a Zacks Rank #2 and has an expected earnings growth rate of 24{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.8{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} over the last 60 days.

IBEX provides end-to-end technology-enabled customer lifecycle experience solutions in the United States and internationally. IBEX offers customer support, technical support, inbound and outbound sales, business intelligence and analytics, digital demand generation and CX surveys and feedback analytics service. Its major products are ibex Connect, ibex Digital and ibex CX.

Zacks Rank #1 IBEX has an expected earnings growth rate of 15.8{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} for the next fiscal year (ending June 2023). The Zacks Consensus Estimate for next-year earnings has improved 9.4{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} over the last 30 days.

Tyler Technologies provides integrated information management solutions and services for the public sector in the United States and internationally. TYL operates in two segments, Enterprise Software, and Appraisal and Tax. Tyler Technologies’ clients consist primarily of federal, state, county and municipal agencies, school districts, and other local government offices.

Zacks Rank #2 TYL has an expected earnings growth rate of 8.1{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} for the current year. The Zacks Consensus Estimate for its current-year earnings has improved 1.2{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} over the last 60 days.

RCM Technologies is a national provider of business, technology and resource solutions in information technology and professional engineering to customers in the corporate and government sectors. RCMT has grown its information technology competencies in the areas of resource augmentation, e-business, Enterprise Resource Planning support, network and infrastructure support and knowledge management.

RCM Technologies carries a Zacks Rank #2 and has an expected earnings growth rate of more than 100{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} for the current year. The Zacks Consensus Estimate for current-year earnings has improved more than 100{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} over the last 60 days.

Free: Top Stocks for the $30 Trillion Metaverse Boom

The metaverse is a quantum leap for the internet as we currently know it – and it will make some investors rich. Just like the internet, the metaverse is expected to transform how we live, work and play. Zacks has put together a new special report to help readers like you target big profits. The Metaverse – What is it? And How to Profit with These 5 Pioneering Stocks reveals specific stocks set to skyrocket as this emerging technology develops and expands.

Download Zacks’ Metaverse Report now >>

Kforce, Inc. (KFRC): Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN): Free Stock Analysis Report

Tyler Technologies, Inc. (TYL): Free Stock Analysis Report

RCM Technologies, Inc. (RCMT): Free Stock Analysis Report

IBEX Limited (IBEX): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.