Calls for student loan forgiveness expected to intensify as Biden’s legislative agenda stalls

President Joe Biden’s ambitious social spending and local climate-alter deal of laws, the Build Back again Much better Act, appears not likely to move as initially composed soon after the reasonable West Virginia Democrat Sen. Joe Manchin declared his opposition in the times before Xmas and reiterated this 7 days that there are no ongoing discussions over the invoice.

Though it is doable Democrats can muster their razor-slender margins in the House of Representatives and Senate to go some kind of stripped-down investing invoice, it is just about a certainty that Biden will either this calendar year or following a very likely reduction of the Home just after the November elections, convert to regulatory changes as the principal auto for his plan vision.

“While Biden will find to provide some variation of his Build Back Better legislative agenda to fruition, he will appear to inspire his party’s base heading into the midterm elections with wins that do not demand any congressional action,” wrote analysts at Beacon Policy Advisors, in a notice to consumers this week.

The Biden administration has not shied from using government authority to implement his financial agenda. For occasion, it has lifted the least wage for federal contractors to $15 for each hour, whilst federal organizations ranging from the Federal Trade Fee to the Department of Agriculture are engaging in an administration-large evaluate of antitrust coverage.

But there are number of other procedures that could inspire Biden’s base additional than college student financial loan forgiveness, provided that voters with school levels assistance Biden as president in a lot higher numbers than voters with no levels.

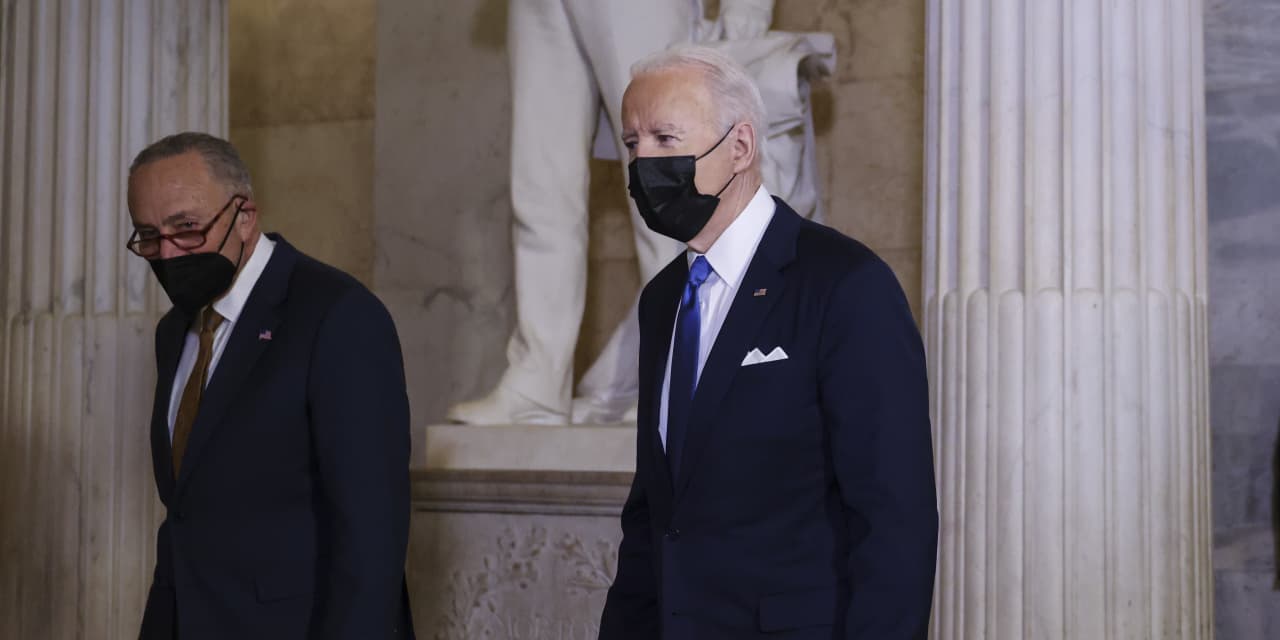

Senate Greater part Chief Chuck Schumer, the New York Democrat, has continually urged Biden to use government authority to forgive up to $50,000 per university student in federally backed scholar bank loan personal debt, a go that would insert $1 trillion to the finances deficit in the extensive operate, in accordance to the Brookings Institution. (It would not increase to the nationwide financial debt, however, since personal debt was presently issued in buy to build the financial loans in the 1st position.)

Biden has explained he does not imagine he has the legal authority to forgive scholar financial loans by fiat, and has stated he would choose that Congress authorize the forgiveness of $10,000 in personal debt per student. Before this calendar year, White Dwelling officers said they ended up examining Biden’s legal authority to terminate student credit card debt via govt action.

Legal authorities say there is no obvious response as to whether or not the president has the authority to cancel scholar mortgage. Opponents of the policy say that it would violate the Appropriations Clause of the Structure and the 1982 Antideficiency Act, which prohibits the executive from paying out money devoid of the authority of Congress.

Proponents of the coverage say that these provisions do not implement to student personal loan forgiveness, as Congress licensed the paying out and federal legislation presents the Secretary of Education broad authority to make your mind up how and no matter whether to obtain personal debt repayments.

“Everybody agrees that the Secretary of Instruction is empowered to make changes on federal pupil financial loans,” wrote Howell Jackson, a Harvard University legislation professor in an April write-up in the Regulatory Critique. “The debate turns on the specific indicating of provisions of the Higher Schooling Act of 1965 which confer on the Secretary the electrical power to ‘consent to modification’ of, and to ‘compromise, waive, or launch,’ quantities owing on particular scholar loans.”

When Biden and Property Speaker Nancy Pelosi, a California Democrat, say they really do not feel the president has the authorized authority to cancel university student personal debt, they are referring to interpretations of the HEA and other related legal guidelines. But a far more essential issue, according to some advocates of the coverage, is no matter if there would be any recourse for opponents of the plan to prevent the president ended up he to go after it.

“Lawsuits challenging administrative pupil personal debt would likely fail,” in accordance to a the latest memo issued by Massachusetts Democratic Sen. Elizabeth Warren, incorporating that it would be tricky for any individual or state to show that they have been wronged by the plan, a required action for plaintiffs to reach standing in federal courtroom.

Jackson argued in a Harvard Legislation School briefing paper that providers the federal governing administration hires to provider federal college student loans could possible obtain standing if they sought after to sue the govt. He noted that the federal authorities was set to spend pupil loan servicers about $1.1 billion past yr, and the loss of these revenue could encourage people corporations to sue to block forgiveness.

The Warren memo, nonetheless, argued that it is not likely courts would remedy these companies’ losses by blocking forgiveness completely. “Even if a person or entity could successfully argue that they have standing, they were being in some way

wronged, and that they are owed some authorized treatment — no particular person or entity could fairly argue that the treatment to their lawsuit ought to be indefinitely holding tens of millions of scholar personal loan borrowers in debt,” it reads.

Even if political things to consider take precedence more than the regulation, it is not apparent that the Biden administration will enact scholar mortgage forgiveness by fiat, in accordance to Beacon analysis analyst Charlotte Jenkins.

“Biden has expressed skepticism about blanket forgiveness allowing learners who attended elite establishments to have relief and is likely fearing backlash from offended voters who have currently paid out off their individual college student loans or who did not pick out to go after greater education and learning because of to its value,” she wrote in a Friday be aware to purchasers.

“Exacerbating this dilemma is that by government action it is much more complicated to implement the implies-analyzed forgiveness that could make forgiveness far more palatable to moderates and the thousands and thousands of blue-collar personnel Biden takes advantage of as a litmus exam for presidential action,” Jenkins mentioned.

“The looming midterm elections will preserve deferment and forgiveness on the agenda as the Democratic Celebration debates the political implications of each outcome,” wrote Jenkins.