Corporate Loans Come Back to Haunt Morgan Stanley Earnings

(Bloomberg) — Morgan Stanley incurred a $356 million writedown on company financial loans caught on its stability sheet in the fourth quarter as the current market for leveraged buyout debt, like Twitter Inc., remained weak.

Most Examine from Bloomberg

The James Gorman-led lender reported the mark-to-industry losses on the credit card debt held for sale and mortgage hedges, which had been partially offset by web desire revenue and fees of $287 million about the period of time.

The figures consist of Morgan Stanley’s day-to-working day corporate lending as effectively as risky bridge financial loans for debt-fueled acquisitions that the financial institution got caught with when credit disorders quickly deteriorated in early 2022. Roughly $3.4 billion of Morgan Stanley’s balance sheet is tied up with loans it lent to Twitter as aspect of Elon Musk’s acquisition of the social-media firm.

The other 5 big US expense banking companies didn’t specify paper losses for corporate loans in the fourth quarter as JPMorgan Chase & Co., Lender of The united states Corp, Citigroup Inc., Wells Fargo & Co., and Goldman Sachs Team Inc. described earnings on Friday and Tuesday.

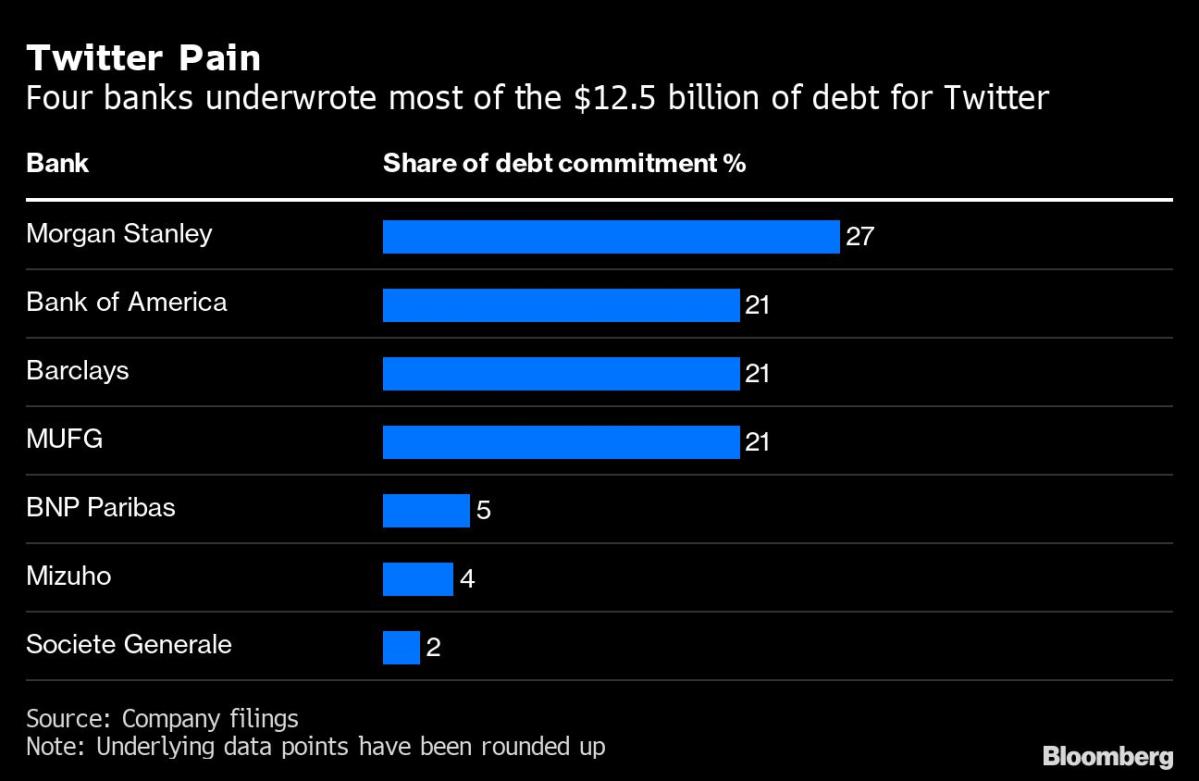

That may underscore the scale of the dilemma at Morgan Stanley, which led the Twitter financing. Paper losses for the group of seven banking companies that backed Musk’s takeover are perhaps about $4 billion, Bloomberg has described. Morgan Stanley led the funding and has the largest publicity at about 27{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of the debt.

When asked by Wells Fargo banking analyst Mike Mayo about the transaction on the Tuesday earnings connect with, Morgan Stanley CEO Gorman declined to communicate particulars and defended the leveraged-lending enterprise.

“I’m not likely to communicate about Twitter. We never communicate about one names as you would anticipate,” he reported.

“The way I feel about this is we run a portfolio small business. We definitely have one credits at any place in time that disappoint relative to some others, but it is the whole package deal,” Gorman extra. “And the whole offer, if you appear at it, really turned out to be pretty great presented the setting we’re in.”

For comprehensive-12 months 2022, Morgan Stanley saw $876 million of mark-to-marketplace losses on company loans held for sale and mortgage hedges, softened by a $701 million obtain in web curiosity revenue and costs.

A agent for the financial institution declined to comment further than the earnings phone.

Total, Morgan Stanley’s earnings narrowly conquer analysts’ expectations on a prosperity-administration report even as the firm’s traders fell shorter of estimates.

Financial institutions saddled with so-known as hung debt commonly have to mark-to-current market the property based on where by the secondary sector could benefit the credit card debt if it had been offloaded. The creditors subsequently know these losses at the time they eventually offer at a discounted rate. Financial institutions never commonly specify no matter whether a decline is on paper or recognized in their earnings.

In the 2nd quarter of 2022, when junk bond and leveraged bank loan costs crashed, the major six US banking institutions described about $1.3 billion of these losses in full.

In the third quarter, when rates remained frustrated but regular, only Morgan Stanley and Citigroup totally broke out the figures in the US, for a reduction of about $200 million complete. And now in the fourth quarter, Morgan Stanley stands out for specifying the pain.

On a media phone for Lender of America’s earnings on Friday, which contributed about 21{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of the Twitter financial debt, main monetary officer Alastair Borthwick declined to supply a fresh new update on the outlook for leveraged-finance writedowns, which he explained as a “similar story” to the prior quarter.

But just mainly because other financial institutions aren’t disclosing their losses doesn’t indicate they are free from the pain, considering the fact that only material writedowns have to have to be disclosed.

“Each lender has their own threshold for how they define material, and it’s generally relative to the dimension of the enterprise,” explained Brennan Hawken, a financial institution analyst at UBS Team AG.

–With aid from Lisa Lee, Katherine Doherty and Sally Bakewell.

Most Study from Bloomberg Businessweek

©2023 Bloomberg L.P.