Many students don’t know how to manage their money. Here are 6 ways to improve financial literacy education

How we can boost the educating of monetary literacy in high faculty? And why is it essential?

Economic Basics Basis

People today will need a standard knowledge of economic ideas to make excellent financial decisions. Our recently released exploration observed most learners generally do not know a good deal about individual finance. This features becoming able to use standard numeracy to genuine-existence money conditions, such as producing paying for choices that are value-for-dollars and understanding desire on financial loans and investments.

Our report also would make six suggestions to strengthen money literacy education in universities.

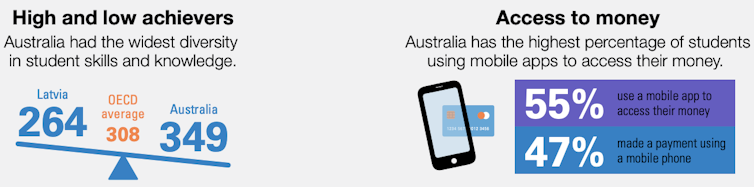

Our findings had been consistent with previous proof that 16{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of Australian 15-calendar year-olds deficiency even the essential level of fiscal literacy they have to have to participate in culture. There is evidence that money literacy in this age group is declining.

Examine more:

Aussie kids’ fiscal know-how is on the decrease. The proposed national curriculum has downgraded it even even further

This development is relating to. The senior a long time of high university are a time when learners just take on additional particular obligation and monetary independence. The monetary behaviors they sort then could final as a result of adulthood. Reduced fiscal literacy is persistently joined to poorer monetary outcomes.

The Australian Curriculum acknowledges students need economic literacy to function in our monetary planet. Nonetheless, this curriculum only covers up to calendar year 10. In several years 11 and 12, the a long time that are significantly important in shaping students’ fiscal ability, monetary literacy is taught only in reduced-degree maths subjects.

ACER/PISA 2018, CC BY-NC-ND

What did the review locate?

Our analysis explored the economic literacy of students in yrs 10, 11 and 12 at two urban and two rural faculties. We observed what college students do know about money literacy has been uncovered from home, maths or enterprise research. Learners who were being enterprise company studies were much more informed than other pupils.

Residence daily life has been discovered to have a massive impression on a child’s money literacy. There are often phone calls for dad and mom to instruct their children about own finance. However, that assumes mom and dad are in a position and prepared to do that.

Browse additional:

How to train your little ones to consider extra critically about income

The students we spoke to were unbelievably various. Home constructions assorted drastically, with lots of learners not dwelling with their dad or mum/s. There was also evidence of dad and mom not getting capable to give money steerage.

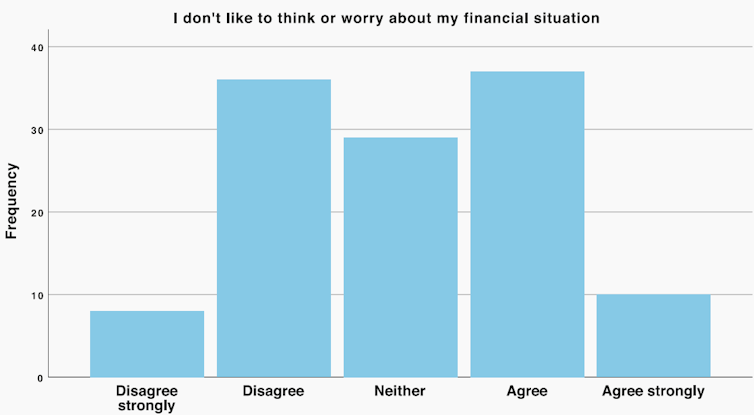

Virtually 50 {ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} the surveyed learners favored not to imagine about their fiscal circumstance.

De Zwaan & West 2022, Money Literacy of Youthful Australians

We talked to a great deal of the pupils about maths and discovered this was not the most powerful curriculum place for understanding about personal finance. When taught as aspect of the maths curriculum it tends to final result in learners fixating on formulation and calculations, without the need of comprehension the fundamental principles. As one college student stated:

“I only genuinely try to remember the formulation due to the fact which is all we acquired taught.”

Numerous learners also dislike maths. This means they are disengaged from mastering at the outset. A person pupil explained to us:

“If I was in class executing that [a simple question about interest], I would just study it, hold looking at it, but not basically process it or try it since I’d just give up.”

There was also typically a disconnect among the economic scenarios learners had been understanding about and their encounters in their possess lives.

Learners who could bear in mind economical concepts would usually remember an working experience or a thing from record when talking about it. This suggests stories might be extra helpful in speaking fiscal principles. For instance, one scholar stated of inflation:

“Over time, because certainly far more funds is currently being printed […] persons believe printing money results in additional income and you are richer, when in fact you’re just producing the currency you have worthless, mainly because there’s so a great deal of it, that it’s not hard to receive it at all. I realized most of that from historical past.”

Interestingly, we found proof of young women of all ages in individual needing a lot more context to make economic choices. When requested economical issues, they puzzled about diverse aspects of the question relatively than swiftly answering. Take a look at questions normally applied to assess economic understanding generally offer you tiny context.

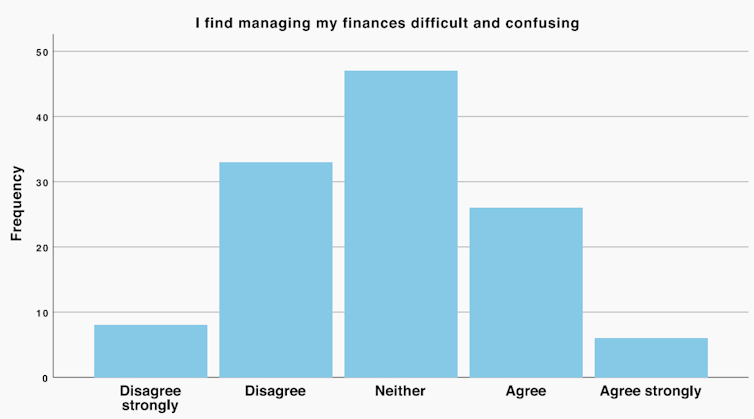

About a person in a few students agreed they identified handling their private funds tough and complicated.

De Zwaan & West 2022, Economical Literacy of Young Australians

Ultimately, we mentioned lots of students were not finding out economical methods, these types of as moderating shelling out, that have lifelong gains.

Read through much more:

Would you move this monetary literacy quiz? Several is not going to – and it’s influencing high-priced aged care conclusions

How can we improve?

Supplied the significance of financial literacy for scholar perfectly-currently being, our report tends to make these tips:

-

fiscal literacy education and learning should really be elevated in substantial educational institutions, ideally as a standalone system, but also by injecting rules of monetary literacy into as numerous curriculum places as achievable – significantly in the perfectly-remaining and pastoral care location

-

economic literacy instruction in maths wants to be enhanced, making use of a selection of approaches – not limited to calculation functions

-

economic literacy instruction need to be expanded to subjects other than maths and company, in line with shifting the concentrate from monetary calculations to financial principles

-

learning functions ought to be aligned with the students’ normal amount of economical knowledge

-

college students require extra exposure to helpful monetary procedures, in unique how to average (or handle) spending for saving

-

a range of assessment procedures really should be supplied to permit learners to clearly show what they have learnt. Evaluation tasks really should go outside of calculations and could involve created parts, visual or remarkable displays, or oral explanations. These could be presented by teams or individuals.