Newtek Business Services (NEWT): Good Growth, Risks Remain

Prostock-Studio/iStock via Getty Images

If the editors of Harvard Business Review are looking for a fresh case study, the unfolding story at Newtek Business Services Corporation (NASDAQ:NEWT) could be a challenging one for business students to study. Newtek is a publicly traded business development company (BDC) founded in 1998. It has developed into a leading provider of business solutions for the small and medium size business category, defined as having revenues of $1 million to $100 million. The company is a leader in the Small Business Administration’s 7(a) lending program, which guarantees loans issued to small businesses. In addition, the company provides a full range of business services including payment processing, payroll solutions, web design, insurance and benefits, IT solutions and cloud-based solutions. The company estimates that there are over 30 million U.S. businesses in this category, and these businesses are largely underserved by the traditional financial companies. Newtek has been helping these small and medium companies for over 20 years.

The company is unique in its organizational structure. It converted to a BDC in 2014. As such, it must meet certain regulatory requirements, not the least of which is to invest at least 70{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of gross assets in “qualifying assets”. Qualifying assets generally include debt or equity securities of private or thinly traded public U.S. companies, cash, cash equivalents, U.S. government securities and high-quality debt instruments with a maturity of less than one year. Additionally, as a BDC, the company is not permitted to incur debt beyond 66 2/3{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of the value of total assets.

Furthermore, in 2015 the company elected to be treated as a Regulated Investment Company under the Internal Revenue Code of 1986 (RIC) for U.S. federal income tax purposes. As a RIC, the company generally does not pay corporate-level U.S. federal income taxes on any ordinary income or capital gains that are distributed to the shareholders. To maintain the qualification as a RIC, the company must meet source-of-income and asset diversification requirements and distribute at least 90{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} of ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses each year. The company’s latest 10-K has a very good description of this structure, from which the above is sourced.

Since 2015, the company has generated $17.17 per share in net income (the company classifies it as “net increase in net assets”) and declared $17.42 per share in dividends to shareholders. This computes to a cumulative payout ratio of 101{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}.

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | Total to Date | |

| EPS | $3.32 | $1.88 | $2.25 | $1.91 | $2.13 | $1.59 | $3.69 | $0.40 | $17.17 |

| DPS | $4.45 | $1.53 | $1.64 | $1.80 | $2.15 | $2.05 | $3.15 | $0.65 | $17.42 |

| Payout ratio | 134{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} | 81{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} | 73{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} | 94{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} | 101{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} | 129{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} | 85{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} | 163{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} | 101{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} |

| Book value | $14.06 | $14.30 | $15.08 | $15.19 | $15.70 | $15.45 | $16.72 | $16.49 |

Source: Company filings, sec.gov

Despite distributing an amount above what was earned, the company has still managed to increase the net asset value per share (book value) 17{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} during this period, from $14.06 in 2015 to $16.49 at the end of the most recent quarter.

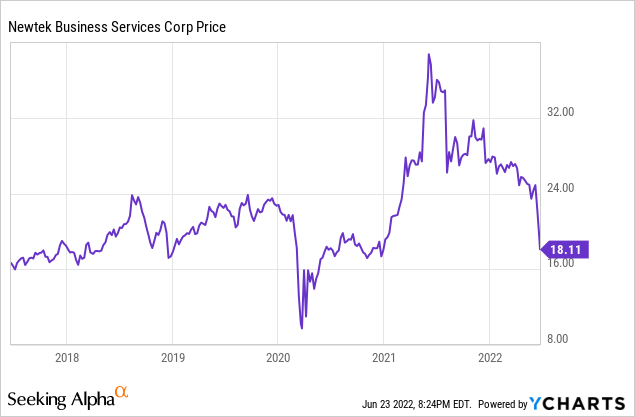

Until last year, the stock price has done very well, rising from $14.70 at the beginning of 2015 to a high of $38.70 in June of 2021. Since then, it has decreased to a recent price of $18.12.

All of the above is going to change going forward, and this is why Newtek is a really interesting case study. On August 2, 2021, the company announced an agreement to acquire National Bank of New York City, which is a nationally chartered bank with over $200 million in total assets and $36.5 million of Tier 1 capital for $20 million in cash. The kicker here is that Newtek will ask shareholders to withdraw the company’s election as a BDC, and upon shareholder approval, become a bank holding company that will elect financial holding company status. After the news, the stock plummeted 27{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in a single day. While registering as a bank will allow the company to reduce its cost of funding via deposits and similar products, the company will be more restricted in how capital is returned to shareholders. There is a good article on Seeking Alpha that explains more of the intricacies here; I would recommend it.

Newtek was a great investment over the past several years, particularly when the generous dividends are taken into account. But it would appear that the days of 100{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} payouts and double-digit yields are probably a thing of the past. Earlier in June, the company’s shareholders overwhelmingly elected to discontinue Newtek’s election as a RIC. It was this structure that enabled the high dividends to be distributed. Notably, the company will not seek to discontinue the election as a BDC until after the closing of the transaction.

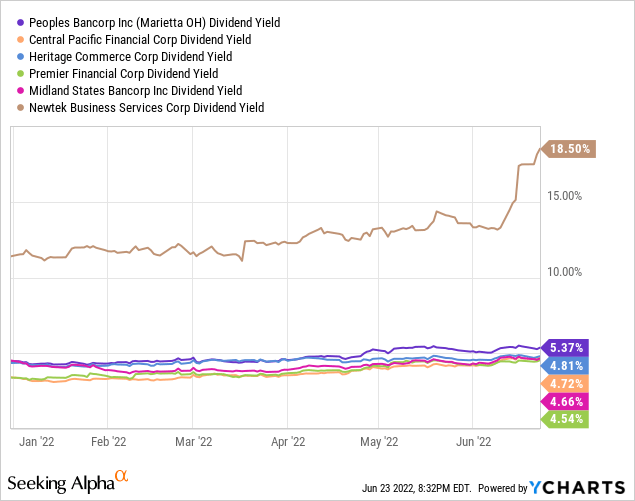

Looking at publicly-traded banks of similar market capitalization, a quick screen shows the highest dividend yields are all currently around 5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}.

Newtek is currently yielding over 16{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} (18.5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} in the chart above), but that is based on a $3.00 annual dividend, which is the current quarter’s dividend annualized. The company has declared $1.40 for the first half of this year, which leaves $1.60 for the second half of 2022. Management made the comment in the Q1 earnings call that shareholders should expect another BDC-level dividend (trued up to the transaction close) in the third quarter.

After that, it would be safe to assume that any dividend paid would be significantly less than what we have become accustomed to from Newtek. No guidance was given, but if the company wants to continue to pay out a healthy dividend and be in the range of similar sized banks, a 5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} yield on an $18 stock equates to about $1.00 annualized, or $0.25 per quarter. 5{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} is still a nice dividend, but far short of where it has been over the past few years.

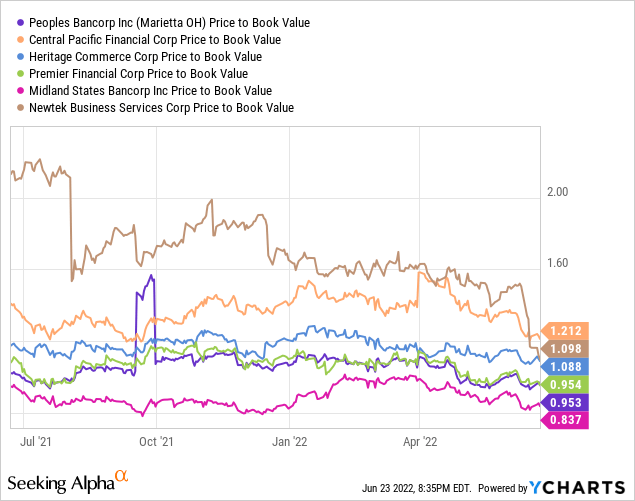

Another interesting development has been the stock price action in recent months. After the shock drop following the acquisition announcement last August, the stock has been slowly drifting down toward book value, which was $16.49 at the end of the first quarter. Compared to the list of small banks above, the price to book of 1.1 is generally consistent with the sample of banks listed.

So perhaps investors have realized that this company will behave more like a bank going forward, and it will trade much closer to book value which is how similar banks are trading right now.

Risks

There are still many unknowns about Newtek going forward. With a possible recession on the horizon, the bank could encounter more significant loan losses than in the past. Interest rates are rising, which is usually good for banks as their net interest margin spreads improve. However, we have not been in an environment with rising interest rates, high inflation and high energy prices in decades. Furthermore, retail banking is a hyper-competitive business. It is very difficult to acquire new customers to build out a banking franchise. Certainly, the management of National Bank of New York City will be asked to provide leadership here. Finally, management made a note of talking about leverage for the new company in the earnings call. Banking companies can become much more highly levered than a BDC. Can management navigate higher leverage in a rising interest rate environment? How management can respond to these macro factors and successfully execute a new strategy remains to be seen.

This small company has had a very successful run since its founding over 20 years ago. Management has done very well growing the company and carving out a strong niche in the small and medium business category. While the next few years will be challenging, I think it would be very interesting to hold on to the stock and see where this company goes. While there are many risks for the company going forward, I think the stock is properly priced. Investors may not like the fact that those fat dividends are going away, but it appears that a healthy, competitive dividend will likely be in store for those who stick around. Regardless of how it turns out, this is a classic case study which may find itself on the desks of business students in the future.