These states poised to pass personal finance education laws this year

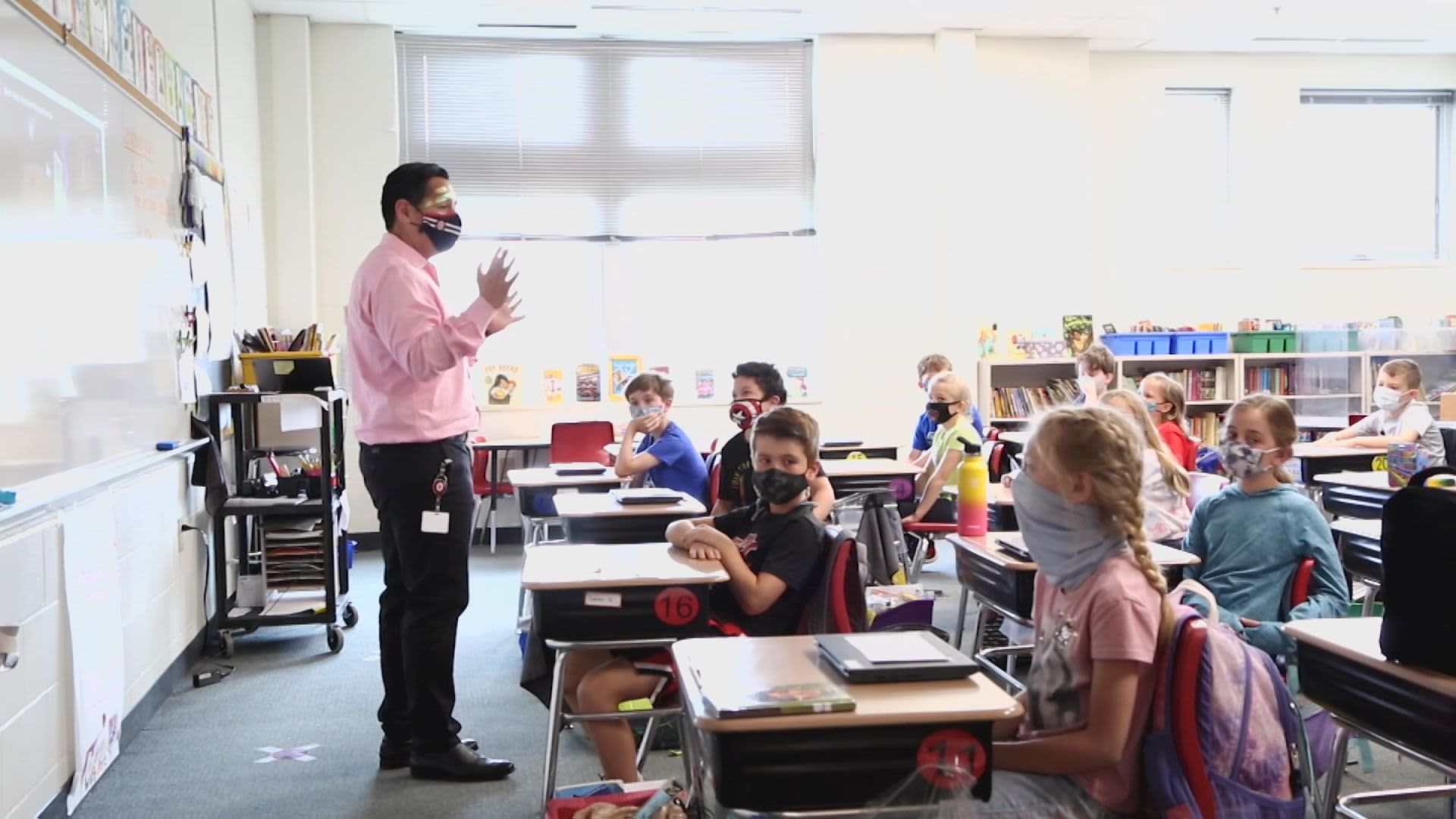

Lee Jimenez, a instructor at Indian Hill Elementary School in Cincinnati, Ohio, discusses credit rating playing cards and techniques of payments with his 3rd grade course working with online fiscal schooling curriculum SmartPath.

SMARTPATH

You can find momentum for personal finance education turning out to be legislation in several states throughout the country.

Even extra states could move laws this 12 months to make sure learners, specially all those at the superior faculty degree, have this kind of instruction.

“It is been a huge modify,” claimed John Pelletier, director of the Middle for Financial Literacy at Champlain Faculty in Burlington, Vermont.

In advance of the coronavirus pandemic, progress on personalized money education and learning experienced stagnated, he stated. But amid pandemic layoffs and the ensuing economic downturn, it grew to become crystal clear that economical literacy is incredibly vital for learners.

“What appears to be to propel these expenses ahead is a catastrophe,” Pelletier reported.

Who is following

Ga will probably be the subsequent point out to go a individual finance education requirement, in accordance to Following Gen Individual Finance, a nonprofit.

Both equally chambers of the state’s general assembly have handed a monthly bill, SB 220, that would demand all high university learners to take at the very least a half-credit score economical literacy system to graduate, commencing with the 2024-2025 university yr. The bill is awaiting the governor’s signature to come to be legislation.

South Carolina also may perhaps before long pass legislation mandating personal finance training. The state has a bill, S16, that is now in convention committee. At the time Georgia’s invoice is signed into legislation, South Carolina will be the only point out in the Southeast that isn’t going to call for private finance coursework, in accordance to Tim Ranzetta, co-founder of Subsequent Gen Personal Finance.

“I consider there is certainly an element of [fear of missing out] happening concerning the states,” mentioned Ranzetta. “Which is why we’re viewing the craze there.”

Much more from Invest in You:

How to determine if you need to rent or own a dwelling

U.S. homes are paying out an excess $327 a thirty day period because of to inflation

Is inflation crunching your finances? In this article are 3 approaches to struggle back again

Michigan could also progress laws in the coming months. A monthly bill that would involve a fifty percent-credit score private finance training course for significant university graduation handed the condition Home of Associates in December and is anticipated to be taken up by the condition Senate in May possibly.

In Minnesota, an omnibus education and learning invoice would mandate that superior faculty freshman starting in the 2023-2024 school calendar year acquire at least a half-credit history own finance program to graduate. And, in New Hampshire, an schooling invoice consists of particular finance on a record of factors that represent an suitable instruction.

So significantly, there are 12 states that adhere to Next Gen Particular Finance’s gold normal of individual finance instruction, that means that they demand or will soon need at the very least a half-credit history, standalone particular finance program for high college graduation.

All round, there are 23 states in the U.S. that have some type of individual finance education and learning mandate, according to the 2022 Study of the States from the Council for Economic Instruction. And 47 states throughout the country incorporate language about individual finance in their point out instruction expectations, although quite a few never have expected classes.

A well known study course of research

Details exhibits that pupils and their moms and dads want increased particular fiscal training out there in general public schools.

Help for getting monetary literacy courses polls at 80{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550} or a lot more in California, Florida, Georgia, Michigan and South Carolina, in accordance to Up coming Gen Private Finance.

In my states, legislation has also been handed with bipartisan assist, generally overwhelmingly from the two sides of the political aisle. In Florida, for instance, the bipartisan legislation was passed unanimously in March.

“It can be a single of those people common perception issues that cuts throughout political events,” stated Ranzetta.

What is actually subsequent

To be absolutely sure, some dad and mom feel that it is their responsibility to teach their children about income, alternatively of them learning it at college. But few are executing the get the job done, and lots of dad and mom may not have had wonderful personal finance education on their own.

That leaves it up to point out education boards to include things like individual finance instruction in legislation.

So far in 2022, 61 payments about personalized finance education and learning have been proposed in 26 states, in accordance to Next Gen Personal Finance. Of people, 47 payments throughout 20 states are nonetheless alive, this means they could sometime develop into law.

In addition to encouraging laws mandating fiscal literacy classes, advocates are on the lookout at the high quality of each bill proposed and if they include teacher schooling. This is an significant piece of the puzzle, as pupils need to have assured, certified lecturers that can explain finance.

“Instructors want to be qualified in personal finance so they can give their students the most effective,” stated Michael Sheffer, director of education at FoolProof Foundation, which gives totally free financial schooling curriculum for students and teachers.

The enhanced urge for food for personalized finance classes has assisted get a lot more quality education and learning to lecturers, a pattern that is possible to continue, he reported. Following Gen Personal Finance has a objective of producing sure that every single higher university student will have taken at minimum 1 semester of private finance by they graduate by the year 2030.

They’re perfectly on the way to earning that a reality, according to Sheffer.

“This is a snowball running downhill now, and it is really finding larger and greater,” he said.

Indication UP: Revenue 101 is an 8-week discovering training course to financial independence, shipped weekly to your inbox. For the Spanish version Dinero 101, click on listed here.

Check out OUT: 74-year-aged retiree is now a product: ‘You don’t have to fade into the background’ with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are buyers in Acorns.