What student loan borrowers need to know about the payment pause

West | Istock | Getty Photographs

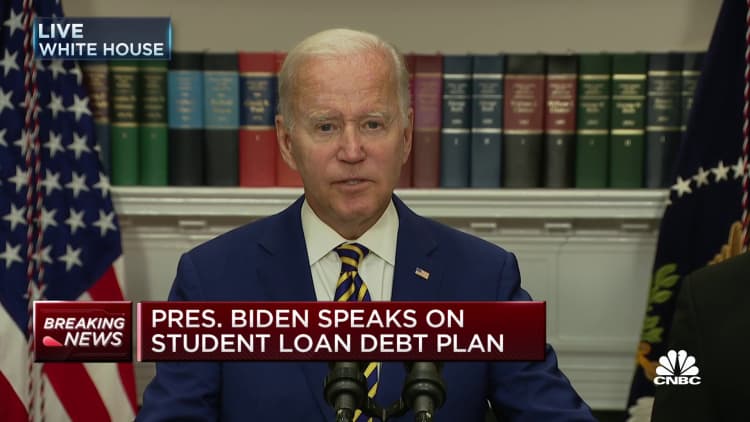

The Biden administration’s most the latest announcement that the pause on federal university student loan expenses would be extended still left borrowers with a lot more uncertainty: It didn’t give a day for when the payments would resume.

The pandemic-period reduction policy suspending federal pupil bank loan expenses and the accrual of fascination has been in effect due to the fact March 2020. Turning the $1.7 trillion lending system back on for some 40 million Us citizens is a significant task that the U.S. Office of Education and learning has been hesitant to undertake.

The administration experienced hoped to relieve the transition for borrowers by very first forgiving a huge share of college student financial debt, but its system to do so, unveiled in August, shortly confronted a barrage of legal worries and continues to be tied up in the courts. That development is why debtors have gotten even additional time without having a scholar mortgage invoice.

Here’s what you need to know about the latest payment pause extension.

College student mortgage expenses could resume as before long as Could 1

The Instruction Section has still left issues a minimal open-ended when it arrives to the timing of federal college student mortgage payments resuming.

It has reported the charges will be thanks once more only 60 times following the litigation about its university student loan forgiveness approach resolves and it is capable to commence wiping out the credit card debt.

If the Biden administration is nonetheless defending its policy in the courts by the close of June, or if it is really not able to go ahead with forgiving university student personal debt by then, the payments will decide up at the close of August, it stated.

Most lately, the Supreme Court docket has said it will listen to oral arguments around the president’s program in February.

That means the earliest that payments could restart would possible be May possibly 1, if the justices attain a fast selection, stated larger education specialist Mark Kantrowitz.

Borrowers who are guiding might get a ‘fresh start’

The U.S. authorities has remarkable collection powers on federal debts and it can seize borrowers’ tax refunds, wages and Social Stability checks if they fall behind on their college student financial loans.

All through the extended payment pause, however, the Schooling Division is also ceasing all assortment action, it claimed.

Borrowers in default on their scholar financial loans should also search into the lately declared “Fresh new Start out” initiative, in which they’ll have the opportunity to return to a existing standing.

Refinancing may well be value considering

Kantrowitz had earlier advised that, irrespective of the chance of finding up a decrease fascination price, federal university student personal loan debtors chorus from refinancing their financial debt with a private loan company though the Biden administration deliberated on how to shift ahead with forgiveness. Refinanced college student loans wouldn’t qualify for the federal relief.

Now that debtors know how a lot in personal loan cancellation is coming — if the president’s coverage survives in the courts — debtors could want to consider the alternative, Kantrowitz explained. With the Federal Reserve expected to carry on raising desire charges, he additional, you’re additional possible to decide on up a lower amount with a financial institution these days than down the street.

Nevertheless, Kantrowitz additional, it’s possibly a tiny pool of borrowers for whom refinancing is smart.

It would be deeply unfair to ask debtors to pay a financial debt that they would not have to shell out, were being it not for the baseless lawsuits introduced by Republican officers and unique pursuits.

Miguel Cardona

Secretary of the U.S. Section of Schooling

He claimed those consist of borrowers who really don’t qualify for the Biden administration’s forgiveness — the system excludes anybody who earns a lot more than $125,000 as an individual or $250,000 as a family — and people who owe additional on their university student loans than the administration strategies to cancel. Individuals borrowers may want to glimpse at refinancing the portion of their financial debt about the reduction amounts, Kantrowitz mentioned.

Borrowers have to have to 1st realize the federal protections they’re supplying up before they refinance, warns Betsy Mayotte, president of The Institute of University student Financial loan Advisors.

For example, the Schooling Section will allow you to postpone your expenditures devoid of curiosity accruing if you can prove financial hardship. The governing administration also delivers bank loan forgiveness courses for lecturers and community servants.

“Your fee isn’t going to issue if you get rid of your position, have sudden health-related costs, are not able to afford your payments and obtain that defaulting is your only solution,” Mayotte mentioned, in a past interview about refinancing.

Make the most of additional hard cash all through the payment pause

Boy_anupong | Moment | Getty Images

With headlines warning of a attainable economic downturn and layoffs buying up, experts suggest that you consider to salt away the money you’d typically put toward your college student personal debt every single thirty day period.

Certain banks and on the internet cost savings accounts have been upping their fascination rates, and it’s worthy of wanting all over for the finest offer offered. You will just want to make absolutely sure any account you put your financial savings in is FDIC-insured, meaning up to $250,000 of your deposit is secured from reduction.

And although fascination fees on federal college student loans are at zero, it is really also a very good time to make development paying down more high priced financial debt, experts say. The normal desire level on credit history cards is currently much more than 19{ac23b82de22bd478cde2a3afa9e55fd5f696f5668b46466ac4c8be2ee1b69550}.

Some could want to preserve shelling out during the pause

If you have a healthy wet-working day fund and no credit card debt, it may possibly make feeling to proceed paying out down your pupil financial loans even all through the break, professionals say.

You will find a huge caveat here, nonetheless. If you’re enrolled in an revenue-pushed repayment strategy or pursuing community assistance personal loan forgiveness, you really don’t want to go on spending your financial loans.

Which is simply because months through the government’s payment pause nevertheless count as qualifying payments for these packages, and considering that they both equally result in forgiveness just after a specified amount of time, any money you throw at your financial loans through this period just minimizes the sum you are going to inevitably get excused.